Can New Advances in CMOS Replace sCMOS Sensors in Biomedical Applications?

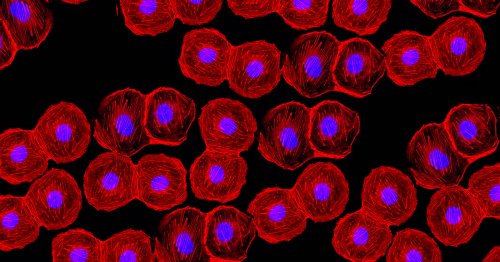

Complementary metal-oxide-semiconductor (CMOS) technology now offers the advanced imaging capabilities required for many biomedical applications, but can it replace the more expensive sCMOS (scientific CMOS) sensors? CMOS and sCMOS sensors have set the benchmark for both performance and value in machine vision in several industries, and this article will explain the benefits and costs of each technology for highly demanding imaging applications in biomedical and life sciences.

What's the difference between CMOS and sCMOS sensors?

Typically, a sCMOS sensor is thought of as a “next-generation” CMOS sensor. sCMOS technology was introduced to bridge the gap between new CMOS sensors and traditional CCD (Charge Coupling Device) sensors during the early phases of CMOS development. Initially, biomedical applications couldn’t use CMOS sensors due to compromises in dynamic range, read noise, frame rates and resolutions. When sCMOS cameras were introduced, they used very similar design principles and fabrication techniques as CMOS sensors, but incorporated several features that helped them overcome initial CMOS shortcomings. This made sCMOS sensors well suited for scientific applications where low light performance, wide dynamic range, and high fidelity were critical.

However, in the years since sCMOS cameras were introduced, conventional CMOS sensors have improved significantly in terms of their quantum efficiency and the ability to reduce their own internal noise, making CMOS cameras a viable option for many advanced biomedical applications. Furthermore, most CMOS cameras are significantly less expensive than sCMOS cameras. This factor alone has motivated many engineers and researchers to consider evaluating the latest CMOS sensor when they need to choose a microscopy camera, histology camera, cytology/cytogenetics camera, or epifluorescence camera for their application.

Do I Need a CMOS or a sCMOS Sensor?

Whether to choose a CMOS or sCMOS sensor depends on a range of factors. If you're debating between the two, you are likely using epifluorescence illumination, because white light is bright enough to not require a sCMOS sensor. The suitability of one over the other can sometimes be as simple as how much light is reaching the camera, or a combination of performance parameters that are unique to a specific application. Regardless of CMOS or sCMOS, you should choose a monochrome sensor over the color equivalent for the inherent quantum efficiency benefit provided by a monochrome sensor.

An sCMOS sensor is characterized by backside illumination and large pixels helping reduce overall noise (like CCD technology). In addition, sCMOS cameras typically include a Peltier cooling system to reduce thermally generated noise over long exposures. Cameras using sCMOS sensors also need a high bandwidth interface such as CameraLink or CoaXpress with a frame grabber board, making such vision systems more complex, and consequently more expensive.

To counter this, CMOS manufacturers have continued making significant improvements in quantum efficiency (the ability to collect incoming photons), reducing read noise (ensuring even low levels of incoming photons are not lost within this noise), and implementing backside illumination. While Peltier cooling is also an option with some CMOS sensors, the improvements to quantum efficiency and reduced noise have made cooling unnecessary for certain biomedical imaging applications.

Another way cost is kept down is the interface—for years, CMOS sensors have been paired with consumer interfaces like USB3, GigE, and 10 GigE. These interfaces do not require a frame grabber, which reduces the complexity (and cost) of the system. Upcoming interfaces like 25/100GigE, USB4, and CXPX will help to eliminate this problem entirely by providing significantly higher bandwidths.

CMOS Sensors are a Lower-Cost Alternative

The lower cost alone has motivated many engineers and system designers to consider evaluating the latest CMOS sensors in place of an sCMOS based system. In many cases, vision system designers are surprised to find a suitable CMOS camera for under USD $1,000, when a typical sCMOS setup with similar performance parameters could cost upwards of USD $10,000.

Whether it's sCMOS or CMOS, many camera manufacturers do not use a single standard to compare cameras. Consequently, it can be challenging to compare cameras regardless of the type of sensor used. In the machine vision world, EMVA1288 has become the accepted standard for specifications and measurement of cameras in Europe, America (AIA - American Automated Imaging Association) and Japan (JIIA - Japan Industrial Imaging Association). Click here to learn more about the EMVA 1288 standard for machine vision.

In summary, for cases that require extreme levels of performance, a sCMOS camera might be a necessity. But it would be worthwhile to identify the most important performance parameters for your specific application and make a fair comparison between CMOS and sCMOS cameras before eliminating one over another. CMOS sensors are continuously advancing and the price to performance ratios between CMOS and sCMOS are narrowing quickly. If your application requirements can be met by a conventional CMOS sensor, it might be a much less expensive alternative for you and your team.

Choosing a FLIR CMOS Machine Vision Camera

If you decide you need a CMOS camera for your application, the two most popular FLIR camera families for epifluorescence applications include the Backfly S and Oryx.

The Blackfly S camera family offers the broadest range of sensors and interfaces, both USB3 and GigE. There is also a wide range of sensor options coupled with both a cased and board-level form factors.

The Oryx camera family offers high resolution sensors paired with the fast 10GigE interface. Oryx cameras are full-featured and suitable for higher end applications, but have a larger form factor. If transfer speeds are critical, Oryx would be an easy choice.

Both the Blackfly S and Oryx camera families can be controlled and programmed using GenICam3 and the Spinnaker SDK, which has been designed to help you build your application faster.

To further narrow down the selection of camera models, our machine vision model selector comes with 14+ (EMVA 1288 based) imaging parameters to filter from. To find models that perform well under low light conditions, filter on finding high absolute sensitivity, quantum efficiency, and dynamic range values. Absolute sensitivity is the number of photons needed to get a signal equivalent to the noise observed by the sensor. Quantum efficiency is the percentage of photons converted to electrons at a given wavelength. Dynamic range is the ratio of signal to noise including temporal dark noise (the noise in the sensor when there is no signal). Also, keep in mind that monochrome models have better performance in low light compared to color equivalents.

To view the details of a machine vision cameras performance, look at the EMVA Imaging Performance document for the model. This can be found on resources tab of every cameras support page or in our Machine Vision Sensor Review.

Still need help deciding or have any questions about your specific project? Click here to get in touch, one of our machine vision camera experts can save you hours in research. To further explore important parameters in choosing machine vision cameras for biomedical and life science applications, see our article Biomedical Imaging: Guide to Choosing Machine Vision Camera Specifications and How to Calculate Them.