Move quickly for a slice of the semiconductor market

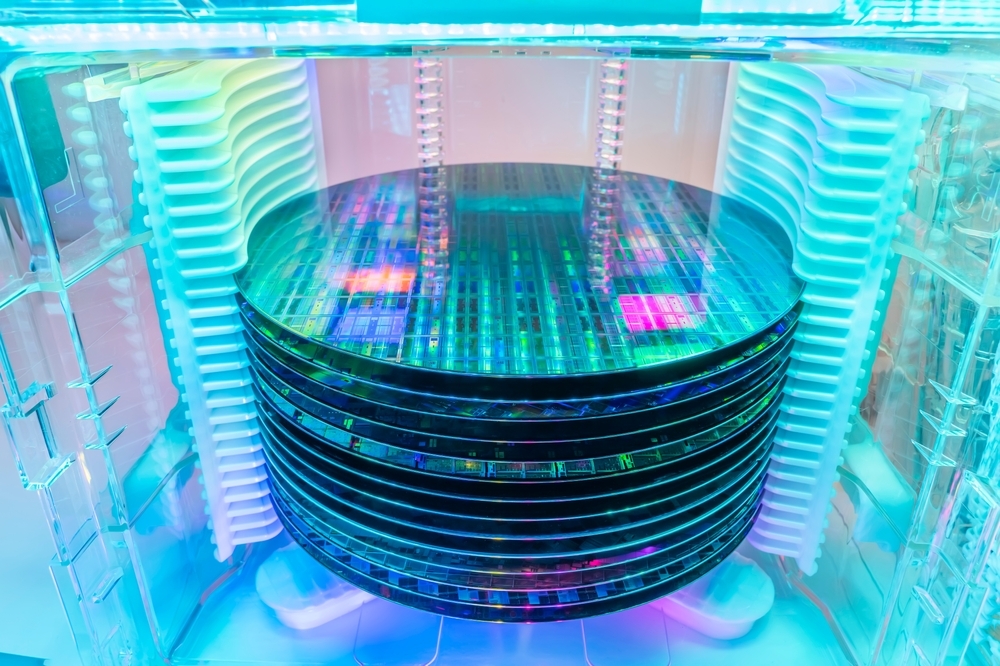

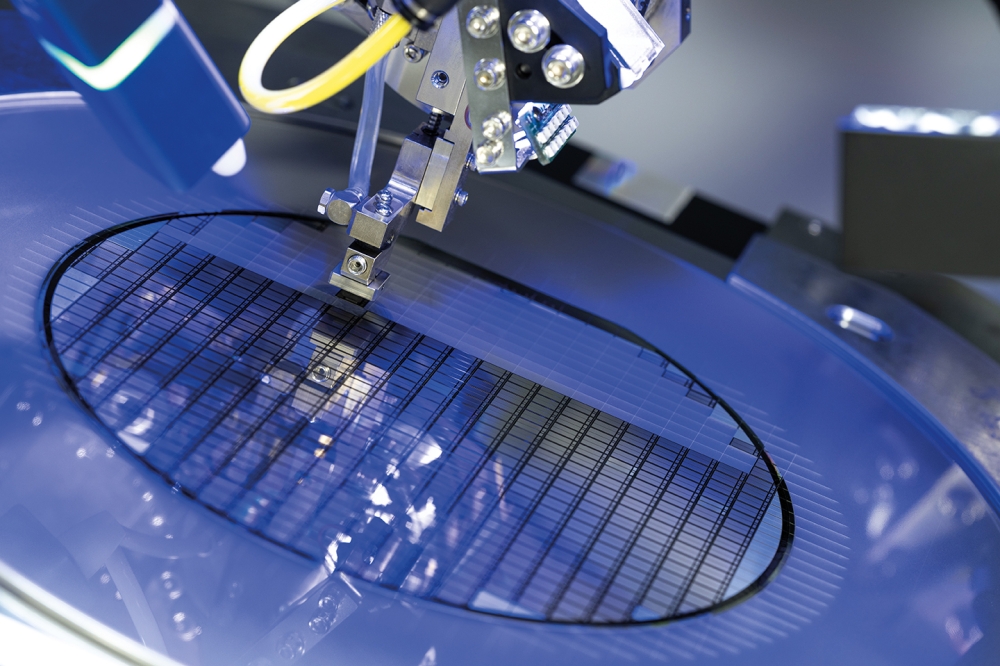

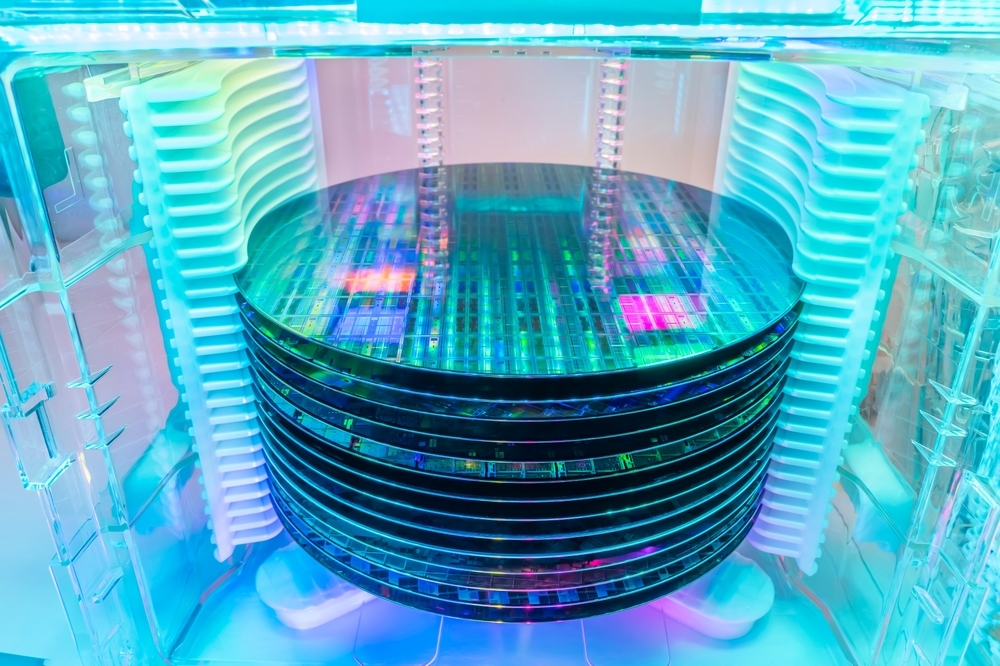

With global sales of semiconductors now at all-time highs, it's not surprising that some technology analysts are growing nervous about the sustainability of the sector's growth. Worldwide sales reached $107.9bn during the third quarter of 2017 according to the Semiconductor Industry Association, more than 22 per cent up on the same period year ago "“ and putting the industry well on track for its highest ever annual revenues, eclipsing last year's total of $339bn.

In which case, semiconductor sales will have increased in four out of the past five years "“ and even the exception year, 2015, saw a dip of less than 1 per cent. That has prompted some analysts to speculate that the market cycle may be nearing its peak; even in a period of recovering global economic growth, they fear parts of the semiconductor industry will struggle to maintain the breakneck speed of expansion of recent times.

That may prove to be the case, though making short-term sales projections is fraught with difficulty. However, even if the semiconductor industry is now poised to take a breather, the medium to long-term drivers for growth are so strong that it will be a pause rather than a hard stop. Some people think of the semiconductor industry as relatively mature, but its best days are yet to come.

In part, those drivers derive from the evolution of technology, particularly in areas such as cloud computing, big data, artificial intelligence (AI), automation and the Internet of Things (IoT). In each case, new applications will be heavy consumers of semiconductors.

These technologies are deploying at speed. Market research firm IHS forecasts, for example, that the IoT market will grown from 15.4 billion devices in 2015 to 30.7 billion devices in 2020 and to 75.4 billion by 2025. Similar rates of growth are to be found in AI, where PwC expects new tools and applications to provide a boost of between 10 and 25 per cent to many countries' GDP over the next decade.

The big data and analytics revolution, meanwhile, continues to underpin accelerating demand for server and data center capacity. Competition in the cloud space, where rival providers are battling for market share, offers a similar type of boost. In the industrial semiconductors space, the automotive sector is also driving demand as the move towards connected cars and autonomous vehicles proceeds at pace.

