Yole: MEMS sensor market set to sky rocket

The demand for new MEMS sensors will lead to a $6.4 billion market by 2018

MEMS devices are proliferating in mobile devices. Market research firm, Yole Développement has counted over 25 sensors and actuators in production or in development for mobile applications.

These include MEMS accelerometers, MEMS gyroscopes, magnetometers, 6-axis e-compasses, 6-axis IMU combos, 9-axis combo solutions, silicon microphones, microspeakers, pressure sensors, humidity/temperature sensors, BAW filters and duplexers, MEMS switches and variable capacitors, silicon MEMS oscillators/resonators, micromirrors for picoprojectors, microdisplays, MEMS autofocus, IR sensors and micro bolometers, biochemical detectors & gas sensors, MEMS touchscreen, MEMS joystick, radiation detectors, MEMS fuel cells, energy harvesting, UV sensors, ultrasonic sensors and more.

Yole has described its findings in a new report entitled, " MEMS for Cell Phones and Tablets".

Mobile phones and tablets are becoming more sophisticated, and MEMS content is ever increasing. Indeed, MEMS sensors and actuators bring a strong value proposition at different levels. These are:

- Navigation & environmental sensing

- Improved sound quality

- Better communication performance

- Improved visual experience + new tactile interface

- Increased battery life

- Infrared sensing

The past 12 months have seen big changes. While in the past, cell phone MEMS were limited to three categories (inertial, microphones and filters), we have seen strong adoption of new device types targeting environmental sensing. Also, pressure sensors are being heavily adopted in flagship phones and tablets, and humidity sensors are being adopted in the Samsung Galaxy S4. All of these new MEMS killer applications are detailed in this report.

Changes have even occurred in existing high volume MEMS areas.

Significant architectural changes have been observed in inertial sensors, with current strong adoption of IMU combo sensors. Likewise, a new opportunity has appeared with a camera module's dedicated OIS gyroscope.

A trend has appeared involving integration of a third MEMS microphone to provide HD voice recording, such as the device used in the iPhone 5. What's more, to the dual microphone architecture described in Yole's last report. This trend is a market booster.

Strong adoption of LTE in high-end platforms will boost the duplexer market for the next three years.

The long-term outlook for MEMS companies is brighter than ever, as existing products and products just ramping up will drive solid growth over the next few years. Also, a new wave of MEMS products will enable further growth.

Yole says some of these emerging MEMS (speakers, oscillators, chemical sensors, switches, auto-focus, etc.) will ramp up in volume almost overnight, just as pressure and humidity sensors did in the past few months.

A nice 19 percent yearly growth is predicted for a market that reached $2.2 billion in 2012, and volume growth will be even more impressive, with 17.5 billion units expected by 2018, up from 4.5 billion in 2012.

Sensor fusion is heating up with its first commercial implementations.

As sensor popularity enables new applications, software is key for obtaining the best performance and functionalities. Sensor hubs appeared at the end of 2012, in Windows Phone architectures and also in some Android platforms such as the Samsung Galaxy Note 2 and Galaxy S4, which integrate Atmel hub.

This greatly impacts the MEMS value chain, since successful products must offer the right level of software and be qualified with sensor hubs in a timely manner.

Sometime in 2013, evolution is still expected in value partitioning, in particular with sensor fusion integration in the application processor. Also, as the value chain continues moving and novel architectures appear, new killer functionalities will hit the market.

In particular, an ecosystem for context awareness or indoor navigation is put in place, with technology demonstrations (such as Movea's recent demo at CES) and release of the first commercial chipsets enabling new sensor and data fusion concepts (Qualcomm iZat, Gimbal, CSR SiRFusion Platform, etc.). The most recent end-user trends shaping demand for nextgeneration MEMS devices are carefully analyzed in this report. In fact, one of the strongest impacts on sensor fusion architecture is the growth of connected devices and the use of the cell phone as a hub.

Yole says there has been a price war and market share erosion, all in the last year

A large, growing market often comes with a strong price decrease. This is true for MEMS in mobile devices, as was observed in 2012. Continuous competition between STMicroelectronics and InvenSense, and the arrival of a third player in gyroscope and IMU, had a significant impact on pricing - which decreased 25 percent in just one year.

In the magnetometer area, the price decrease was even more significant, at 35 percent. Memsic's aggressive pricing strategy forced market leader AKM to realign.

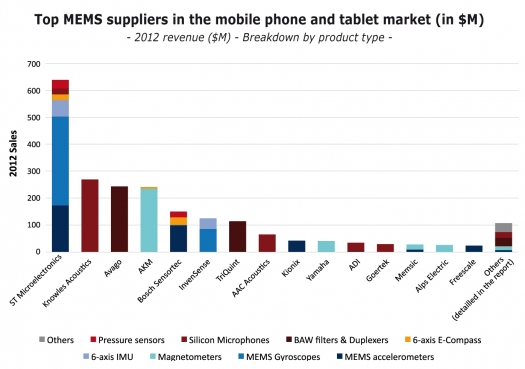

While the big guns still dominate this field and possess most of the business (STMicroelectronics for gyros and accelerometers, AKM for magnetometers, Knowles Acoustics for microphones and Avago for BAW), things are changing. This is illustrated in the figure at the top of this article.

For example, in some cases Yole has seen an erosion of market share, for reasons described in this report. In fact, our analysis shows that in one year, Knowles lost 19 percent market share, AKM 8 percent and Avago 2 percent in their respective markets.

Opportunities for challengers are emerging every day, driven by several factors:

- Technology shift linked to the demand for higher performance in order to enable new-end functionalities and integration levels (this may be happening for magnetometers)

- New business models, such as integrating MEMS dies, which are sold off-the-shelf (typically by Infineon)

- Adoption of disruptive concepts for new sensors and actuators

Out of the 20+ players currently doing business in mobile MEMS applications, only three have been able to successfully diversify by enlarging their MEMS product portfolio.

It's a difficult achievement because Yole Développement's MEMS law remains valid: there is still no standardisation for MEMS products and processes. However, all industry players are actively looking to provide new functions and launch new components.