IC Insights: Qualcomm & Samsung trounce AMD

What's more, strong growth in mobile processors for smartphones and tablet PCs continue to lower Intel's market share

Dwindling notebook and desktop personal computer purchases and a strong growth in smartphones and tablet PCs knocked Advanced Micro Devices (AMD) down to fourth place in microprocessor sales in 2012 from second, where AMD had been perched behind Intel since the 1990s.

This is according to a new ranking of MPU suppliers by IC Insights.

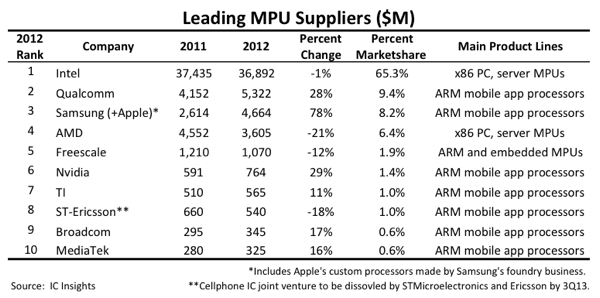

The new top 10 MPU list shows most leading suppliers of mobile processors based on ARM technology moving higher in the ranking while PC-dependent x86 MPU companies - Intel and AMD - continued to lose market share in 2012. This is depicted in the table above.

Among the MPU leaders, only top-ranked Intel and fourth-place AMD sell central processors built with x86 micro-architectures for standard notebook and desktop PCs running Windows operating system software from Microsoft.

The remaining top 10 suppliers develop and sell mobile MPUs with RISC processor cores licensed from ARM in the U.K.

Moving ahead of AMD in the 2012 microprocessor ranking were Qualcomm, the cellphone IC sales leader that's been primarily successful in selling cellphone application processors, and Samsung, which in addition to its own ARM-based processors is the sole foundry source for Apple's custom-designed MPUs for its iPad tablet PCs and iPhone handsets.

Sales of Qualcomm's ARM-based Snapdragon system-on-chip (SoC) processors increased 28 percent in 2012 to $5.3 billion, increasing its MPU market share to 9.4 percent and moving it to second place in the ranking from third in 2011. Samsung (with Apple's MPU foundry business) moved to third place in the 2012 ranking from fourth in 2011 with a 78 percent increase in MPU sales. About 83 percent of Samsung's $4.7 billion in MPU revenues in 2012 came from Apple's processors.

Intel remained the dominant leader in microprocessor sales but its share slipped to 65.3 percent of the MPU market compared to 67.3 percent in 2011 and 68.6 percent in 2010, based on IC Insights' analysis of suppliers.

AMD's share of microprocessor sales fell to 6.4 percent in 2012 compared to 8.2 percent in 2011 and 9.6 percent in 2010, according to the new MPU ranking, which was recently released to subscribers of IC Insights' McClean Report 2013.

Slowing sales of legacy PCs caused AMD to announce in late 2012 that it would be the first MPU supplier sell microprocessors built with x86 and ARM architectures - initially for server computers - starting in 2014.

The $56.5 billion microprocessor market continued to be the largest single semiconductor product category in 2012, accounting for 22 percent of total IC sales. However, microprocessor sales growth slowed to 2 percent in 2012 following a strong 19 percent increase in 2011.

IC Insights is forecasting a 10 percent increase in total MPU sales in 2013 to $62.0 billion. During 2012, strong increases in mobile application processors used in cell phones and tablet PCs offset a 6 percent decline in MPU sales for desktop and notebook PCs, servers, and embedded-processor applications.

Between 2012 and 2017, total MPU sales are projected to grow at a compound annual growth rate (CAGR) of 12 percent, reaching $97.7 billion in the final year of the forecast.

Starting with The 2013 McClean Report, IC Insights expanded its coverage in the microprocessor market category to include system-on-chip processors used in cellular-phone handsets and touch-screen tablet PCs.

Previously, these SoC processors were counted in the special-purpose logic/MPR category of the IC market - with cell phone application processors being part of the wireless communications segment and tablet processors in the computer and peripherals product segment.

Prior to being reclassified, cellphone application MPUs represented about 32 percent of wireless communications special-purpose logic sales and 17 percent of unit shipments in 2011, based on IC Insights' previous market data. Tablet MPUs accounted for about 7 percent of computer/peripheral special-purpose logic sales and 2 percent of units in 2011, when these mobile processors were part of this IC segment.