Growth in the AMOLED Market Threatened by Overcapacity

IHS Markit analysts conclude in a new study that thin-film transistor (TFT) display panel manufacturers have overbuilt AMOLED capacity which will likely saturate the 2018 market.

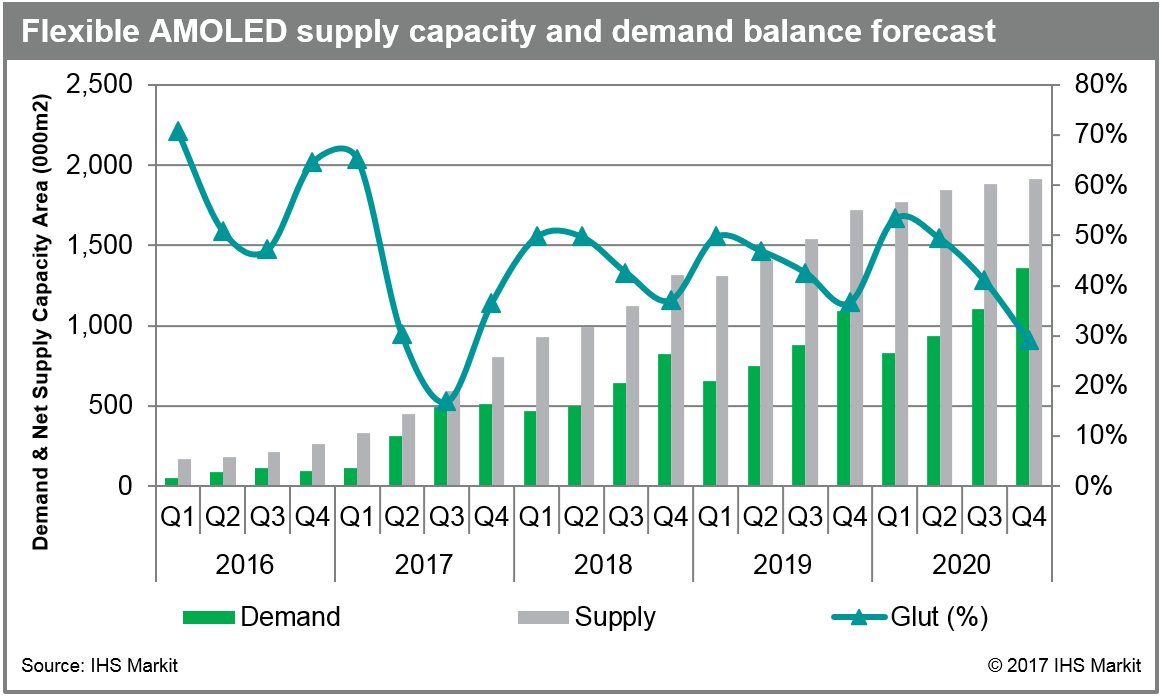

Flexible active-matrix organic light-emitting diode (AMOLED) panel fabs are building at a quicker pace than global demand, says IHS Markit, which has led the analysts to forecast that supply will outpace demand by 44 percent in 2018.

Display market capacity is measured in square metres and the manufacturing output for flexible AMOLED panels is expected to reach 4.4 million in 2018, doubling its 2017 output. At the same time, demand for flexible AMOLED panels is increasing much more slowly than had been expected by suppliers. Demand is projected to increase a substantial 69.9 percent to 2.4 million square meters in 2018, far outpacing demand, according to IHS Markit's AMOLED & Flexible Display Intelligence Service.

"Manufacturers had expected that flexible AMOLED panels would penetrate into the smartphone market fast," said Jerry Kang, principal analyst of display research at IHS Markit. "But, this year, most smartphone brands have focused on LCD or rigid AMOLED wide-screens with an 18:9 or higher aspect ratio rather than curved screens using flexible AMOLED panels because the price of flexible AMOLED modules is still much higher."

According to the IHS Markit OLED Display Cost Model, producing an AMOLED screen costs 1.5 times more than producing same-sized OLED panels on the same Gen 6 production line. "The wide-screen smartphone is expected to maintain its competiveness against one with a curved edge screen for a while," Kang added.

Due to the high cost of flexible panels, smartphone manufacturers use them for their highest-end product segment, making it more difficult for second-tier flexible AMOLED panel suppliers to meet the product qualification. "This may result in seriously low fab utilization at the second-tier panel suppliers," Kang concluded.

Flexible AMOLED panels share technology with all thin-film transistor (TFT) panels; the term TFT refers to the panels' underlying circuit design that places a control transistor with each pixel using thin-film semiconductor manufacturing techniques; LCD, LED and AMOLED share a common heritage. As the price disparity suggests, flexible AMOLED panels are more advanced that basic TFT designs; manufacturers typically make more than one type in their factories and are continually striving to enhance the performance of basic TFT screens along with AMOLED panels. TFT designs utilize inorganic compounds in key components while AMOLEDs use organic materials, predominantly carbon, which shortens their life expectancy relative to other panels. On the plus side, the lifetimes of either panel type exceeds those of other major smartphone components and AMOLED screens are also much thinner, use less energy and can reproduce more vivid, dramatic colors than basic TFT designs.