Pandemic lessons learned will shape IC manufacturing well beyond 2022

From the first days of the pandemic to the recovery now taking hold, the

semiconductor industry has retained its role as both a pain point and

as a balm to speed a much needed global economic reset. One quarter into

the New Year, we examine common assumptions, the facts, and strategies

for achieving sustainable growth amidst challenging times.

AN ANALYSIS BY MARK ANDREWS, TECHNICAL EDITOR, SILICON SEMICONDUCTOR

BUSINESS UNUSUAL is how many have described the semiconductor industry throughout the past two years. This description persists as manufacturers work their way out of varying pandemic-induced crises towards sustainable growth.

If the pandemic can be credited for any changes in semiconductor manufacture it is an important new understanding across different industries that a full recovery is going to require increased production of semiconductors from the most simple power controllers to the most advanced ASICs. What isn’t clear is how to find the best road for meeting demand amidst continuing supply chain woes and the reality of a world that continues to grow ever more dependent on advanced technology. While digitization was already well underway in 2019, the pandemic transformed evolution into revolution. And as we can all appreciate now more than ever, revolution by nature forces a disruption of the status quo.

It doesn’t take an in-depth market study or a survey of the world’s top manufacturers and suppliers to know that the IC business is booming and will stay that way for the foreseeable future. But since technology is in a sense ‘all about the numbers,’ let us take a look at one recent study released in January by IC Insights that showed 2021 chip sales grew 25 percent. This came on the heels of records set in 2020 despite the challenges of manufacturing amidst the worst global pandemic in a hundred years. While 2022 is expected to be another growth year, IC Insights believes that a long anticipated return to more typical business growth will result in a comparatively ‘modest’ growth rate of 11 percent this year. Keep in mind that 11 percent growth in virtually any of the 10 years preceding 2020 would have sent champagne corks popping across the globe.

In an industry as large as global semiconductor manufacturing, it is best to have as many insights as is practical before closing the books. The Semiconductor Industry Association (SIA), in a March 2022 report, said it expects 2022 may hold some additional surprises in the form of growth that could surpass the IC Insights forecast. The SIA stated that global IC sales increased 26.8 percent year-on-year as of January – this figure is the second highest first quarter start in history. Bear in mind that January sales are typically well off those of the previous year’s fourth quarter since in January of a typical year, the ICs going into holiday gifts around the world have largely been built, sold, and shipped to OEMs; slight seasonal peaks and valleys typically appear in the quarters that follow, but first quarter is usually a time to restock, resupply and plan how to achieve success throughout the ensuing months. Not so much in January 2022 – this year, January was all about filling orders and reducing backlog.

The lack of advanced ICs and semiconductors of all types has been widely discussed as reasons for some OEMs to report smaller than expected sales. Indeed, some were held back, like Apple that reported it ‘lost’ up to $6 billion in sales due to its inability to complete product builds. Over at Nvidia Corporation, CFO Colette Kress echoed that refrain, saying her company did not realize a substantial amount of sales it believes it could have achieved had all key components been delivered as originally expected. Kress forecast supply constraints to ease by mid-year. But her forecast needs to be considered in two contexts that have great potential to upset the applecart: first, manufacture and delivery may continue to improve if there is no major surge in COVID-19 infections due to new variants emerging. Secondly, while Kress did not attempt to offer insights about other business influencers beyond the pandemic, it is clear that no one can accurately predict how the conflict in Ukraine begun by Russia weeks ago may eventually affect global markets including semiconductors.

While every product that needs to move from one distant point to another has been impacted by pandemic related shipping and distribution challenges, automobile manufacturing is often cited as a heavy industry bellwether. While this is very likely true within regions dependent on a particular auto makers’ health, understanding the true cause and effect at the national and global level isn’t as simple as accounting for a single variable. Like most complex manufacturing processes, the success of vehicle production and sales can’t be tied solely to one commodity. In fact, recent studies appear to reveal that some of the assumptions around the impact of IC shortages on new car sales may have been over stated. While contributing to empty sales lots and higher prices, was the lack of some semiconductors the ultimate culprit?

