Yole: Combo sensors will drive changes in MEMS market

Valued at a massive $3 billion market, Yole predicts that combo sensors will almost triple from 2012 to 2013

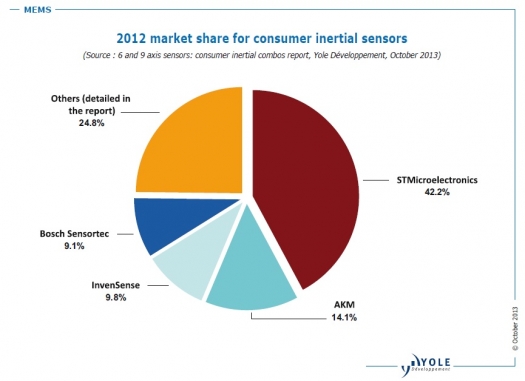

According to Yole' s report, "6 and 9 axis sensors: consumer inertial combos report," there are 3 market leaders in consumer inertial MEMS; STMicroelectronics, InvenSense and Bosch Sensortec.

2012 was seen by many as a turnkey year for consumer combo sensors, with high volume adoption in platforms such as Samsung Galaxy S smartphones.

Since then, many developments have occurred, and the market acceptance of combo solutions has been extremely quick, not only for 6-axis IMU (adopted in a growing number of platforms) but also for 6-axis e-compass (shipments are reaching new records every month).

What's more, 9-axis solutions are being introduced to the market and innovative solutions should follow: with integration of pressure sensing, processing units, and RF capabilities.

Yole says the combo sensor market is estimated to be $446 million in 2013, growing to $1.97 billion in 2018. This represents 21 percent of the global inertial consumer market in 2013, and will grow to an impressive 66 percent by 2018.

"While smartphones and tablets are now driving volume increases and adoption of combos, the picture should be different in 2018," says Laurent Robin, Activity Leader, Inertial MEMS Devices & Technologies at Yole Développement.

"The next market wave should come from wearable electronics, where long-term market potential is huge. While combo sensors will take a significant portion of total market share, opportunities will remain for discrete sensors: from accelerometers used in basic activity trackers to gyroscopes for camera module stabilisation," he explains.

The road was not so easy for inertial combos and some challenges still need to be solved. Outside of the offering, which is still smaller than with discrete sensors, combo sensors are sometimes said to be inaccurate or to create constraints for placement on the board (for magnetic field detection: a tiny magnetometer die is often preferred than a larger combo package).

Footprint reduction was the only argument in favour of combos in the past. However it is fair to say that significant achievements have been made in the past couple of months.

Most of the past yield issues have been solved, leading to lower price. Also, combo solutions facilitate both qualification and testing at the integrator level, and development of sensor fusion.

Four players share 75 percent of the market, is there any room for newcomers?

STMicroelectronics is the global leader in the inertial consumer sensor market with 42 percent market share. Only InvenSense and Bosch Sensortec are able to compete with it today.

It is key to be able to control the different technologies or to establish the right partnerships to sell a large range of combo solutions. ST is just starting to sell its own magnetometer in 2013, while Bosch has been very active in launching new product lines since 2012. InvenSense has just partnered with Melexis as an alternative source to AKM for the magnetometer die in 9-axis solutions, although this is not official information.

Price is still sharply dropping, with IMUs sold to some large volume customers below $1 in 2013. To stay in the race, the 3 leaders are going to introduce technical innovations: monolithic integration of 6 to 9-axis, use of TSV, chip scale packaging, and active capping.

Current challengers and newcomers are eyeing this combo opportunity and expect to take market share while the supply chain is not yet mature. Kionix, Freescale, Alps Electric, Fairchild, Maxim and more than 10 other companies are targeting this market space.

New business models are built and more fabless companies are likely to be involved in the combo market.

Value is moving to function delivery with embedded sensor fusion

Sensor fusion developments must be taken seriously. There has been hype about it for many years and now we start to see commercial implementation.

The first real products with sensor fusion are already on the market, such as sensor hubs in the latest smartphones and tablets from Samsung and more recently by Apple, with the M7 processor in iPhone 5S. In addition, GPS chipsets with indoor navigation capability relying on MEMS sensors are now available from CSR, Qualcomm and Broadcom.

The report provides a detailed understanding of the sensor fusion roadmap and how it will impact the MEMS industry:

- New market opportunities: For instance, context awareness functionalities are on the roadmap of various players

- New architectures: Sensor hubs as MCUs or low-power application processor core play an increasing role, while standardization initiatives are ongoing

- Technical impact: Better inertial performance can be requested for some functions

Change in value repartition

Different types of companies are playing in the sensor fusion ecosystem. Yole sees the first signs of consolidation as collaborations along the value chain are set up (Qualcomm with Cisco Systems, Aruba acquisition of Meridian, Apple acquisition of WiFiSLAM being just a few examples)