Gartner: Manufacturing equipment spending to tumble

Although the outlook for semiconductor equipment market is improving, it will remain soft in the short term

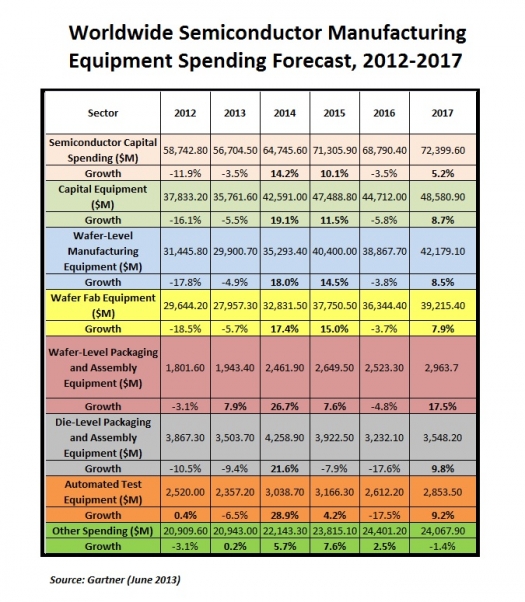

Worldwide semiconductor manufacturing equipment spending is projected to total $35.8 billion in 2013, a 5.5 percent decline from 2012 spending of $37.8 billion, according to Gartner, Inc.

Gartner says that capital spending will decrease 3.5 percent in 2013, as major producers remain cautious in the face of market weakness.

"Weak semiconductor market conditions, which continued into the first quarter of 2013, generated downward pressure on new equipment purchases," says Bob Johnson, research vice president at Gartner.

He also points out, "However, semiconductor equipment quarterly revenues are beginning to improve and positive movement in the book-to-bill ratio indicates that spending for equipment will pick up later in the year. Looking beyond 2013, we expect that the current economic malaise will have worked its way through the industry and spending will follow a generally increasing pattern in all sectors throughout the rest of the forecast period."

Gartner predicts that 2014 semiconductor capital spending will increase 14.2 percent, followed by 10.1 percent growth in 2015. The next cyclical decline will be a mild drop of 3.5 percent in 2016, followed by a return to growth in 2017.

A summary of market research firm Gartner's findings is illustrated in the table above.

Although capital spending for all products will decline in 2013, logic spending will be the strongest segment, declining only 2 percent compared with a 3.5 percent decline for the total market. This is driven by aggressive investment of the few top players, which are ramping up production at the sub-30nm nodes.

Memory will continue to be weak through 2013, with maintenance-level investments for DRAM and a slightly down NAND market until supply and demand balance returns. For 2014, Gartner sees capital expenditure (capex) returning to growth with an increase of 14.2 percent over 2013.

The foundry segment will see an increase in spending of about 14.3 percent this year, while both integrated device manufacturers (IDMs), and semiconductor assembly and test services (SATS) providers will show spending declines.

Beyond 2013, memory surges in 2014 and 2015 and a cyclical decline in 2016, while logic returns to a steady growth pattern.

The wafer fab equipment (WFE) market is seeing continuous quarter-over-quarter growth in 2013, as major manufacturers come out of a period of high inventories and a generally weak semiconductor market.

Early in the year the book-to-bill ratio passed 1:1 for the first time in months, signalling that the need for new equipment is strengthening as demand for leading-edge devices is improving.

Looking beyond 2013, Gartner sees growth returning to the WFE market with double-digit growth in 2014 and 2015, before a modest cyclical downturn in 2016.

The capital spending forecast estimates total capital spending from all forms of semiconductor manufacturers, including foundries and back-end assembly and test services companies.

This is based on the industry's requirements for new and upgraded facilities to meet the forecast demand for semiconductor production. Capital spending represents the total amount spent by the industry for equipment and new facilities.

A more detailed analysis is in the report, "Forecast: Semiconductor Capital Spending, Worldwide, 2Q13 Update," which is available on Gartner's website.