In a recent IC Insights study, researchers took an in-depth look at the automotive device market as part of the organization’s January Semiconductor Industry Flash Report; look to the IC Insights February quarterly update for in-depth auto IC sales numbers and forecasts.

This is the point where previous ‘conventional wisdom’ departs from the facts that are now available. According to a sizeable majority of auto related headlines, supply and demand imbalances can be traced to ways that the semiconductor device shortage that began in late 2020, grew in 2021, and persists into 2022 has dramatically impacted both the availability and cost of new vehicles. Further, that the lack of new vehicle production has led to escalating used car prices and a general lack of replacement vehicles for anxious buyers.

The commonly accepted rationale for what led to auto makers’ woes goes a bit like this: In March of 2020, just as the first shut-downs signaled the onset of the COVID-19 pandemic, auto demand plunged worldwide. Auto makers reacted to this and began to shut down plants and halt semiconductor orders from suppliers. Like many manufacturers, the relatively cheap and fast ability to move goods around the pre-pandemic world led auto makers to depend on a ‘just-in-time’ inventory strategy that helped reduce costs of warehousing months’ worth of parts at the expense of flexibility should vital parts suddenly become unavailable. Just-in-time as a business strategy works so long as the supply chain is functioning according to established performance metrics. The strategy falls flat on its face when container ships can’t load or unload, and vendor factories are idled for protracted periods of time.

While auto makers were putting the brakes on their usual inventory restocking practices, there was a global surge in demand for cellphones, televisions, computers and monitors, games, and home appliances from a global population that was sheltering in place. As the pandemic grew in mid-2020, what began as sheltering in place turned into a tsunami of work-from-home paradigm shifts that are only now beginning to reverse in substantial numbers. As conventional wisdom holds, semiconductor manufacturers and suppliers switched production capacity away from automotive devices to the commoditized components and ASICs needed to build electronic systems now suddenly in much higher demand compared to purchasing in typical years.

When auto makers wanted to reopen factories in 2020, the story goes than many if not most found that semiconductor suppliers had shifted production capacity away from automotive applications to meet greater than usual demand for consumer electronics. IC manufacturers could not meet a renewed demand for automotive products, so a serious shortage ensued. This shortage drove up the price of new cars and light trucks while transforming pre-owned cars into driveway goldmines.