Even in the PC industry, now struggling to maintain sales in the face of the threat from mobile devices, demand is getting a lift in niches such as gaming, where consumers require ever stronger and faster machines. Just as is the case across the rest of the marketplace, the demand is for higher-quality technologies capable of superior performance delivered more rapidly.

However, technological advancement is only part of the story of the positive outlook for the semiconductor industry. The emergence of China as a voracious consumer of chips is also a crucial growth driver.

The world's second largest economy is a relative newcomer to semiconductors; as recently as 2003, sales to Chinese customers were lower than in Europe, North America or Japan. But as China's smartphone and tablet industries took off, demand increased rapidly, with the growth of advanced electronics manufacturing in the country subsequently adding to consumption. China became the world's largest consumer of semiconductors in 2006 and is thought to have accounted for around 60 per cent of global sales in 2017.

For manufacturers of chips and other materials, China clearly represents a huge opportunity. But Western companies will need to think carefully about how they target the market "“ for example, by building links with domestic players or building support networks throughout the Chinese technology ecosystem. Those businesses that simply assume Chinese buyers will purchase their products without any investment in broader relationships within the country are likely to be disappointed.

Moreover, time is running out to build these relationships. While Western companies' experience and established product development cycles represent a potential source of competitive advantage, the huge investment now underway in domestic innovation in China means this lead will be temporary. Sales of Chinese chips already account for around 7 per cent of global semiconductor sales and with the Chinese government targeting the sector as a key focus for its industrial policy "“ termed Made in China 2025 "“ the domestic industry is moving up the value chain.

New manufacturing facilities in China, expected to come on stream during 2018, have the potential to hasten this shift, posing a challenge to international semiconductor manufacturers with ambitions to expand in the country. Such businesses must capitalize on the Chinese opportunity before it is too late.

Still, for nimble manufacturers with the agility to adapt quickly, both to the demands of doing business in China and the broader theme of evolving technology, the outlook in the semiconductor industry is now brighter than ever. With demand for chips set to continue to rise and the advent of innovative manufacturers with a broader product range spanning more of the technology solution, there is every reason to be confident.