High-end inertial sensor market on growth trajectory

Global economic growth, new markets and resurging defence opportunities are fueling the growth of advanced inertial, high-end sensors (HES) according to Yole Developpement researchers.

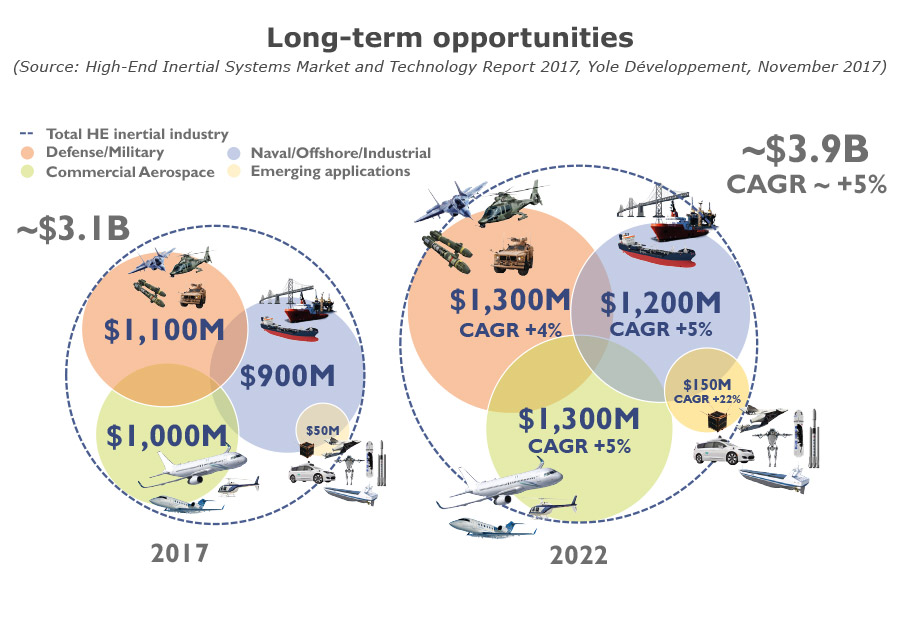

A trio of political and economic trends is positively impacting the demand for high-end inertial sensors and providing opportunities for companies entering the industry with new device solutions. The global market is expected to reach nearly (USD) $4 billion by 2022, a 5 percent compound annual growth rate (CAGR).

The global inertial sensor market is fragmented, but the majority of historical development has focused on the needs of defence and security contractors; given its existing market heft, CAGR in defence inertial sensor markets will be 4 percent over the next four years. Aerospace and aviation segments also consume a significant portion of the inertial sensor market while the non-military industrial sector is showing similar growth thanks to "˜hot' emerging applications including autonomous vehicles, advanced drones and robotic systems with varying degrees of autonomy.

Defense and commercial aerospace markets have always been the backbone of the high-end inertial system market, and that is still true today. But emerging applications are whetting the appetite of many players,' commented Dr. Guillaume Girardin, Technology & Market Analyst at Yole.

Yole's new report, "˜High End Inertial Systems Market and Technology,' provides market data on high performance devices including sensor-based accelerometers, gyroscopes, IMU and INS. Other key technologies include SiMEMS, Quartz-based MEMS, Fiber Optic Gyroscopes, Ring Laser Gyroscopes or Hemispheric Resonant Gyroscopes as well as Dynamically Tuned Gyroscopes.

"We estimate that the high-end inertial system market reached the US $3 billion milestone in 2017," asserts Girardin. "Defense makes up 36 percent of this, with commercial aerospace comprising 33 percent. Industrial, offshore and maritime applications account for the remaining 31 percent."

Emerging applications that need the most advanced sensors, control and interface systems span a wide range from robotics to industrial automation; autonomous cars, ships, planes and drones, structural monitoring, space conquest with reusable rockets and microsatellites will all add to the growing global market. Most manufacturers are approaching new opportunities by partnering with end-users to understand requirements that will drive high-end inertial systems specifications in terms of accuracy, volume, shielding and cost.

High-end inertial sensors are important aspects of the (USD) $20 billion global sensor market that is expected by researchers and manufacturers to grow at an accelerated pace through the middle of the next decade. Learn about opportunities for inertial sensors, imaging technologies, MEMS, radar and LiDAR as well as emerging new technologies at HES International, 10-11 April 2018 in Brussels, Belgium.

https://www.i-micronews.com/category-listing/product/high-end-inertial-sensors.html#description