Back-end semiconductor equipment: advanced packaging drives revenues in 2025

Back-end semiconductor equipment market faces short-term decline but anticipates recovery with adoption of advanced packaging techniques.

Back-end equipment spending has always been in the range of 1% of the total semiconductor industry revenue, confirms Yole Group. Hence, the back-end segment is expected to grow in line with semiconductor growth.

The semiconductor market recovery in mainstream segments like automotive, industrial, and consumer has been slower than expected in Q2 and will continue so in Q3 2024. Excess inventories and muted demand are prolonging the downturn in these sectors, with utilization rates still below optimal levels, particularly in traditional wire bonding. As an example, ASE reports utilization of just 60% in some of its conventional back-end equipment segments, while ASMPT confirms softness in China’s high-end smartphone and industrial markets. However, these sectors are expected to improve in late 2024 or early 2025, with recovery expected in 2025.

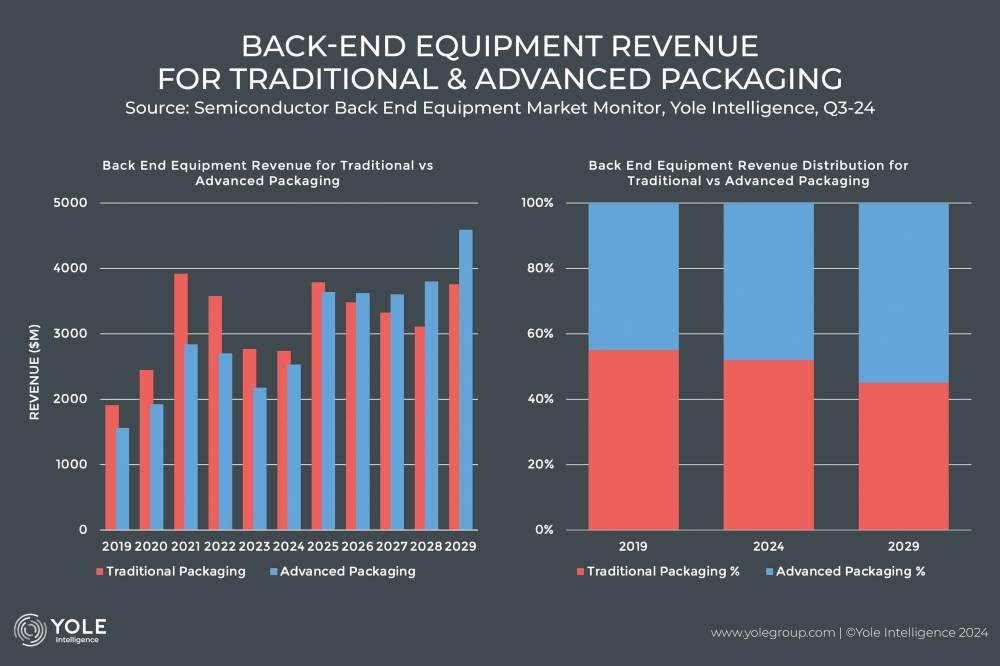

This is reflected in the back-end equipment market, where the quarterly revenue dipped from $1.4 billion in Q1-24 to $1.29 billion in Q2 2024, a -8.1% decrease quarter to quarter; the market is expected to dip further in Q3. However, Yole Group’s analysts expect a rebound in Q4 2024, with quarterly revenue reaching $1.31 billion, which is expected to grow further to $1.74 billion in Q1 2025. Indeed, at the beginning of 2025, the market is showing a strong recovery in demand, coupled with increased adoption of advanced packaging.

The back-end equipment market, integral to semiconductor assembly and packaging, is positioned for strong growth over the next few quarters, though near-term challenges persist. Insights from major OSATs, leading back-end equipment vendors, and standard industry outlooks suggest several key trends and opportunities shaping the sector.

