Soitec posts net profit

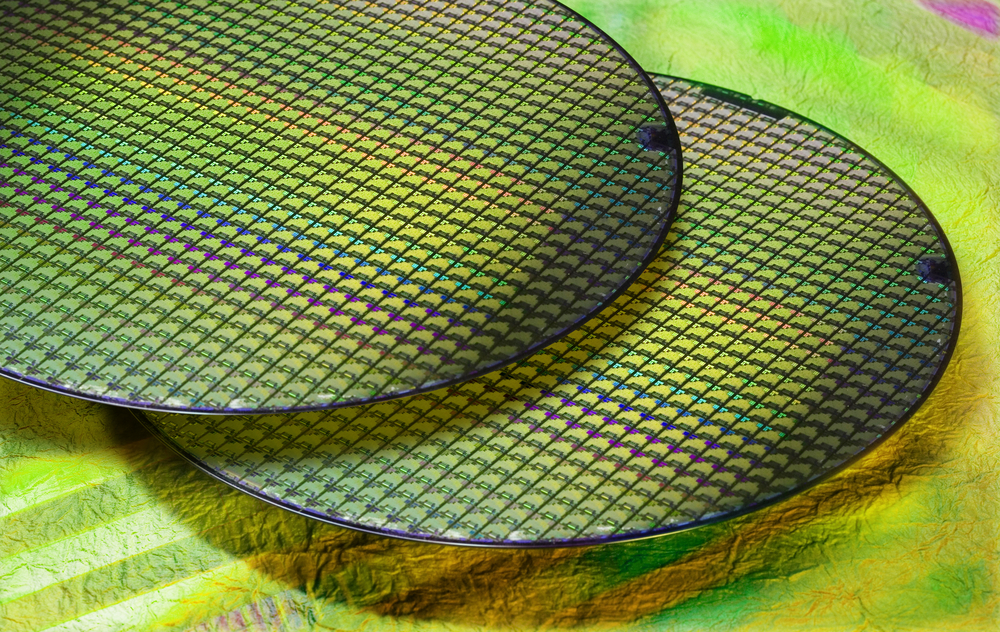

Silicon-on-insulator wafer supplier Soitec has announced its results for the first half of its fiscal year 2017 (H1'17 - period ended on September 30th, 2016).

Highlights include sustained revenue growth of 4 percent driven by communication and power products; improvement in operating profitability (current operating income of € 9.4m); and net result in positive territory: €3.1m

Paul Boudre, Soitec's CEO and chairman said: "As committed, we successfully refocused our business on electronics and repositioned Soitec on a path to deliver profitable growth. In the first half of our fiscal year, our solid sales performance combined with tighter operating and financial discipline have led Soitec to report a positive net profit.

"We continue to benefit from a sustained momentum in radio frequency and power applications for the mobile and automotive markets. Meanwhile, our confidence in the forthcoming large-scale adoption of FD-SOI [fully depleted silicon-on-insulator] technology by the semiconductor industry is reinforced by new milestones achieved in terms of industrial readiness and product launches. With a restored balance sheet and the resources we need to finance our growth investments, we are in a strong position to capitalise on the promising prospects of consumer electronics markets," added Paul Boudre.

Consolidated H1'17 revenues came to €112.1 million, a 3 percent increase (+4 percent at constant exchange rates), compared with the previous financial year. This growth was primarily driven by higher sales of 200mm wafers (78 percent of H1'17 sales) which rose by 5 percent at constant exchange rates, supported by the steady demand for radio frequency and power electronics applications in the mobile and automotive markets.

Sales of 300mm wafers (20 percent of H1'17 sales) recorded a slight decrease (-1 percent at constant exchange rates) reflecting the ongoing and anticipated decline of the PD-SOI product line. Revenues from royalties and IP (2 percent of H1'17 sales) went up by 9 percent at constant exchange rates.

Gross profit reached €32.0 million (or 28.6 percent of revenues) in H1'17, up from €27.1 million (or 24.9 percent of revenues) in the previous financial year. This reflects higher volumes, a more favourable product mix and a good control over the production costs at the Bernin I plant (200mm wafers) which has been running at full capacity, while the level of capacity utilisation at the Bernin II facility (300mm wafers) remained low.

Net R&D expenses rose to €9.7 million or 8.6 percent of revenues, from €8.0 million or 7.4 percent of revenues in H1'16, reflecting an increase in gross R&D expenses related to FD-SOI, whilst prototype sales, subsidies and income tax credit were almost stable.

Sales and marketing expenses went up to €3.4 million from €2.6 million in H1'16 essentially to support the efforts aimed at promoting the adoption of the FD-SOI technology. In the meantime, general and administrative expenses were up to €9.5 million from €8.5 million in H1'16 reflecting an increase in total payroll. All in all, H1'17 selling, general and administrative expenses came to €12.9 million or 11.5 percent of revenues, compared with 10.2 percent in the previous financial year.

H1'17 current operating income came to €9.4 million, compared with a current operating income of €7.9 million in the previous financial year.