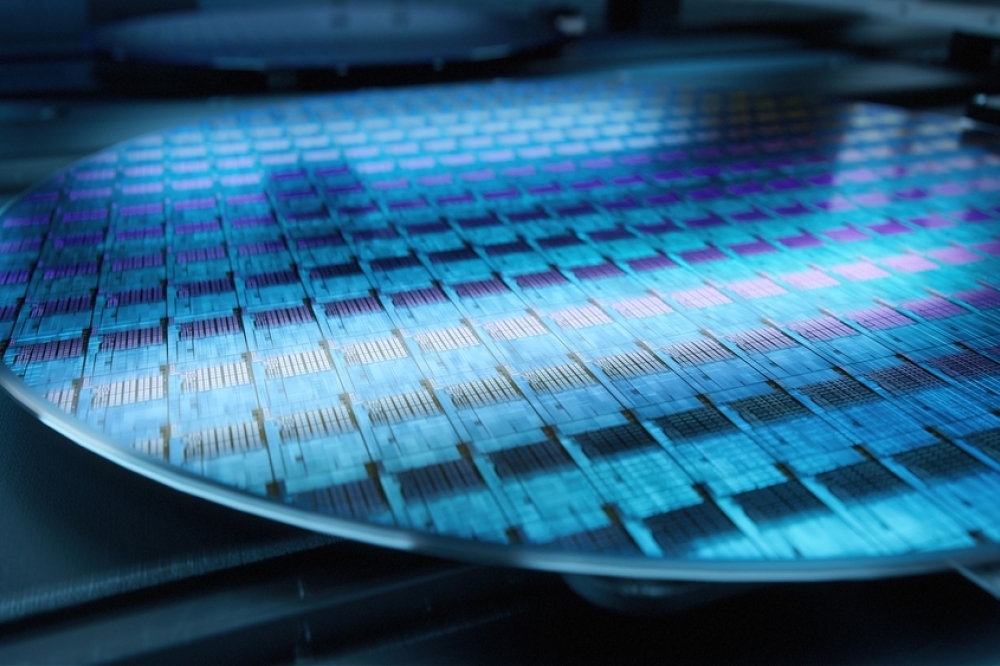

IC Insights has said that it believes that the commonly accepted scenario described above is not the complete story behind automotive industry production shortfalls. In the opinion of IC Insights’ researchers, the real reason behind the automotive IC shortage lies in a combination of factors: first, the surge in demand for automotive ICs in 2021 was to blame, not the inability of semiconductor manufacturers to increase production. Automotive ICs are increasingly vital in each succeeding generation of new cars and light trucks thanks to their role in advanced driver assistance and safety (ADAS) systems, greater vehicle autonomy, the shift from conventional internal combustion engines and drive trains to electric vehicles, and more in-vehicle entertainment and internet connectivity. Essentially: supply was falling short due to a combination of pent-up demand in 2020 and the fact that more ICs were needed per vehicle. (See Figure 1)

According to the researchers, IC manufacturers actually shipped 30 percent more devices to the automotive industry in 2021 as compared to 2020, which was substantially greater than the 22 percent increase in total worldwide IC unit shipments recorded in 2020. What is especially revealing is that the growth of IC units shipped to auto makers in 2021 was substantially greater than pre-pandemic 2019. Further, the response by manufacturers’ to their auto manufacturer customers’ needs represented the greatest increase in shipments since 2011. The most recent substantial jump in IC shipments to auto makers occurred between 2016 and 2017 when shipments increased 20 percent. The 2017 growth spurt was considered record-setting at the time.

So where does the mismatch come between the shipments we can see vs. the commonly held public perception that semiconductor manufacturers did not ‘step-up’ when needed? A lot hinges on the subjective nature of perception and the complicated entanglement of influencers that affect outcomes across global markets. According to IC Insights, the pandemic’s impact on global supply chains occurred at a time of continual growth in the quantity of semiconductors needed to complete a vehicle build. Essentially, demand for automotive ICs experienced what is generally called a ‘step-function’ increase in 2021. Such increases will almost always trigger a temporary mismatch between supply and demand regardless the product. So we can now see that despite a 30 percent increase in device shipments, IC manufacturers could not keep up with the fact that more ICs are needed in each new vehicle, paired with unexpectedly high demand that grew during the second half of 2020 and throughout 2021.

The pandemic-driven global imbalance between semiconductor manufacturing and OEM consumption has led to a substantial reevaluation of where the most advanced chips are manufactured and how industry might work to restore balanced growth while simultaneously addressing long term needs. Major issues include the concentration of chip manufacturing in the Asia-Pacific region; impacts of More’s Law-driven device architectures changing into ‘More than Moore’ paradigms; and the implications still being assessed of talent shortages now seen globally as today’s most senior engineers, researchers and technicians retire or for other reasons decide to leave the industry.

Even before the pandemic, alarm bells were ringing when manufacturing advanced ICs had substantially moved out of North America and Europe in favor of lower labor cost locations across the Asia-Pacific region, most notably to Taiwan, Korea and China. Perhaps one of the most striking indicators is a look at the share of worldwide semiconductor manufacturing in the United States in 2020 compared to 1990. According to an analysis by Brookings Metro published earlier this year, despite its incumbency role in developing the semiconductor industry, US-based IC manufacturing has fallen steadily in the last 30 years from a 37 percent share to about 12 percent in 2020. According to experts at Employ America, this transformation has many implications, but the two most worrisome is the loss in production leadership and also what they describe as the ‘learn by doing’ processes that go hand-in-hand with manufacturing.