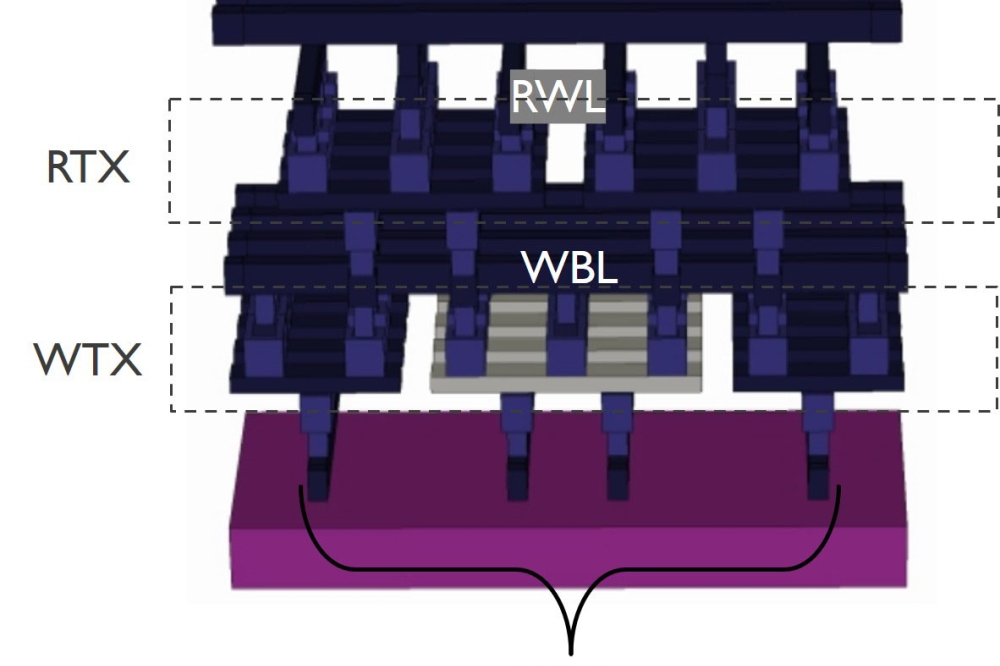

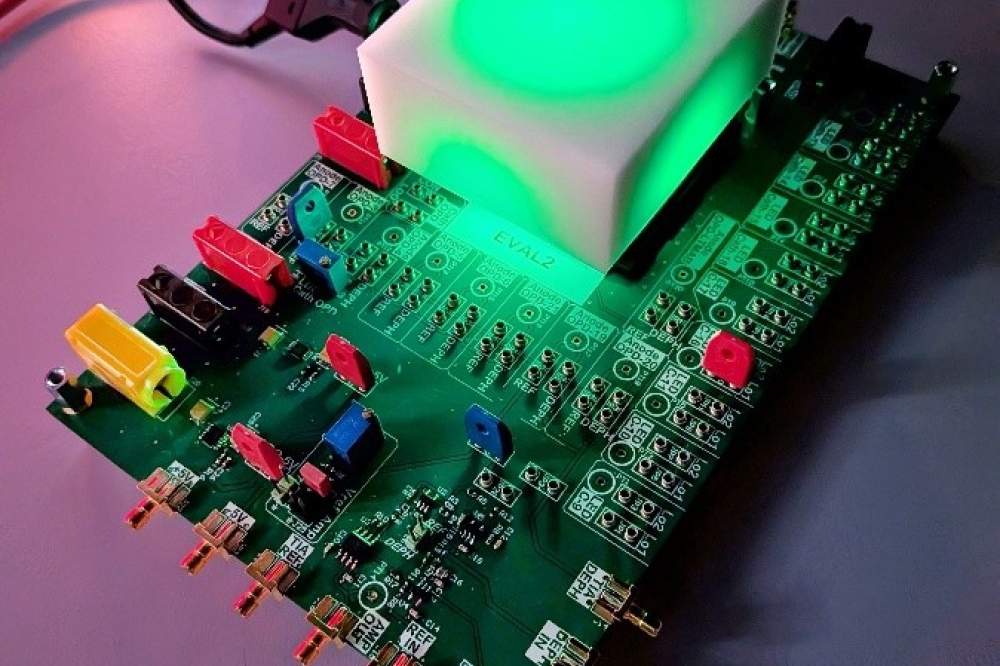

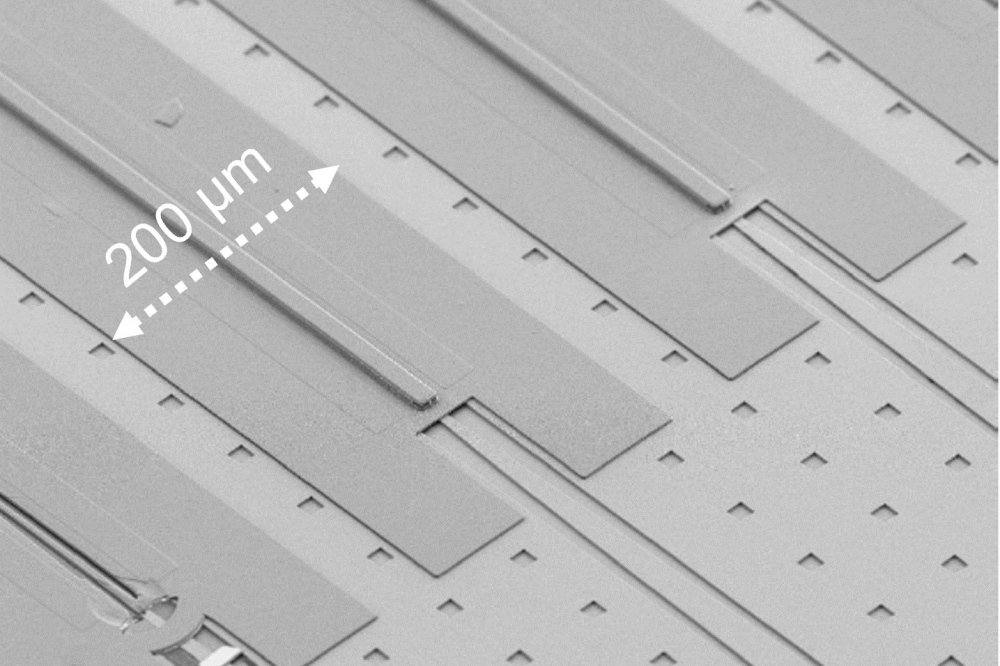

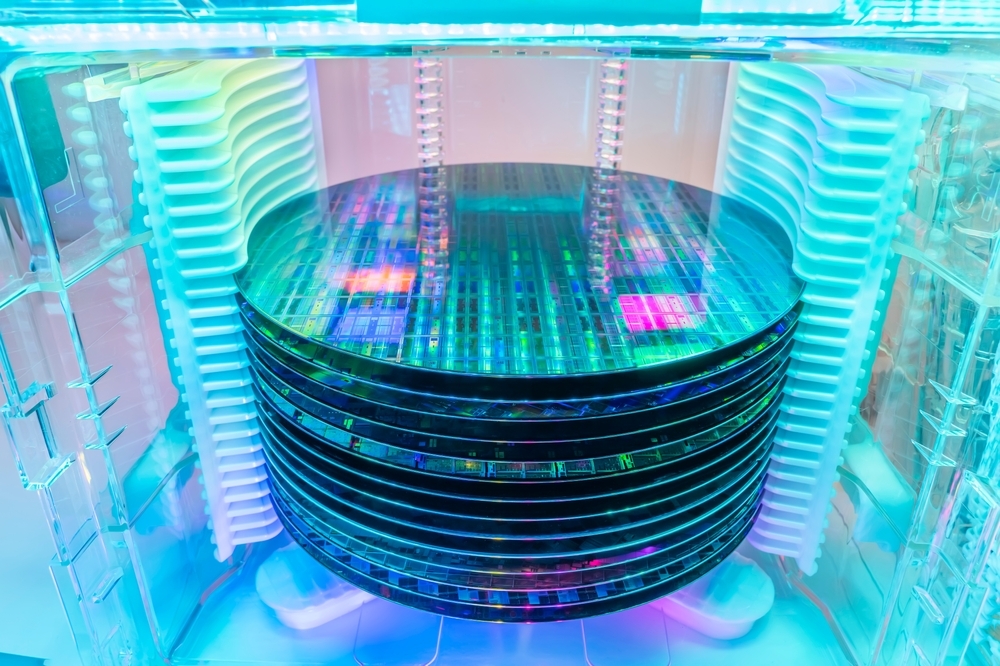

Advanced packaging is the main driver for the back-end equipment market. Demand for advanced packaging technologies, all related to the push for AI and high-performance computing (HPC), remains resilient. Indeed, both Besi and ASMPT have reported substantial order volumes for 2.5D/3D packaging equipment as well as hybrid bonding systems supported by AI servers and high-bandwidth memory (HBM). These technologies are becoming increasingly essential for next-gen AI chips and photonics applications.

