SJ MOSFET migrates from power supplies to renewable energy

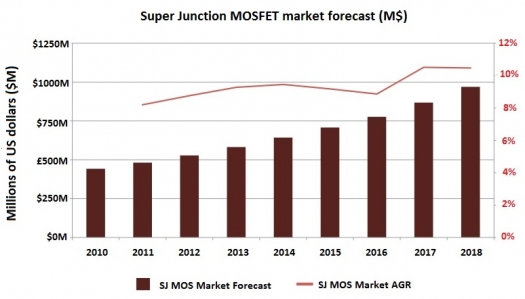

A $1 billion market by 2018, the Super Junction MOSFET sector is forecast to grow at 10.3 percent per year. There are already eight new players who have joined in the last three years

It's no secret that consumer is SJ MOSFET's main application segment, representing two thirds of its total market.

And while some applications such as desktop PC and game console power supplies are stagnant, most applications are still growing.

This is according to Yole Développement's "Super Junction MOSFET Business Update" report.

The biggest growth area will be power supplies for tablets, with an expected 32 percent increase in CAGR from 2013 to 2018. However, the main products where SJ MOSFET is used are PC (Desktop and laptop) power supplies and TV sets, which total half of the SJ MOSFET market.

The driver for using SJ MOSFET in these applications is, first and foremost, size reduction. SJ MOSFET allows for a much smaller size than planar MOSFET, since they generate less heat.

The Hybrid and Electric car markets should not be ignored. Although they are less than $5 million today, they Yole believes they will represent more than $100 million by 2018.

Industrial applications are less interested in SJ MOSFET use, since these applications do not require a high frequency of switching when operating in an H-bridge. SJ MOSFET is interesting only for specific topologies such as multi-level, or for cheap, low-power solutions (small UPS, residential PV). But even in these applications, planar MOSFET or IGBTs remain better solutions since they are cheaper and meet all requirements.

In summary, SJ MOSFET is currently employed mostly for high-end solutions.

The graph at the top of this story shows the SJ MOSFET market forecast up to 2018.

Deep trench technology is improving, but is still too expensive.

There are two types of technology used for Super Junction MOSFET. The first one, developed by Infineon, uses a series of epitaxies and doping to create a locally doped "island" in the epi-layer. The doped region then diffuses and creates an n-doped pillar. The second technology uses deep reactive ion etching to dig a trench. This trench is then filled with an n-doped material to create the super junction structure. Players exploiting this particular technology are Toshiba, Fairchild Semiconductor and IceMOS Technology.

Technology evolution is accelerating and the opposition between multiple epitaxy and deep trench is growing stronger. Toshiba released its 4th generation of its DTMOS, a deep trench power MOSFET with a smaller pitch size. It means a smaller die size and an improved RdsON. It's still more expensive to produce than a CoolMOS (Infineon's brand name), but it's becoming more and more competitive.

Compound semiconductor remains a threat to SJ MOSFET.

SiC will be positioned at higher voltage and will target high-end solutions as well although silicon will still be present in 2015. IGBT has the best cost vs. switching efficiency trade-off, and International Rectifier is working on high-speed IGBTs that are competing directly with Super Junction MOSFET. In the end, SJ MOSFET is positioned in-between, and depending on the voltage, application and frequency of switching, it could compete with SiC, Fast IGBT, IGBT or GaN.

Packaging has also plays a role in SJ MOSFET technology. In 2010, STMicroelectronics and Infineon maintained their leadership role by providing a common package type of very small size. It fits perfectly with consumer applications, where size reduction is a strong driver.

Eight new players entered the game in the last three years. How will they capture market share from STMicroelectronics and Infineon?

In 2012, Power Electronics was in crisis. IGBT fell 20 - 25 percent in sales. Meanwhile, Super Junction MOSFET grew at 8.3 percent, a trend Yole expects will continue until 2018, when it tops the $1 billion limit. This forecast demonstrates how much the technology is needed.

In 2011, production capacity was too small to handle the high demand. This shortage situation helped the SJ MOSFET market weather the 2012 crisis. For manufacturers, this demand was used as a buffer, and the market analysts believe that in 2013 the market will return to its normal supply status.

Another sign of SJ MOSFET being very attractive is the numbers of players that have entered/may enter the market. In the last 36 months eight new players have thrown their hats in the ring. Among them, the Chinese foundries and their fabless counterparts appear to pose the biggest threat to the historical leaders' market share.

Since the technology is widely used and widely produced, expect to see more players join, such as Magnachip and ON Semiconductor. The availability of the technology in Chinese foundries makes things even simpler. 2010 market share was split between the historical leaders, with Infineon having a clear advantage since they were first to commercialise the technology.

However, recent announcements and partnerships will probably lead to a more level playing field. What's more, the feedback from integrators is that they don't really worry about the manufacturer's name or brand; instead, they focus on the specifications they need and the devices that fit.

With Chinese, Taiwanese and Japanese foundries and device makers entering the market, Yols expects market share to shift. Several small players will eat a few percent and cause the leaders' share to shrink.