IHS: MEMS sensor market spurred by health awareness

The market for wearable electronics and fitness monitoring is set to quadruple

From smart wristwatches that record heart rates, to intelligent armbands that track physical activities, wearable electronics and fitness monitoring devices are attracting increased attention from health-conscious consumers.

According IHS iSuppli, this will cause shipments of microelectromechanical system (MEMS) sensors used in these products to more than quadruple in just five years.

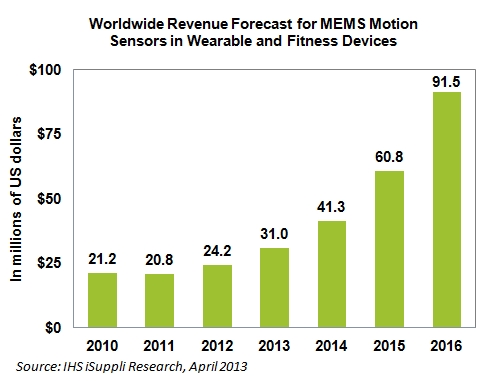

Starting with a stable base in the $20.0 million range, revenue for MEMS motion sensors in wearable electronics and fitness monitoring is set to climb to $31.0 million this year and then jump 33 percent to $41.3 million in 2014.

IHS iSuppli's MEMS and Sensors service predicts an even larger increase, equivalent to 47 percent will occur in 2015 when takings amount to $60.8 million.

"The biggest leap will occur in 2016 when annual revenue rises 50 percent to $91.5 million," says Marwan Boustany, senior analyst for MEMS & sensors at IHS. "That means the market by then will have expanded by more than a factor of four from $20.8 million in 2011."

The figure above presents the IHS forecast of global MEMS shipments for wearable electronics and fitness monitoring devices.

Two trends are spurring demand for wearable and mobile health technology, in turn fuelling the MEMS motion sensor market for wearable and mobile health devices, explains Boustany.

"One trend is the higher average life expectancy of people all over the world, coupled with the amplified prevalence of illnesses like cardiovascular disease and diabetes. The second trend arises from greater awareness in the population of health, fitness and wellness issues - indicated by the rapid growth in demand for healthy nutrition, diet programs, gym memberships and even health-based mobile applications."

Activity monitors such as the FitLinxx Pebble and Fitbug, for instance, are increasingly finding their way into consumers' hands as employers seek to augment their corporate wellness strategies, notes Shane Walker, senior manager for consumer & digital health research at IHS.

"In the United States, this is due in part to the growth of consumer-directed healthcare plans and the Affordable Care Act, which is incentivising insurers. These corporate programs are opening yet another channel of distribution for new monitoring devices," he says.

Market drivers and the top wearable electronics devices

Boustany adds, "Several factors overall will help drive the market for wearable electronics and fitness monitoring devices. For one, the sensor technology has reached a state of maturity, having been introduced to consumers via smartphones and their use of accelerometers, gyroscopes and electronic compasses."

"The billions of sensors consumed by smartphones to date, meanwhile, have served to lower the average selling prices of the sensors and improved their production. A significant market stimulus also comes from patients diagnosed with health issues related to the lack of exercise, encouraged by their doctors - or in some cases, their employers - to track activity and manage their condition," he continues.

Other important drivers are the proliferation and suitability of the Bluetooth Low Energy 4.0 communication protocol, as are the efforts of sensor manufacturers in combining and miniaturizing sensor technology.

For the latter, sensor fusion technology conjoined with small combo sensors - such as 9-axis inertial measurement units from French-Italian maker STMicroelectronics, California-based InvenSense and Bosch of Germany - make it easier than ever to incorporate motion sensors in a wide range of wearable devices.

Development kits proposed by sensor suppliers like InvenSense have likewise stimulated the imagination of designers for sports applications. Here new products are emerging, such as ski and snowboard goggles with motion sensors to monitor jump heights and the speed of runs, as well as 9-axis motion tracking armbands to improve swimming technique.

Electronics ready to wear

At the end of 2016, the top wearable electronics device overall for MEMS motion sensors will be activity monitors. Already in high demand, the device features a built-in accelerometer to monitor movement and provide feedback, such as for calorie consumption.

Pedometers will rank second, helping to determine the number of each steps a person takes and popular as an exercise measuring device; followed by smart watches and smart glasses as the next largest application. In the smart watch category, Apple is rumoured to be launching an iWatch soon, and both Google and Samsung are also looking to enter the segment.

While all the pieces are in place for the wearable technology and mobile health market to prosper, the mass adoption of activity monitors and similar devices will depend on the success of companies to move to so-called true lifestyle products.

The devices by that point will be fashionable, resemble jewellery being worn or remain inconspicuous, allowing the wearer to integrate the gadgets with normal clothing and other accessories. The products should also be easy to use, reliable and competitively priced in order to maximize penetration among consumers.

IHS says that growth of the wearable electronics and fitness monitoring market will, in turn, provide good revenue opportunities for MEMS motion sensor manufacturers.