Medical Imaging Chip Global Unit Volume To Soar Over the Next Five Years

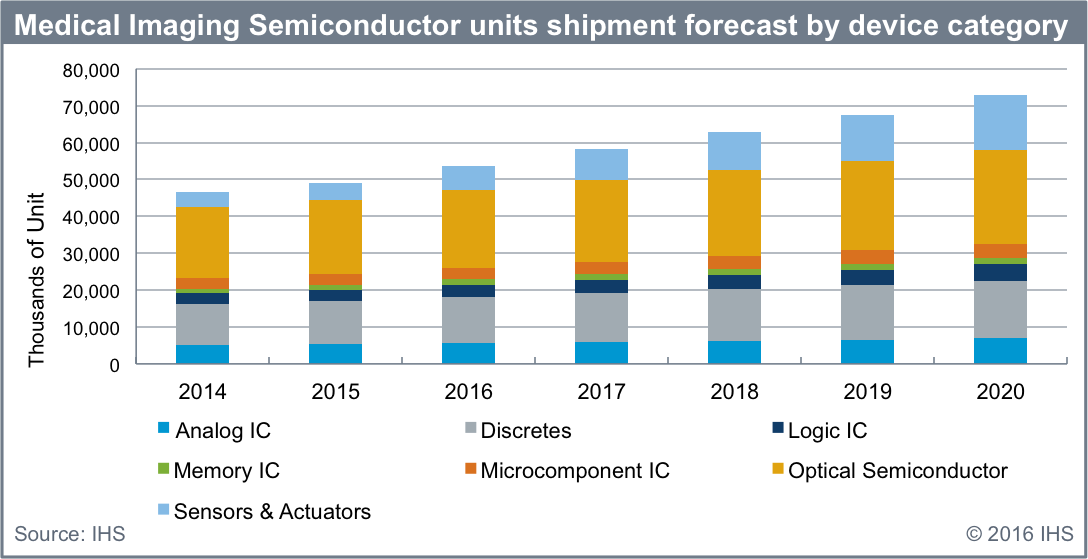

Given the medical imaging industry's growing requirements for power savings, higher resolution and the need to support integrated security and communications, the unit volume of semiconductors used in medical imaging will continue to increase. The market grew at a five-year compound annual growth rate of 8.2 percent, from 46 million in 2015 to 73 million in 2020. Even with increasing demand for energy-efficient and integrated components, year-over-year global revenue growth from semiconductors used in medical imaging was flat, due to optical component price erosion, reaching $1.1 billion in 2015.

One of the most important trends in the semiconductor industry today is the development of chip solutions that integrates several components into a single chip package to minimize size, save energy and lower production cost without sacrificing functionality. As the size of semiconductors continues to decline, imaging systems that used to cost more than a million dollars "“ and which traditionally required a lot of space to install -- have evolved into smaller, less-expensive systems that can be used in small clinics or doctors' offices.

The IHS Markit Industrial Semiconductor Market Tracker tracks the following four major types of medical imaging equipment (the following medical imaging data comes from the IHS Markit Medical Devices and Equipment service):

1. The ultrasound market is forecast to grow 4.7 percent over the next five years. Portable ultrasound in China is not growing as fast as previously expected, due to less capital investments and strategy shifts toward higher-end systems from major suppliers. With ultrasound typically costing less than computed tomography (CT) and magnetic resonance imaging (MRI), healthcare reform is likely to favor the more widespread adoption of ultrasound, which bodes well for patients and doctors opting for systems that minimize radiation exposure.

2. The X-ray market is expected to grow 5.3 percent, led by mobile X-ray replacing existing analogue mobile systems with more efficient and higher-priced digital X-ray systems -- especially in the APAC region.

3. The MRI market is expected to grow 6.4 percent, due to higher demand for open MRI in emerging markets, which is more cost effective than closed systems. Open MRI has not gained traction in the United States and other mature markets, because of its lower field strength and weaker image quality compared to closed MRI.

