IHS: Micron relishes success in scaled-down DRAM market

As the Flash memory market dwindles, the larger DRAM market has grown a whopping 44 percent for Micron in the fourth fiscal quarter

Having emerged as one of the winners in the game of semiconductor survival that has characterised the memory market, US based Micron Technology is now reaping the rewards.

The company is attaining surging revenue in its dynamic random access memory (DRAM) line.

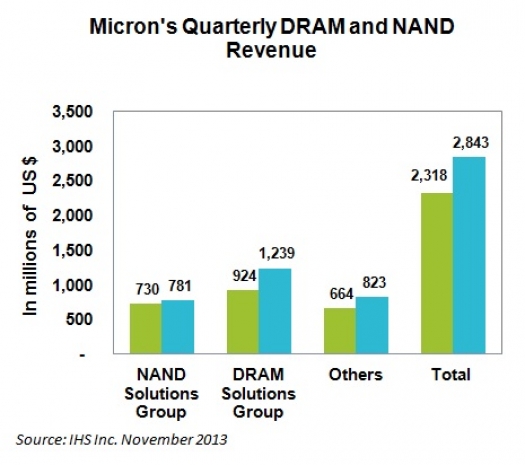

Micron's revenue for the fiscal fourth quarter, which ended in August, amounted to $2.84 billion, up a solid 23 percent from $2.32 billion in the third quarter, according to a Flash Dynamics Market Brief from analyst IHS Inc..

Within the company, the DRAM Solutions Group posted earnings of $1.24 billion, a 34 percent gain from $924 million. This compares to much slower growth in its NAND Solutions Group of 7 percent, moving from $730 million to $781 million, as shown in the figure at the top of this story.

"Spurred by the slowdown in demand from the key PC segment, the DRAM industry has undergone a major wave of consolidation, with the number of large suppliers in the market dwindling to three, down from five in 2008," says Dee Robinson, senior analyst, memory & storage, for IHS.

"Simply by surviving this consolidation, Micron has come out on top, giving it a larger slice of the market pie. Furthermore, with fewer players in the market, the supply side of the equation has become more manageable, with Micron and the other surviving suppliers more capable of influencing production and pricing," Robinsons continues,

Recently, Micron, along with the other two major DRAM suppliers, was able to undertake production cuts to mitigate any potential oversupply, stabilising pricing.

And then there were three"¦

Besides Micron, the only other major DRAM producers operating at present are Samsung and SK Hynix, both of South Korea. Last year, Micron gained the right to acquire Elpida Memory of Japan, which had been the fourth DRAM producer of note until it declared bankruptcy. The overall effect of the consolidation has been to streamline production in the entire DRAM space, contributing to stability and price increases for a previously volatile product.

Fire sale

DRAM is also performing well because of short-term causes. The recent fire at SK Hynix has served to grow revenue and broaden margins for PC DRAM because of new constrictions in supply caused by the disaster.

Micron appears to have benefited from this development, just as the DRAM market has on the whole.

Mobile DRAM was a particularly strong contributor to Micron coffers during the period. Strong demand in the mobile segment drove gains in the DRAM Solutions Group as well as in one other sector, the Wireless Solutions Group.

Profit pressure

In contrast, however, to the significant revenue growth for the quarter, Micron's operating profit did not enjoy similar strength in expansion. For the DRAM Solutions Group, margins grew by just 2 percent despite a quarterly increase of 5 percent in DRAM average selling prices.

Even so, DRAM remains the most profitable product segment for the company given operating income of $183 million, representing earnings after depreciation and operating expenses like wages are taken out.

The most significant positive change for Micron's bottom line came with the decrease in losses for the Wireless Solutions Group, where operating losses narrowed to -$50 million from -$62 million in the company's fiscal third quarter. This was mainly due to the strength of DRAM pricing rather than on the Flash memory side where the market has been experiencing soft demand.

While the NAND Solutions Group continued to report an increase in margins, the decline in NAND average selling prices has been more severe than expected. A decrease of 9 percent in prices basically negated gains from the company's robust cost declines of 10 percent.

For NAND, the slide in pricing along with a weaker-than-anticipated bit growth is indicative that the erstwhile bull market for Flash memory dating to the beginning of the year now appears to be running out of steam. NAND bit growth for Micron in the fiscal fourth rose 18 percent, compared to the much larger 44 percent bit growth in DRAM for the company.