Over half of chip-reliant organisations are concerned about semiconductor supply

With rising AI and Gen AI adoption, downstream industrie] estimate a 29% acceleration in the demand for chips by the end of 2026, double the rate of the semiconductor industry’s expectation.

The Capgemini Research Institute’s report into the future of semiconductors ‘The semiconductor industry in the AI era: innovating for tomorrow’s demands’ shows that rising AI and generative AI (Gen AI) adoption is causing a surge in demand for advanced semiconductor solutions. Despite its lead in innovation, confidence in the semiconductor industry’s ability to meet demand has been hindered by geopolitical tensions, international trade restrictions and the push for sovereignty. According to the report, while the demand for AI chips, custom silicon chips, and memory-intensive chips is expected to increase over the next 12 months, the semiconductor industry needs to capitalize on emerging opportunities. These include design and cutting-edge, sustainable fabrication methods, as well as investment in domestic sourcing and nearshoring to enhance stability.

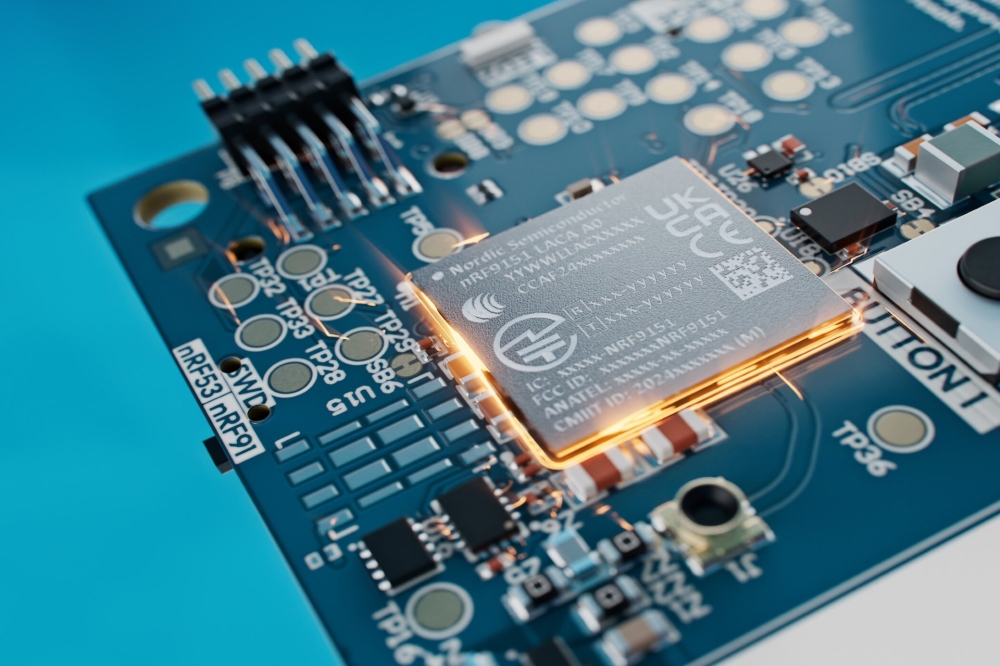

Gen AI adoption and a wide range of burgeoning technologies, such as 5G, IoT, autonomous vehicles, AR/VR, and edge computing are driving demand for more powerful, efficient, and customized chips: nearly three in five semiconductor organizations say that Gen AI, 5G or other next-generation communication protocols are impacting their strategy.

While semiconductor technology breakthroughs have spurred innovation in the downstream industries and enabled the emergence of smarter, more efficient products, fewer than three in ten downstream organizations believe chip supply is sufficient.

“We are at a pivotal moment for the semiconductor industry. Gen AI is driving accelerated demand for chips and semiconductor companies face increasing demands from customers who want more personalized and software-centric experiences,” said Brett Bonthron, Global High-tech Industry Leader at Capgemini. “The industry should see this as an opportunity to ramp-up production and adopt a ‘chip-to-industry’ approach that supports a full stack, ’software-first’ set of capabilities. Investment in cutting-edge fabrication methods and design processes powered by AI and Gen AI will be key to meet the specialized needs of emerging applications. Equally, it is crucial that the industry further enhances sustainable manufacturing processes and uses advanced security to safeguard IP.”

