Global Wafer Fab Equipment revenue poised to surge

Projected to hit $165 billion by 2029, amid semiconductor devices market fluctuations.

With semiconductor device revenue showing 19% year-over-year growth (2) , WFE vendors are adapting to uneven CapEx by broadening their application mix…

OUTLINE:

Wafer Fab Equipment (WFE) vendors’ overall revenue for 2024 is projected at $133 billion, with 83% coming from shipments and 17% from service & support. The overall market will reach $165 billion by 2029.

USA-headquartered companies traditionally lead in revenue generation. On the other hand, in 2023 and 2024, mainland China will be the most important equipment shipment destination, with a third of the overall WFE revenue

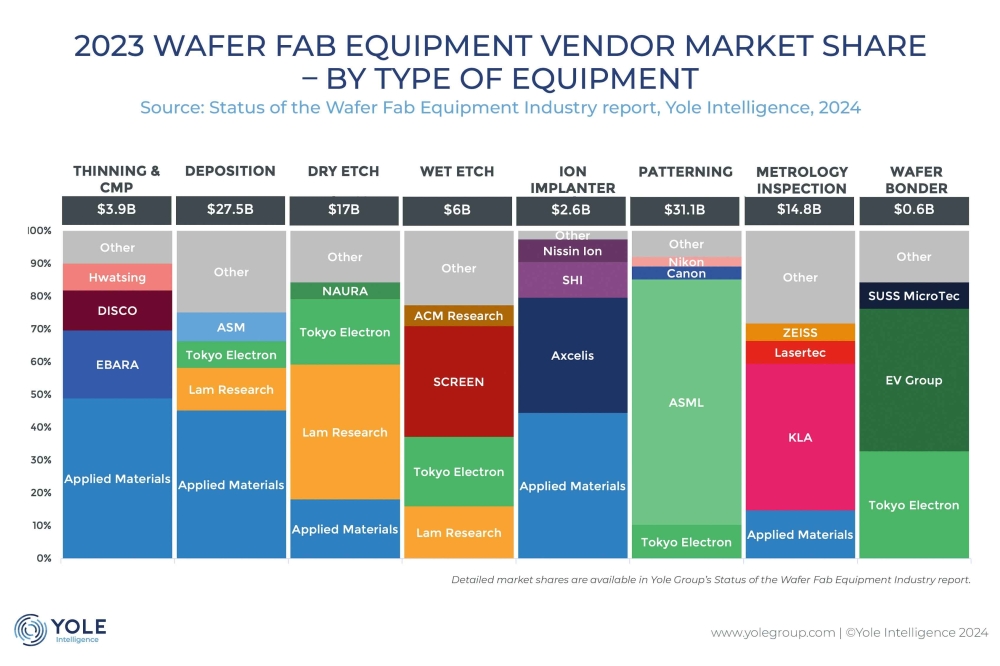

WFE market leaders are ASML, Applied Materials (AMAT), Lam Research, Tokyo Electron Limited (TEL), and KLA.

The semiconductor industry is on a strong upward trajectory, with revenue expected to reach $630 billion by 2024 and a 19% year-over-year growth from 2023 to 2024. However, beneath these impressive figures, the reality is more complex. Growth will vary significantly across different device segments. Yole Group analysts attribute this surge primarily to investments in generative AI for DRAM / HBM and processors, while NAND CapEx remains weak, and CapEx in the legacy logic and specialty markets faces potential risks. In this uncertain landscape, WFE vendors are navigating uneven capital expenditures by diversifying their application portfolios to sustain or boost their revenue levels.

By 2029, overall WFE revenue is projected to reach $165 billion, maintaining similar proportions with 2024 between the two segments, shipments and service & support, announces Yole Group in its new report, Status of the Wafer Fab Equipment Industry.

WFE shipments are expected to grow to $139 billion during this period, with a +4.7% CAGR . This segment is clearly driven by changes in device architecture across memory and logic. At the same time, the service & support segment is set to generate $27 billion in revenue, with a +3.3% CAGR (4). Indeed, it is pushed by the surge in installed base utilization rates and increasing machinery complexity.

Yole Group has unveiled its latest semiconductor manufacturing report, Status of the Wafer Fab Equipment Industry. This comprehensive technology and market analysis provides a thorough overview of the semiconductor equipment market, including annual market size data and a detailed historical perspective. Yole Group’s analysts offer a compelling breakdown of the wafer fab equipment (WFE) market by process technology and device application, along with an in-depth analysis of vendor market shares. The report also explores the relationship between WFE market size, the semiconductor device market, and CapEx, covering related market segments, subsystems, components, and modules. Additionally, it offers a technological outlook, detailing equipment characteristics such as equipment morphology with detail on chamber types, substrate types and sizes, and emerging process parameter trends that influence equipment architecture. The study also includes a significant analysis of the supply chain, recent mergers and acquisitions, and updates from the equipment industry.

This report is part of Yole Group’s global semiconductor manufacturing collection, which includes resources such as the Wafer Fab Equipment Market Monitor and the upcoming Back End Equipment Market Monitor. The complete collection can be accessed HERE.

From a player point of view, the overall market is dominated by the big-five WFE vendors that have occupied their position for many years: ASML, which has been leading the market since 2023, followed by AMAT (Leader in 2022), Lam Research, TEL, and KLA.