Automotive power-train silicon sensors to top $1 billion

The global market for automotive power-train silicon sensors will cross the $1 billion threshold at the end of 2013.

According to a new report from IHS Inc., this is partly due to stricter emission standards in the United States and Europe.

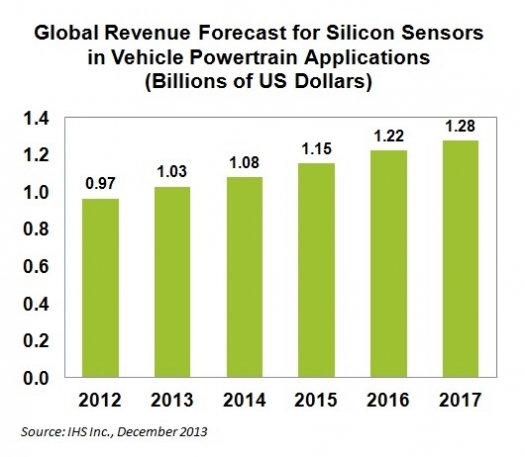

Sensor revenue in vehicle power-train applications is set to reach $1.03 billion by year-end measured at first-level package, up 7 percent from $964.5 million in 2012. Revenue will continue to grow at rates ranging from 5 to 7 percent during the next four years, on its way to some $1.28 billion by 2017, as shown in the graph above.

"Although vehicles today produce considerably less pollution than 20 years ago, significant advancements continue to be made by car manufacturers in engine-out emissions and exhaust after-treatment technologies," says Richard Dixon, senior principal analyst for MEMS & sensors at IHS. "These improvements have been carried out as a result of mandated legislation in areas like the U.S., Japan and Western Europe, aimed at lowering carbon emissions in vehicles to help reduce global warming."

Such emission-reduction systems are used on all types of vehicles in mature markets. For example, established oxygen catalysts in diesel engines and three-way catalysts in gasoline engines are particularly effective at removing hydrocarbons, nitrogen oxide and carbon dioxide. But legislation is especially targeting diesel engines, which make up 50 percent of the European market, Dixon notes.

While the high fuel efficiency of diesel engines explains their popularity, it is also the engine type requiring the most treatment due to a combination of poisonous nitrogen oxide gases and particle matter (soot) produced during the combustion process. Methods to reduce these pollutants like cooled exhaust gas recirculation (EGR), diesel particle filters and selective catalytic reduction systems require sensors for control but also to monitor their performance, Dixon adds.

Other systems exploited by vehicle manufacturers in the fight to meet future tougher emission-control standards include stop-start systems and gasoline particle filters.

In stop-start systems, the engine turns off when a car stops at a junction or traffic light. Stop-start systems use a combination of wheel-speed sensors to ascertain if the vehicle has stopped, with switches that determine if the clutch or brake has been actuated and the gear is in neutral position, while pressure sensors measure the vacuum generated in the braking system under a stopped engine condition.

A current sensor is also deployed to determine if the battery condition is sufficient to handle the restart of the car. Considerable fuel-and thus, carbon dioxide savings-can be made in this fashion. Stop-start systems are anticipated to grow very fast in the years ahead, with penetration in vehicle to reach well over 30 percent by 2017.

Meanwhile, the use of gasoline particle (GPF) filters may impact European car makers in the future. GPFs are effective at removing soot particles from a gasoline direct-injection engine in the same manner as a filter in a diesel engine.

GDI engines produce higher nitrogen oxide than standard gasoline engines, and removing this poisonous gas produces the similarly dangerous soot. GPFs are being considered to meet the new targets on particle emissions in Euro 6 legislation. A pressure sensor monitoring the filter is one application for silicon, even though other sensors monitoring particle mass will also be important.

Other systems that will make use of sensors to help in the emissions-reduction effort include:

In-cylinder pressure sensors, useful in regulating conditions in combustion. IHS sees these devices, projected to include one sensor per cylinder, as important in the future, especially for diesel vehicles. Companies like Volkswagen and Daimler are already deploying these sensors in new models.

Oil pressure sensors, in order to monitor leakages in the crankcase-itself under pressure.

Evaporative fuel sensors-mostly used in the United States, but European markets are utilizing systems to store and later release evaporated fuel from fuel lines and fuel tanks, to be burned in the engine.

New SCR systems, used on high-end diesels like Mercedes- Benz E-class cars, which need pressure sensors to monitor the contents of a separate tank supplying ammonia into the exhaust system to reduce nitrogen oxide emissions.

Meanwhile EGR systems show only light growth for pressure sensors. Most of the information for EGR systems today is provided by knowledge of the valve position that bleeds in exhaust gas to mix with air and fuel in the cylinder, and temperature to show the start of EGR gas flow. Pressure sensors can provide additional value by giving details of the flow rate, but that is the exception at present.