Investment in advanced packaging capacity is ramping up significantly. Besi, for instance, has increased its R&D and CapEx spending, focusing on hybrid bonding and TCB capabilities to meet the expected surge in AI demand. Similarly, K&S and ASMPT are actively expanding in thermocompression bonding and related flux-less processes, positioning themselves well for ongoing AI-driven growth. This level of investment is a clear indicator that the major players are preparing for a more dynamic second half of 2024 and into 2025.

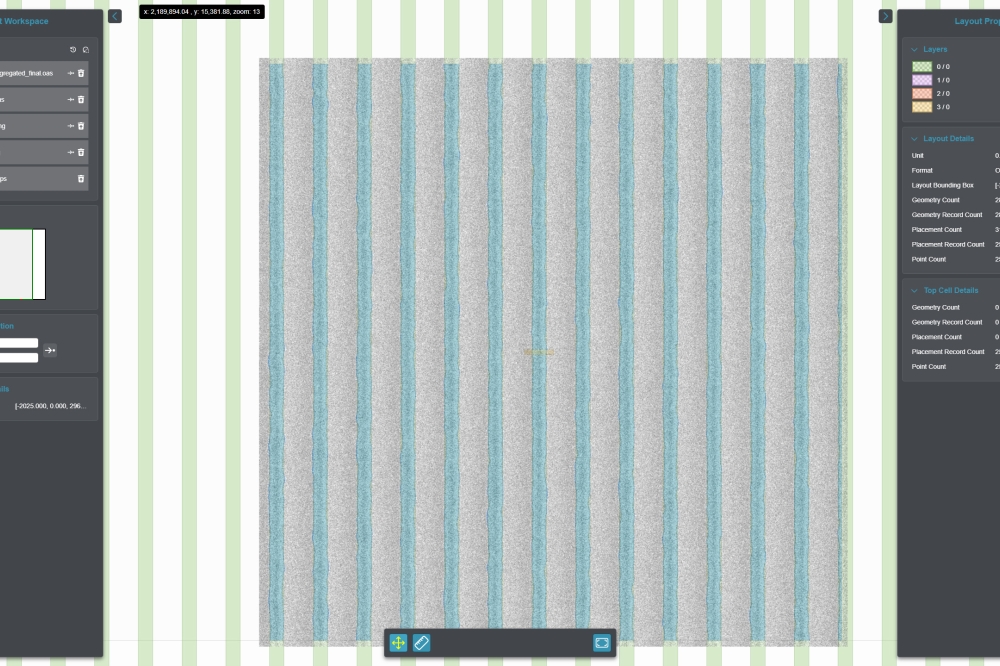

Yole Group has launched its first semiconductor product, the Semiconductor Back-End Market Monitor, which focuses on packaging processes starting at the middle-end stage. Covering 36 segments and analyzing 66 leading equipment companies, this Market Monitor provides quarterly insights into back-end equipment markets, essential for advancing chip technology and supporting digital transformation.

With the growing demand for advanced packaging solutions including 2.5D/3D packaging and hybrid bonding, for example, the market is evolving to support cutting-edge applications in AI and high-performance computing. At the same time, traditional packaging methods remain essential for various semiconductor applications, ensuring a balance between innovation and established techniques and driving efficiency across multiple industries.

The Market Monitor tracks back-end equipment vendor revenues in relation to semiconductor chipmaker revenue and CapEx. It provides an overview of back-end equipment revenue, segmented by process technology, market share estimates, current quarterly data, and insights into revenue forecasts for 2024-2029.