Ask any production manager or engineer how they honed their fab expertise and grew within their fields. Most will attribute success to a combination of continuing education and the hands-on work experience that gives seasoned employees an edge. From a company’s least experienced new hire to a company’s most senior researchers and chief technologists, experience counts not only in terms of production efficiency but also because of its unique ability to drive innovation. It may sound obvious, but many of the best ideas manufacturers develop are outgrowths of hands-on work with the product and the machines, processes and materials required to make said products. Essentially, building advanced devices concentrates the experience needed to build next-generation devices in the location where the manufacturing takes place. Studies by Employ America have shown that not just in the US, but in any location that hosts advanced manufacturing, it is the presence of manufacturing facilities alongside research and academia that enables constant product and process improvement, which elevates competitiveness.

In the United States and across the European Union, the importance of having advanced semiconductor manufacturing in-country is key to continuing leadership within a given field. This has led to a number of legislative initiatives in both the United States and the EU to foster ‘home grown’ manufacturing. The United States has its America COMPETES Act along with the CHIPS for America Fund now being debated in Congress. The EU has developed and supported its counterpart, the European Chips Act, which ambitiously calls for quadrupling Europe’s production capacity by 2030 while also attempting to create systems designed to avoid future supply chain disruptions. Both US and EU initiatives are designed to counter the subsidies, government ownership and tax advantages found in other countries including China and Taiwan that underwrite the development and expansion of semiconductor manufacturing within their borders.

Governmental actions in North America and Europe have not gone unnoticed as evidenced by new rules and tax incentives to support and safeguard local semiconductor industry recently passed by South Korea’s National Assembly. In China, 15 local semiconductor funds have been established in an effort to supply 70 percent of its own chip needs by 2025.

Not finding a sought-after consumer electronics product, or paying substantially more for it, is certain to catch the eye of any frustrated shopper. But what does not make mainstream media headlines is the titanic shift underway that is already changing the way chips are designed and manufactured.