4. The CT market is expected to grow 4.2 percent, led by 64-slice systems which are more cost effective than the 128-slice systems, but still provide= sufficient image quality for diagnostic purposes. As the 128-slice system market matures and the devices become more affordable, it will gradually gain momentum. The demand for less-than-16-slice systems and 17- to 63-slice systems will continue to decline, because emerging regions are price-sensitive and quality is not a primary consideration.

Semiconductor content thrives in medical imaging

The demand for high-quality and innovative medical imaging has increased the advancement, performance and penetration of semiconductors and sensors. Ongoing component price erosion continues to intensify across the semiconductor industry, as semiconductor manufacturing continues to increase significantly in China.

Complementary metal"“oxide"“semiconductor (CMOS) image sensors are highly predominant in CT-scan and X-ray systems, allowing amplified cross-sectional image slices of scanned body areas with higher resolution, faster data throughputs and better diagnostics. CMOS is an emerging technology that is preferred over charge-coupled device (CCD) technology, due to lower cost, higher readout speed and less noise. Scanner performance improvements and innovations have significantly increased slice count, leading to faster and clearer images. It is also a lot safer for patients, thanks to its reduced radiation dosage levels.

More power discrete and module semiconductors are required for motor control and input-power refinement -- especially in MRI systems requiring greater magnetic-field strength, with the transition to 3 Tesla (3T) technology. Analog semiconductors are also prevalent in the medical imaging market, due to the integration of low-noise amplifiers, voltage-to-current amplifiers, and multi-channel analog-to-digital converters (ADCs) into single analog front-end integrated circuits (AFE ICs). These circuits are much smaller, and dissipate less power, than earlier-generation parts, while providing twice the performance. Analog advancements have addressed the low-power and low-cost needs of CT scanners with high slice counts and clearer images. A high-resolution ADC must be used during an MRI scan to produce a strong magnetic field.

Processors are another crucial component and differentiator in medical imaging devices. These include microcontrollers (MCUs), microprocessors (MPUs), digital signal processors (DSPs), applications/media processors (APs) and configurable system-on-chip (CSoC). AP is defined under application-specific logic. Configurable processors, including field programmable gate arrays (FPGAs) and CSoCs, are defined under programmable logic devices. Processor trends in medical imaging reflect -- and even exemplify -- trends that are occurring across the semiconductor industry.

MCUs typically control human-machine interface functions, motor control, power management control, connectivity, security and other functions that have little to do with image processing. They are inexpensive compared to image processors, and they are also less likely to fail in adverse environments with a lot of radioactivity, high temperatures or electro-magnetic interference, which makes them well suited for use in medical-imaging equipment. MCUs are used in touchscreens and keyboard controllers, motor controllers, sensor fusion, network connectivity, safety and security. Improvements in the equipment's ease-of-use, comfort and control of the equipment improves, are primarily due to the use of MCUs. As imaging equipment trends from large, clinically installed models to mobile and portable solutions, these features will be in high demand, requiring higher quantities of MCUs with greater functionality.

Since medical imaging equipment is expensive, and unit-shipment numbers are relatively small, the designs for image pre-processing vary widely. This type of equipment can include vast numbers of discrete analog-to-digital components, through DSPs fed into one large FPGA, to process and organize all of the signals in parallel; or, the FPGA might include integrated DSP slices. Part or all of this pre-processing may be replaced by custom application-specific integrated circuits (ASICs). Occasionally a semiconductor supplier markets a single ASIC processor as an inexpensive integration of these multiple components, but the trend seems to come back to DSPs and FPGAs to accommodate increasing precision and flexibility. This "tic-toc" design strategy will continue back and forth between increasing performance and cost effectiveness.

The vast majority of image post processing is done on workstations and industrial computers specially designed for medical imaging. In fact, some of the most common image processing is completed on industrial PCs and industrial devices that are not classified in the "imaging device" category. The need for processors that support better resolution and high-performance 3D imaging affects processors in these devices, more than it affects the actual imaging equipment itself.

However, not all medical-imaging equipment requires an external computer for image processing -- especially very compact and portable devices where it is more convenient to build all-in-one solutions. APs and CSoCs are increasingly used as substitutions for post processing, when costs and power efficiency are required, but higher resolution is not.