Slow GDP growth takes its toll on western IC market

The U.S. and Eurozone remain weak although Japan's GDP outlook is improving while China remains solid

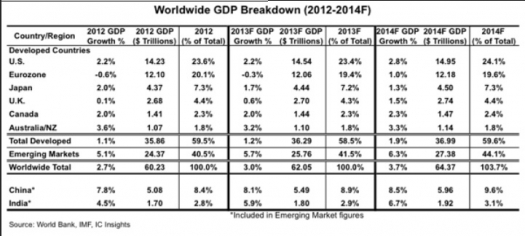

Many of the preliminary H1 2013 GDP figures by country or region have now been reported. Based on the first quarter data, IC Insights has slightly lowered its worldwide GDP forecast from the 3.1 percent shown in the March Update to 3.0 percent. The new outlook is depicted in the table at the top of this story.

The reduction in the worldwide GDP growth forecast for this year was driven by a lower GDP growth forecast for the U.S., which now stands at 2.2 percent (the same as in 2012). The primary reason for the lowering of the forecast for U.S. GDP growth this year was the beginning of sequestration (i.e., large and widespread cuts to government spending) on March 1st, 2013.

In contrast to the lower U.S. GDP forecast for this year, IC Insights raised its expectations for 2013 GDP growth in Japan to 1.7 percent, up from 1.2 percent. In addition to fiscal stimulus measures, the Japanese government has undertaken a program to significantly devalue its currency (i.e., Yen).

These stimulus measures, in concert with the currency devaluation program, helped boost Japanese company exports in early 2013. As a result, the Japanese economy registered a 3.5 percent annualised increase in GDP growth in H1 2013. Although this high level of growth is not expected to continue throughout this year, the expectations for Japan's economy this year are definitely on the rise.

China's GDP growth rate was announced to be 7.7 percent in H1 2013. With China's economy expected to pick up momentum in the second half of this year, IC Insights has left its 8.1 percent full-year forecast for China's GDP growth unchanged.

Unfortunately, with little good news coming out of Europe in early 2013 and the full impact of the U.S. sequester cuts still looming, IC Insights still believes that there continues to be more downside risk to its worldwide GDP growth forecast for this year than upside potential.

IC Insights believes that the correlation between worldwide GDP growth and IC market growth has been excellent over the past few years and will again be good in 2013. Using IC Insights' most current worldwide GDP forecast of 3.0 percent, the most likely range for IC market growth in 2013 is still 3-7 percent, as shown in the figure below.

As a result of weaker GDP growth in the U.S. and negative growth among the Eurozone countries, which, together account for about 43 percent of global GDP, IC Insights has lowered its 2013 IC market growth forecast one percentage point to 5 percent.

IC Insights' 5 percent full-year IC market growth scenario for 2013 incorporates a H2/H1 2013 IC market increase of 8.8 percent (0.4 points less than the 22-year average of 9.2 percent). Thus, it is assumed that there will be a slightly below normal seasonal increase in IC demand in the second half of 2013 as compared to the historical average but a much stronger increase than in H2 2012/H1 2012 (3.6 percent).