Samsung overtakes Intel as semiconductor leader

In Q2 2017, Samsung's top-line revenue surpassed Intel's "” but in pure semiconductor revenue, generated by the sale of its own products, Intel remained the market leader, a position it's historically held in our Semiconductor Competitive Landscape CLT Intelligence Service.

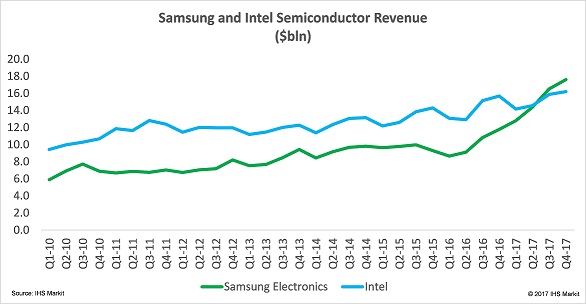

Our semiconductor revenue market share calculation excludes the sale of components to third parties since the third party will be credited with the component sale into the merchant market. In Q2 2017, we estimated Intel's semiconductor revenue at $14.6 billion and Samsung's at $14.4 billion. This represented 12 percent quarter-over-quarter and 58 percent year-over-year growth for Samsung, driven by its memory business growing 15 percent quarter over quarter and 71 percent year over year.

The memory market supply-and-demand issues continue to favor Samsung, who makes over 80 percent of its revenue from memory integrated circuits (ICs). In Q3 2017, Samsung grew its revenue from memory by more than 16 percent quarter over quarter and 62 percent year over year. By contrast, Intel's memory business is a mere 6 percent of its overall revenue and, while it grew 2 percent quarter over quarter and 37 year over year in Q3 2017, it had an insignificant impact on overall semiconductor performance.

In Q3 2017, Intel's semiconductor revenue grew 9 percent quarter over quarter and 5 percent year over year to $15.9 billion. The performance was good news to Intel investors because it reflected successes in the company's strategic move away from a declining client computing market and toward what Intel describes as data driven segments: data center, memory and Internet of Things (IoT). However, it could not compare to Samsung's 15 percent quarter-over-quarter and 53 percent year-over-year semiconductor revenue growth, topping $16.5 billion in Q3 2017. Samsung remained the global memory market leader and continued work on its long-term strategy "” to provide the most advanced memory technology.

As memory companies continue their transition to more advanced nodes, we expect overall capacity to remain low in the short term as vendors work on expanding their manufacturing. We also expect demand from multiple market segments for both DRAM and NAND to remain healthy. We forecast Samsung to remain number one in semiconductor revenue in Q4 2017, growing 6 percent quarter over quarter and 49 percent year over year to $17.6 billion, while Intel Q4 2017 semiconductor revenue grows 2 percent quarter over quarter and 3 percent year over year to $16.2 billion.

Our Q4 2017 forecasts take both companies' semiconductor revenues above the $60-billion mark for 2017. The long-term battle for revenue supremacy within the semiconductor industry continues as the memory market reaches an equilibrium in supply and demand, and as new revenue opportunities in artificial intelligence (AI) and the IoT, including connected devices and self-driving cars continue to emerge.

The IHS Markit Semiconductor Competitive Landscaping Tool (CLT)™ is an easy-to-use Microsoft Excel database that provides detailed coverage of the global semiconductor market by company, product category, application market and region. The tool contains three separate databases and is published quarterly.