AMAT Silicon Systems Group sales swell 345 percent

The firm expects more strong growth in Silicon Systems orders in the next fiscal year. Overall, however, full year sales for 2013 decreased overall compared to 2012, by 14 percent to $7.51 billion

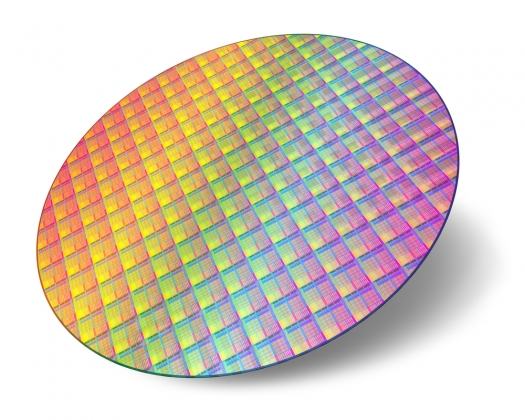

Applied Materials, Inc. a manufacturer for the semiconductor, display and solar industries has reported results for its fourth quarter and fiscal year ended October 27th, 2013.

Fourth Fiscal Quarter GAAP Results

In its fourth quarter, Applied generated orders of $2.09 billion, up 5 percent from the prior quarter led by strengthening demand in the Silicon Systems Group. Fourth quarter net sales were $1.99 billion, up 1 percent sequentially. For the quarter, the company recorded GAAP gross margin of 40 percent, operating income of $211 million or 10.6 percent, and net income of $183 million or 15 cents per diluted share.

Full Fiscal Year GAAP Results

In FY 2013, orders grew 5 percent to $8.47 billion and net sales declined 14 percent from $8.71 billion in FY 2012 to $7.51 billion. The company recorded GAAP gross margin of $2.99 billion or 39.8 percent, operating income of $432 million or 5.8 percent. Net income ballooned 145 percent, from $109 million in FY 2013 to $256 million or 21 cents per diluted share in FY 2013. Applied returned $701 million to stockholders, including $456 million in dividends paid and $245 million in stock repurchases.

"This has been a transformative year for Applied Materials as we shaped a more competitive company, reduced overhead expenses, stepped up investment in product development and built momentum for profitable growth," said Gary Dickerson, president and chief executive officer. "As we look ahead to 2014, we expect stronger investment by our semiconductor and display customers and major technology inflections in transistor and memory that play to our strengths."

Fourth Quarter Reportable Segment Results and Comparisons to the Prior Quarter

Silicon Systems Group (SSG) orders were $1.39 billion, up 16 percent, with higher orders in foundry, flash and logic, partially offset by decreases in DRAM. Net sales declined 2 percent to $1.24 billion. GAAP operating income declined to $213 million or 17.1 percent of net sales. New order composition was: foundry 47 percent; flash 25 percent; logic/other 17 percent; and DRAM 11 percent.

Applied Global Services (AGS) orders were $548 million, up 6 percent. Net sales were $538 million up 8 percent. GAAP operating income increased slightly to $115 million or 21.4 percent of net sales.

Display orders of $114 million were down 55 percent from high levels in the previous quarter and reflected customer push-outs of orders that are expected to be recorded in future periods. Net sales were up slightly to $163 million. GAAP operating income declined to $19 million or 11.7 percent of net sales, including the impact of a $10 million inventory charge.

Energy and Environmental Solutions (EES) orders increased to $40 million. Net sales declined 2 percent to $44 million. EES had a GAAP operating loss of $30 million.

Additional Quarterly Financial Information

Backlog grew 4 percent to $2.37 billion including negative adjustments of $21 million.

Gross margin was 42.0 percent on a non-GAAP adjusted basis, down slightly from 42.9 percent in the prior quarter. GAAP gross margin declined from 40.8 percent to 40.0 percent.

On a year-over-year basis, G&A declined by $13 million, or 10 percent, while RD&E increased by $35 million, or 12 percent. These changes primarily reflect the impact of ongoing initiatives to reduce company overhead spending and increase funding of profitable growth opportunities, particularly in the Silicon Systems Group.

The effective tax rate was 5.7 percent on a GAAP basis.

The company paid $120 million in cash dividends and used $47 million to repurchase 3 million shares of its common stock.

Operating cash flow declined to $19 million, primarily reflecting working capital requirements to support increasing customer demand. Net accounts receivable grew 40 percent to $1.63 billion, with a high proportion of shipments near the end of the period.

Cash, cash equivalents and investments ended the quarter at $2.90 billion, down 4 percent from the prior quarter.

Full-Year Reportable Segment Results and Comparisons to the Prior Year

SSG orders increased by 4 percent to $5.51 billion, net sales decreased by 14 percent to $4.78 billion, and GAAP operating income decreased to $876 million or 18.3 percent of net sales.

AGS orders decreased by 8 percent to $2.1 billion, net sales decreased by 11 percent to $2.0 billion, and GAAP operating income decreased to $436 million or 21.6 percent of net sales.

Display orders increased by 157 percent to $703 million, reflecting a recovery in TV equipment demand and share gains in array PVD equipment. Net sales increased by 14 percent to $538 million, and GAAP operating income increased to $74 million or 13.8 percent of net sales.

EES orders decreased by 15 percent to $166 million, and net sales decreased by 59 percent to $173 million, reflecting continued overcapacity conditions in the global PV solar industry. EES generated a a GAAP operating loss of $433 million, which included $278 million in impairment charges recorded in the second quarter of FY 2013, along with $40 million of restructuring charges, asset impairments, and certain items related to acquisitions.

Business Outlook

For the first quarter of fiscal 2014, Applied expects net sales to be up 3 percent to 10 percent from the previous quarter. The company expects non-GAAP adjusted operating expenses to be in the range of $540 million, plus or minus $10 million. Non-GAAP adjusted diluted EPS is expected to be in the range of 20 cents to 24 cents.

Applied's first quarter outlook for non-GAAP adjusted operating expenses excludes known charges related to completed acquisitions, integration and deal costs of approximately $28 million. The first quarter non-GAAP adjusted diluted EPS outlook excludes known charges related to completed acquisitions, integration and deal costs of 4 cents. The company's first quarter business outlook does not exclude other non-GAAP adjustments that may arise subsequent to this release.

Webcast Information

Applied Materials discussed these results during an earnings call and a replay is available on the firm's website.