IC Insights: TSMC may knock Intel of it's perch

IC Insights estimates the share of the total IC market by foundry-produced devices is forecast to reach over 45 percent in 2017.

The graph below shows the reported IC foundry sales and "final market value" IC foundry sales as a percentage of total IC industry sales from 2007-2017. The "final market value" figure is 2.22x the reported IC foundry sales number. The 2.22x multiplier estimates the IC sales amount (i.e., market value) that is eventually realised when an IC is ultimately sold to the final customer (i.e., the electronic system producer).

IC Insights says an example of how an IC foundry's "final market value" sales level is determined can be made using fabless company Altera. Since Altera purchases PLDs from an IC foundry, and does not incorporate them into an electronic system, Altera is not considered the final end-user of these ICs.

Eventually, Altera resells its IC foundry-fabricated PLDs to electronic system producers/final end-users such as big players Cisco or Nokia at a much higher price than it paid the IC foundry for the devices, increasing the gross margin.

As a result, a 2.22x multiplier, which assumes a 55 percent industry-wide average gross margin for the IC foundry's customer base, is applied to the IC foundry's reported sales to arrive at the "final market value" sales figure.

The total "final market value" sales figure for the IC foundries is expected to represent just over 36 percent of the worldwide $271 billion IC market forecast for 2013, and just over 45 percent of the $359 billion worldwide IC market forecast for 2017. The "final" IC foundry share in 2017 is forecast to be slightly more than double the 22.6 percent "final" marketshare the IC foundries held ten years earlier in 2007.

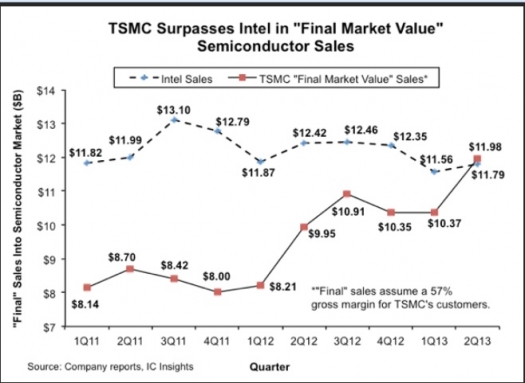

To further illustrate the increasingly important role that foundries play in the worldwide IC market, IC Insights applied the "final market value" sales multiplier to TSMC's quarterly revenues and compared them to Intel's quarterly IC sales from Q1 2011 through Q2 2013.

Since TSMC's sales are so heavily weighted toward leading-edge devices, IC Insights estimates that the gross margin for TSMC's customer base averages 57 percent (a 57 percent gross margin equates to a 2.33x sales multiplier).

Using the 2.33x multiplier, IC Insights believes that TSMC's "final market value" IC sales surpassed Intel's IC sales in 2Q13. This is depicted in Figure 2 below. Also the market analysts say that as a result, TSMC currently has more impact on total IC market revenue than any company in the world.

Considering that Intel's IC sales were 45 percent greater than TSMC's "final market value" IC sales as recently as 1=Q1 2012, this was a dramatic change in a very short period of time.

The "final market value" IC sales figure of TSMC helps explain why the capital expenditures of Intel and TSMC are expected to be fairly close in size this year ($11.0 billion for Intel and $10.0 billion for TSMC) and next year ($11.0 billion for Intel and $11.5 billion for TSMC).

So, when comparing the semiconductor capital spending as a percent of sales ratios for IDMs and IC foundries, the foundries' "final market value" sales levels should be used.

In general, IC foundries have two main types of customers. The first are fabless IC companies such as Qualcomm, Nvidia, Xilinx and AMD. The second type are IDMs which include Freescale, ST, TI, Fujitsu. The success of the fabless IC segment of the market, as well as the movement to more outsourcing by existing IDMs, has fuelled strong growth in IC foundry sales since 1998.

What's more, an increasing number of mid-size companies are ditching their fabs in favour of the fabless business model. A few examples include IDT, LSI Corp., Avago, and AMD which have all become fabless IC suppliers over the past few years.

IC Insights believes that the result of these trends will be continued strong growth for the total IC foundry market, which is forecast to increase by 14 percent this year as compared to only 6 percent growth expected for the total IC market.