A surge in demand for AI chips and custom-designed chips

According to the report, while 39% of semiconductor organizations anticipate that Gen AI will drive demand for custom chips in the next two years, most downstream organizations (81%) expect their demand to increase by 21% over the next 12 months alone.

Consequently, downstream organizations and tech giants are exploring in-house custom chip design which allows them to tailor semiconductors to their unique specifications. This minimizes reliance on external vendors and preserves control over their intellectual property (IP), while boosting speed, efficiency, and compatibility with other hardware and software.

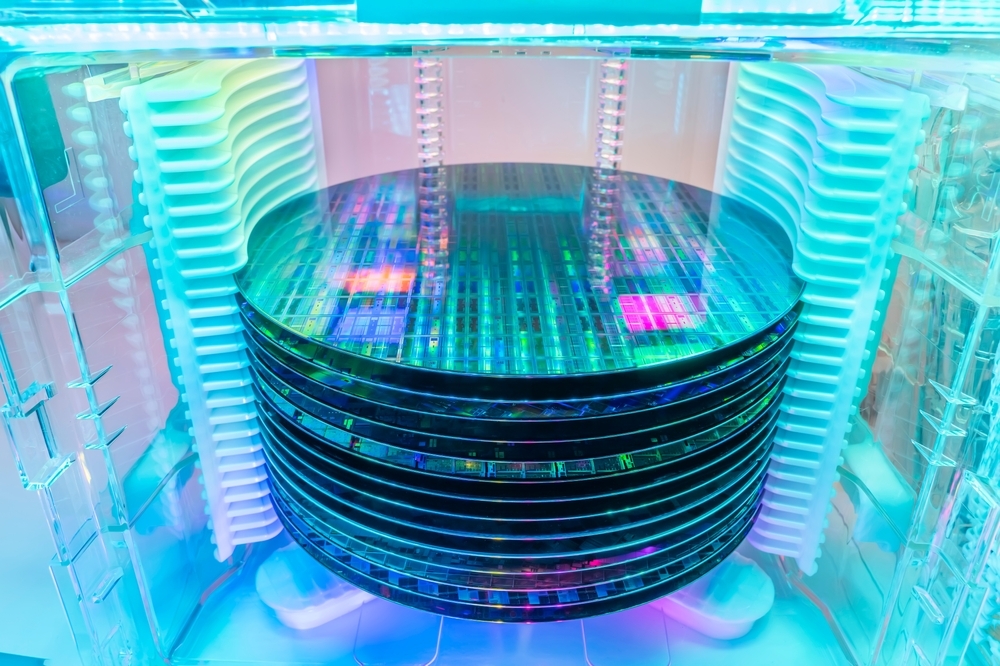

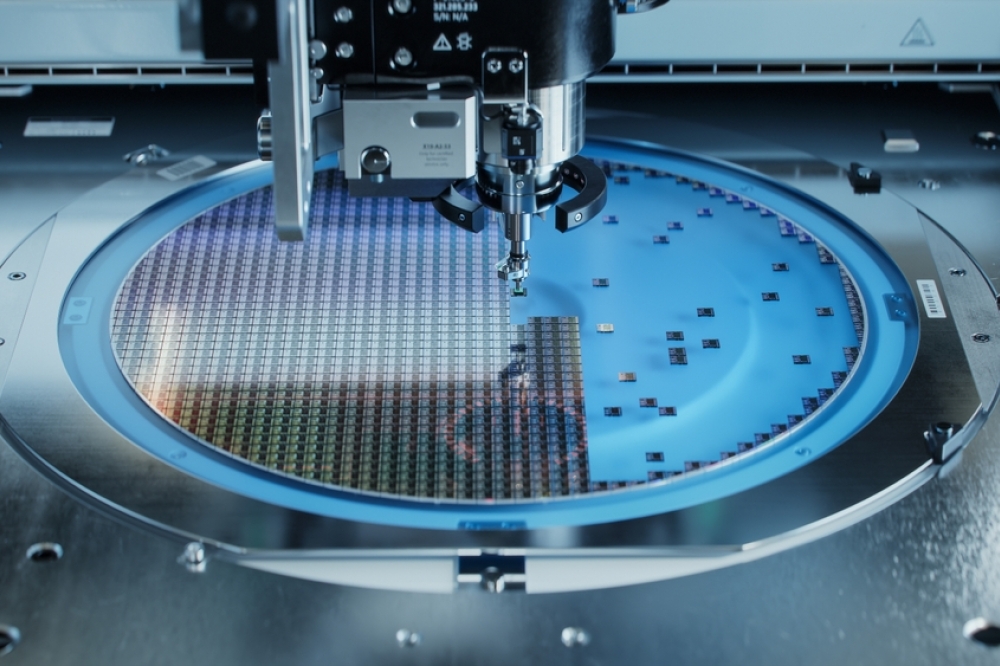

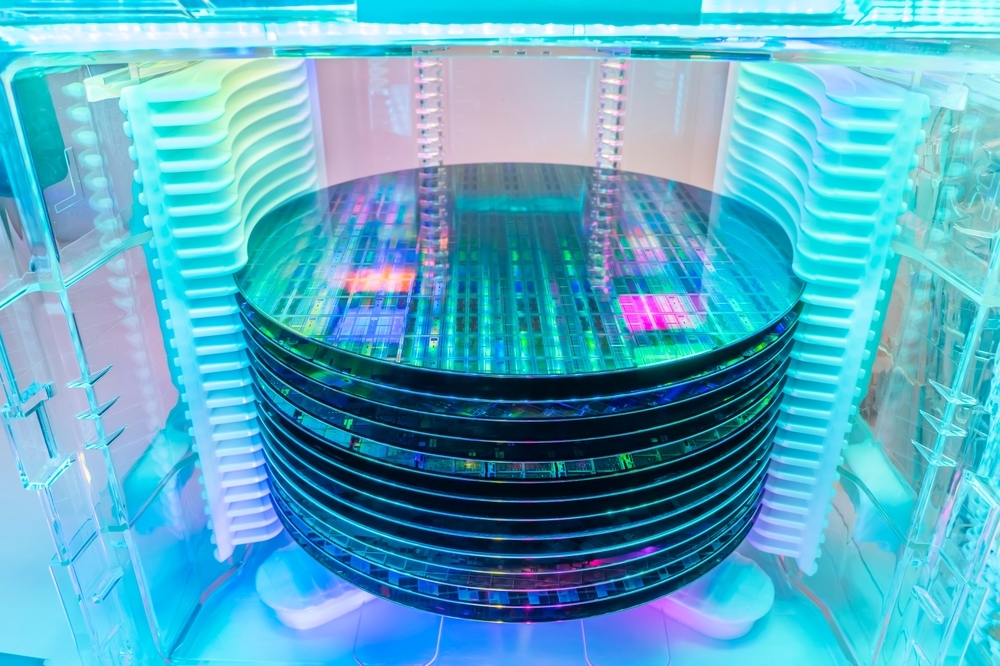

In parallel, to meet demand from downstream organizations, the semiconductor industry continues to excel in design and manufacturing innovation and to push the boundaries of physics, advancing notably in chip architectures, extreme ultraviolet (EUV) lithography and smaller process nodes, 3D packaging and use of chiplets[2]. According to the report, the industry is expecting its R&D budget to increase by around 10% over the next two years.

Nearly half of manufacturers say they are also relying on AI and Machine Learning (ML) to optimize processes.

The adoption of AI and Gen AI is driving demand for more specialized, high-performance chips

Increased adoption of AI and generative AI is driving the need for specialized neural processing units (NPUs) and high-performance graphics processing units (GPUs), that can handle massive computations and large datasets efficiently. More than half of downstream industries (54%) believe that advancements in GPU computing and AI/machine learning acceleration can bring most value.

Chip sustainability, supply chain resilience, and security are downstream organizations’ top priorities

According to the report, more than half of downstream organizations plan to prioritize chip sustainability, supply chain resilience, and cybersecurity features in the next two years.

Only two in five semiconductor organizations are confident in the resilience of their supply chains. Over the next two years, the semiconductor industry expects to increase its domestic sourcing from the current 40% to 47% to mitigate the risks associated with international logistics. To enhance stability, the industry also anticipates an increase of 4% in nearshoring. 74% of semiconductor organizations expect to increase their US investments, compared to 59% increasing their investments in Europe.

Security of chips remains a critical area in a highly complex and interdependent supply chain, nearly three in five semiconductor design organizations highlight a focus on cryptographic protection.

Finally, with nearly 60% of downstream organizations saying that chip sustainability is going to be crucial in their chip selection, the industry is prioritizing core eco-friendly initiatives: energy conservation; implementation of water recycling and reuse systems; using less toxic alternative chemicals; and minimizing waste.