TI 2Q13 financial results boosted by analogue and embedded processing

These sectors now account for 78 percent of the firm's revenue

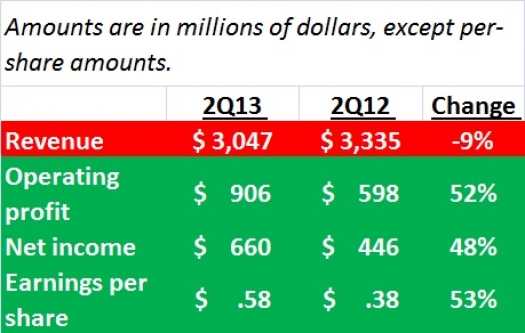

Texas Instruments Incorporated (TI) has reported second-quarter revenue of $3.05 billion, net income of $660 million and earnings per share of 58 cents.

Results include a gain associated with the transfer of wireless connectivity technology to a customer and higher-than-expected charges associated with previously announced restructuring. The net impact of these items was a benefit of 16 cents to EPS.

Regarding the company's performance and returns to shareholders, Rich Templeton, TI's chairman, president and CEO, made the following comments:

"Our revenue ended the quarter as expected, up 6 percent sequentially. Excluding legacy wireless, revenue grew 8 percent; our positions in industrial and automotive markets were important contributors to the sequential growth in revenue. Additionally, backlog increased, and with it, visibility into the second half improved."

"Analogue and Embedded Processing are now 78 percent of revenue, 6 points higher than a year ago. Our legacy wireless products declined to less than 5 percent of revenue and should be below 2 percent in the third quarter. Silicon Valley Analog (formerly National Semiconductor) led our Analogue growth and is gaining share, one year ahead of plan.

"Our business model continues to generate strong cash flow from operations. Free cash flow for the trailing 12 months was almost $3 billion, up 10 percent compared with a year ago. Free cash flow comprised 24 percent of revenue, which is consistent with our target of 20 to 25 percent.

"We returned $1.0 billion to shareholders through dividends and stock repurchases in the second quarter. For the trailing 12 months, the return to shareholders totalled $3.6 billion, or 123 percent of free cash flow. Our strategy to return to shareholders all of our free cash flow not needed for debt repayment reflects our confidence in the long-term sustainability of our Analogue and Embedded Processing business model."

"Our balance sheet remains strong, with $3.2 billion of cash and short-term investments at the end of the quarter, 82 percent of which is owned by the company's U.S. entities, even after reducing debt by $500 million. Inventory days were 105, up from 101 a year ago, and consistent with our model of 105 to115."