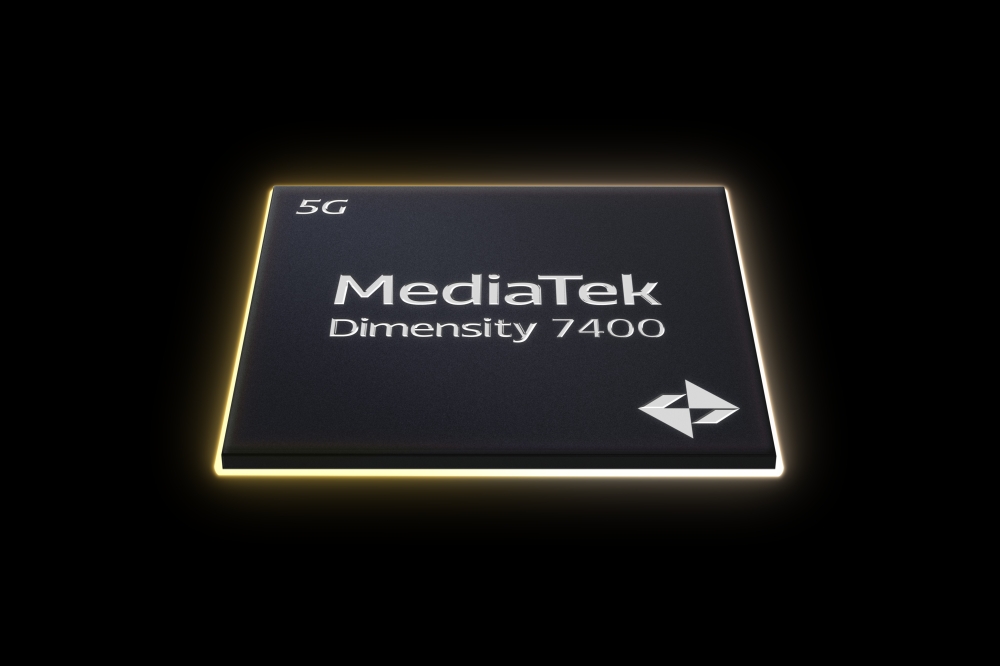

While Gordon Moore’s ‘Law’ drove the pace and essential rules for competitive semiconductor architectures through the early 2000s, it has become more and more apparent that transistor shrink can no longer meet the needs for greater performance, reduced size and lower power consumption that have enabled widespread use of semiconductors across multiple product categories. The ‘More than Moore’ (MTM) movement has many permutations, but to condense this into digestible bites, think of MTM innovations as design approaches that depend upon new electronic materials science, new device structures and even whole new underlying technologies as a means to achieve performance, cost and power consumption goals rather than conventional Dennard scaling.

As outlined in an article in this edition of Silicon Semiconductor, ClassOne Technology Vice President John Ghekiere points to ways that he has seen companies outside the exclusive club of ‘Uber Foundries’ still pursuing transistor shrink are instead charting new courses to achieve their goals without the complexities and expense driven into Moore-style transistor shrink. These are innovative companies working to develop top-performance devices, yet they eschew coughing up the price for EUV lithography systems or other exorbitantly expensive technologies designed to enable transistor features scaled to and below 3nm.

“The withering march of relentless device scaling described by Moore’s Law has left a mere handful of device manufacturers in that race, with TSMC clearly in the technology lead. When the cost per transistor inflected to become more expensive with each generation, somewhere between 26 and 22 nanomater nodes, it drove even many of the larger and more powerful manufacturers to alternate paths of innovation and new means of bringing value; GlobalFoundries pivoted boldly into FD-SOI; STMicroelectronics into SiC. The broad expansion of new device types - in short, the ubiquitous adoption of microelectronic devices into almost every aspect of our daily lives - has brought about the More Than Moore era, where feature scaling is no longer the sole means of device innovation,” he said.

The headlong pursuit of More Than Moore strategies at the time other manufacturers are seeking to build 3nm devices, plus the simultaneous need for more semiconductors for more applications is creating a unique combination of challenges and opportunities for the industry. This is perhaps best appreciated when one considers that third and fourth quarter 2021 saw one of the largest employment sea changes since the Great Recession of 2008. In the United States alone, 4 million persons changed jobs, retired before age 65, or left the workforce across a multitude of professional roles for a variety of reasons.

The SEMI trade association reported results of its latest industry survey on 28 February 2022 that points to the greatest concerns amongst its international membership. More than 400 US member companies replied, offering insights into perspectives about the importance of enhancing competitiveness through targeted public and private investments aimed at developing the industry’s manufacturing capacity, infrastructure and workforce. SEMI conducted the survey in partnership with MITRE Engenuity, the technology foundation for public good launched by MITRE two years ago.

The survey indicated US manufacturers and key suppliers see needs and challenges in three primary areas:

- A need for investment across the entire semiconductor ecosystem

- Investment by private firms as well as publicly-funded entities to counter the governmental incentives provided in current centers of IC manufacturing in Asia-Pacifi

- Investment in multi-generational workforce initiatives including STEM incentives, apprenticeship programmes, and similar efforts built around creating interest in careers that pay well but may be perceived as unreachable goals

While governments and major semiconductor manufacturers agree hybrid investment strategies are key to increasing competitiveness and to ensuring continual growth in the global chip supply, it was somewhat surprising to see the importance placed on growing the talent pool of engineers, technicians, researchers and scientists focused on developing and manufacturing advanced ICs. Respondents in the SEMI survey were essentially saying that building new fabs in Europe, the United States and elsewhere are critical to expanding global semiconductor capacity while supporting the ‘on-shoring’ of IC manufacture, but that shiny new infrastructure will come to naught if those facilities cannot be staffed by a highly educated, well trained workforce.

The combination of senior technical staff reaching retirement age and plans to dramatically increase manufacturing in North America and Europe are at odds – factors that will play an increasingly important role to correcting the supply/demand imbalance while ensuring that there is a steady supply of semiconductors from a diversified global manufacturing base.