In H1'17, the EBITDA of the continuing operations (Electronics) stands at €18.5 million , or 16.5 percent of sales, above the initial annual target of c. 15 percent. This compares with an EBITDA of €15.0 million, or 13.8 percent of sales in H1'16.

Net result in positive territory

The withdrawal from non-core businesses, the profitable growth generated in Electronics business as well the sharp decline in net financial expenses led Soitec to report a positive net result in H1'17.

A net amount of €1.2 million was recognised in other operating expenses in H1'17, mainly as a result of legal fees arising from an industrial property litigation in the United States. The operating income totaled €8.2 million, compared with €2.6 million in the previous financial year.

The Group recorded net financial expenses of €5.9 million, compared with a charge of €12.7 million in the previous financial year.

Following the withdrawal from the Solar activities as well as from the Lighting and Equipment activities, the residual income and expenses related to these businesses were recorded under discontinued operations. With an operating loss of €1.9 million (versus €4.9 million in H1'16) and a net financial income of €2.9 million (versus a loss of €27.1 million in H1'16), the net profit from discontinued operations stood at €1.1 million s compared to a net loss of €32.4 million in H1'16.

As a result, Soitec recorded a net profit of €3.1 million in H1'17, compared with a net loss of €42.8 million in the previous financial year.

Overall, Soitec's net cash position has increased by €34.1 million during H1'17.

Strengthening of Soitec's financial position

Soitec raised a gross amount of around €151.9 million in funds in H1'17 to reinforce its balance sheet and give the group the financial resources it needs to finance its growth investments. This capital injection was also a mean to strengthen its shareholder structure with Bpifrance, CEA Investissement, and NSIG Sunrise now each holding a 14.5 percent shareholding in Soitec.

Soitec has also secured the resources it needs to fund investments in production capacity to manufacture FD-SOI at the Bernin site (around €40 million). Cash and cash equivalents stand at €83 million on September 30th, 2016 compared to €49 million on March 31st, 2016.

Net debt consequently stands at €35 million on September 30th, 2016 compared to €170 million on March 31st, 2016.

Business trends

Demand remains robust for RF-SOI products in mobile applications and for Power-SOI products in automotive. Bernin I 200mm wafer production site continue to run at full capacity and demand is already strong for calendar year 2017.

As Soitec's Shanghai-based industrial partner Simgui successfully achieved first customer qualifications for 200mm SOI wafers in October 2016, industrial production is now expected to ramp up, bringing additional capacity for Soitec to meet customers' demand and continue to benefit from sustained growth in 200mm wafers.

In 300mm, a low-point was reached in Q2'17. As expected, activity for PD-SOI products steadily continues to contract. However, multiple foundries and their fabless customers are engaged in the development of products based on 300mm wafers for RF and volume ramp up is now expected in calendar year 2017.

Still in 300mm, the FD-SOI ecosystem continues to strengthen: further progress in the adoption of FD-SOI by the semi-conductor industry was achieved in the past few months.

In particular, the first consumer electronics product driven by FD-SOI technology was launched in China in August 2016. AMAZFIT, the fitness smartwatch by Huami (a Xiaomi partner company), includes a FD-SOI-based GPS chip enjoying a record energy efficiency level.

The chip allows the watch to reach a very long battery life with the GPS turned on. The production of FD-SOI-based chips to serve tier-1 fabless customers has started for 28nm and is expected in 2017 for 22 nm. Further products are due to be launched in the coming months (Internet of Things, infrastructure, automotive).

In the meantime, GLOBALFOUNDRIES unveiled the extension of its FD-SOI roadmap. In addition to its existing platform (22FDX), the upcoming 12nm FD-SOI semiconductor technology will bring opportunity to its fabless customers to expand their product roadmaps for mobile applications beyond 22nm FD-SOI.

Outlook

FY'17 Electronics sales are expected to grow at low single digit at constant exchange rates. Soitec will benefit from further growth in 200mm thanks to solid demand in RF-SOI and

Power-SOI whilst 300mm business is expected to start recovering in H2'17 from the low point reached in Q2'17 with new products offsetting the further anticipated slowdown of PD-SOI.

Supported by the full utilisation of its 200mm manufacturing capacity and the improved gross margin recorded in H1'17, Soitec expects its operating profitability to be sustained and H2'17 Electronics EBITDA margin to be in the same order of magnitude as in H1'17 (16.5 percent).

Beyond FY'17, further sales and EBITDA gradual increase is expected.

Soitec will continue to benefit from the continuous growth in RF-SOI and from the opportunity to leverage its partnership with Simgui who will bring an additional annual capacity of 150,000 SOI wafers (200mm) by 2018. In the meantime, Soitec has the internal manufacturing capacity to support the expected growth in 300mm RF-SOI.

Soitec also benefits from significant manufacturing capability to support the early stages of FD-SOI adoption as evidenced by the contemplated investment of €40 million in Bernin II aimed at progressively boost FD-SOI production capacity from 100,000 to 400,000 FD-SOI wafers (300mm) per year.