Wafer manufacturers reconsider contract trading

Wafer makers may change their tactics due to shortage and increased price

Since orders have been continually finalised in December, PV demand is likely to remain strong during off-peak season in 4Q13. According to EnergyTrend, a research division of TrendForce, the overall PV demand is likely to remain high in 1Q14.

In addition, the market will demand more high-efficiency products, which may lead to supply shortage for high-efficiency products. Therefore, contract trading, which has disappeared for a long time, may return to the wafer market.

As indicated by EnergyTrend's investigation, wafer supply shortage started to appear in the end of October and the issue is not likely to be solved in the short run. Based on EnergyTrend's investigation, smaller manufacturers with better technology skills have mostly achieved full-production and price may continue to increase.

Moreover, certain manufacturers reduce the use of OEM and switch to produce their own brands and in turn make better profit. For example, Chinese manufacturers, such as Phoenix Solar and Dahai, have come to Taiwan to promote their own brands. Certain cell manufacturers even arranged products to go through validation process.

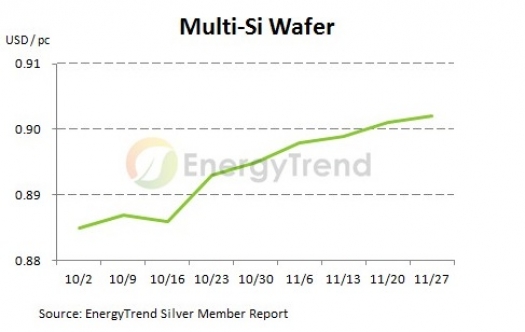

Besides, supply shortage will allow wafer manufacturers to search for better deals. Based on EnergyTrend's understanding, wafer manufacturers have gradually revised multi-silicon wafer price upward in the end of October. Over the past month, price has increased by 5 percent for certain manufacturers.

Looking into December price, wafer manufacturers may be able to continuously revise the price upward. Furthermore, it's projected that wafer supply shortage is likely to remain in 1Q14 with some manufacturers considering short-term contract trading. However, payment conditions, pricing methods, and client acceptance will be the critical factors to determine if this will work.

Although PV demand is increasing, the focus of the demand is slowly shifting to other segments within PV industry. Based on EnergyTrend's investigation, the growth of grid can't seem to catch up with that of power plants in the world. China has started to shift the focus toward distributed PV applications.

Meanwhile, lack of grid capacity has also become an issue in the Japanese market. Hence, demand growth for PV plants may slow down in 2014, but demand for high-efficiency products which are used on roof-top systems may further increase.

Judging from the spot market's overall performance, Chinese polysilicon price remained high and demand was still in good shape. Although output has increased, they were sold out in a short period of time. With spot and auxiliary material supply declining, last week's price came to US$17.046/kg, a 0.01 percent rise. For multi-silicon wafers, supply shortage continued to exist.

Chinese manufacturers have also reduced the supply towards Taiwanese manufacturers, which caused last week's spot market price to continuously increase, with average price reaching US$0.902/piece, a 0.11 percent rise. For mono-si wafers, last week's average price remained steady.

For cells, since major manufacturers have achieved full-production and market condition was still in good shape, last week's spot price continued to reflect an uptrend, with average price reaching US$0.39/watt, a 0.26 percent rise.

For modules, last week's price fluctuated, reaching US$0.672/watt, a 0.15 percent rise. On the other hand, the rise of regional brands has brought challenges to conventional manufacturers through low-price strategy. The average price for inverters came to US$0.199/watt, a 2.45 percent drop.