Worldwide semiconductor revenue grew 21% in 2025

“AI semiconductors — including processors, high-bandwidth memory (HBM), and networking components continued to drive unprecedented growth in the semiconductor market, accounting for nearly one-third of total sales in 2025,” said Rajeev Rajput, Sr. Principal Analyst at Gartner. “This domination is set to rise as AI infrastructure spending is forecast to surpass $1.3 trillion in 2026.”

Among the top 10 semiconductor vendors ranking, the positions of five vendors have changed from 2024.

NVIDIA extended its lead over Samsung by $53 billion in 2025. NVIDIA became the first vendor to cross $100 billion semiconductor sales, contributing to over 35% of industry growth in 2025.

Samsung Electronics retained the No. 2 spot. Samsung’s $73 billion semiconductor revenue was driven by memory (up 13%), while non-memory revenue dropped 8% YoY.

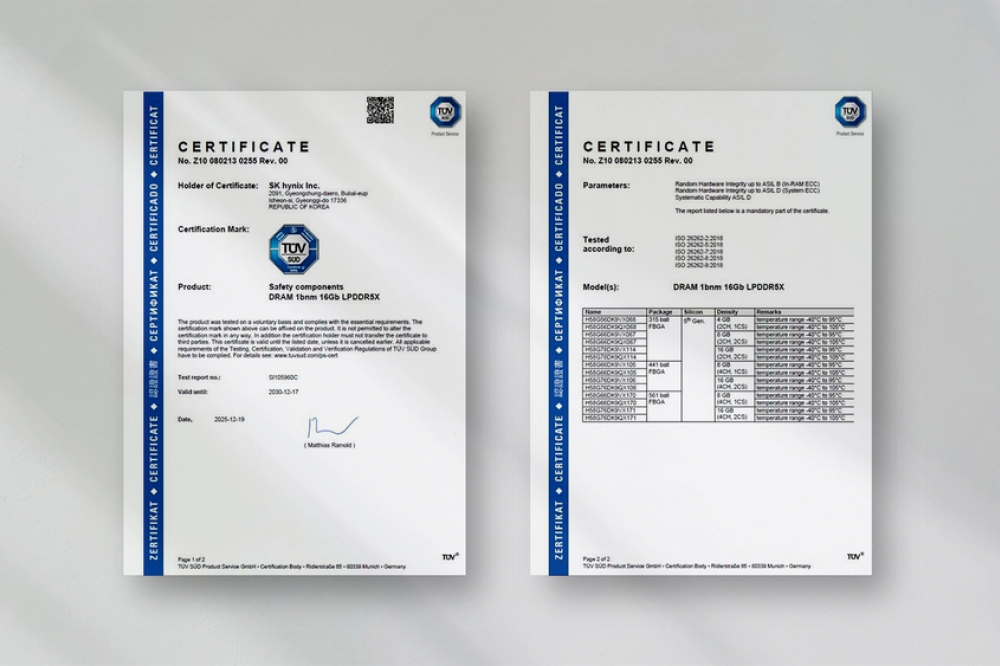

SK Hynix moved into the No. 3 position and totalled $61 billion revenue in 2025. This is an increase of 37% YoY, fuelled by strong demand for HBM in AI servers.

Intel lost market share, ending the year at 6% market share, half of what it was in 2021.

The buildout of AI infrastructure is generating high demand for AI processors, HBM and networking chips. In 2025, HBM represented 23% of the DRAM market, surpassing $30 billion in sales while AI processors exceeded $200 billion in sales. AI semiconductors are set to represent over 50% of total semiconductor sales by 2029.