Samsung, TSMC, and Micron top list of IC manufacturers

The top ten companies now hold 67 percent of worldwide IC industry capacity, up from 54 percent in 2009

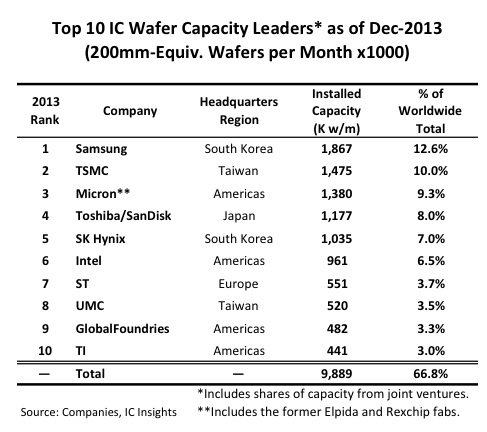

In December 2013, Samsung had the most installed wafer capacity with nearly 1.9 million 200mm-equivalent wafers per month. That represented 12.6 percent of the world's total capacity and most of it used for the fabrication of DRAM and Flash memory devices.

Next in line was the largest pure-play foundry in the world TSMC with about 1.5 million wafers per month capacity, or 10.0 percent of total worldwide capacity. Following TSMC were memory IC suppliers Micron, Toshiba/SanDisk, and SK Hynix.

In January 2013, Micron and Nanya amended their Inotera partnership such that Micron now takes 95 percent of Inotera's wafer output. Previously, Micron and Nanya evenly split Inotera's capacity.

Then, in July 2013, Micron finally closed the deal on its acquisition of Elpida Memory and the Rexchip business in Taiwan that Elpida operated in partnership with Powerchip.

It took Micron a full year to complete the purchase after several delays with getting approvals from bondholders and governments. With the addition of the Elpida and Rexchip fabs as well as the extra Inotera capacity, Micron became the third-largest wafer capacity holder in the world in 2013 with nearly 1.4 million 200mm-equivalent wafers per month (9.3 percent of total worldwide capacity). At the end of 2012, Micron had the sixth-largest amount of wafer capacity.

The fourth-largest capacity holder at the end of 2013 was Toshiba with a little under 1.2 million in monthly wafer capacity (8.0 percent of total worldwide capacity), including a substantial amount of Flash memory capacity for joint-investor/partner SanDisk.

After Toshiba came another memory IC supplier SK Hynix with a little more than one million wafers/month (7.0 percent of total worldwide capacity).

Rounding out the top six companies was Intel with 961,000 200mm-equivalent wafers per month capacity, or 6.5 percent of total worldwide capacity. Just two years ago in 2011, Intel was the third-largest capacity leader, but in early 2012 the company reduced its ownership position in IM Flash as well as its wafer output share from its joint venture with Micron.

A ranking of the industry's ten largest IC manufacturers in terms of installed capacity is shown in the table at the top of this story. Included in the list are four from North America, two companies from South Korea, two from Taiwan, and one each from Europe and Japan.

Information in this article comes from the 2014 edition of IC Insights' McClean report, which will be released later this month.

The three largest pure-play foundries - TSMC, GlobalFoundries, and UMC - are ranked in the top ten listing of capacity leaders. In total, these three companies have held about 80 percent of the worldwide pure-play foundry market since 2010.

Moreover, these three foundries had a combined capacity of about 2.5 million wafers per month as of December 2013, representing about 17 percent of the total fab capacity in the world.

The combined capacity of the top five leaders accounted for 47 percent of total worldwide capacity in December 2013. At the same time, just over two-thirds (67 percent) of the world's capacity was represented by the combined capacity of the top ten leaders, while the top fifteen accounted for 76 percent and the top twenty-five, 85 percent, of worldwide installed IC capacity in December 2013.

It should be noted that the shares of these groups have each increased significantly since 2009. The top five group gained 11 percentage points; the top ten group, 13 points; the top fifteen group, 12 points; and the top twenty-five group, seven points. Those are big gains over the course of just four years.

IC manufacturing is increasingly becoming a high stakes poker game with enormous up-front costs. Today, it costs $4.0 - $5.0 billion for a high-volume state-of-the-art 300mm wafer fab and the cost to build tomorrow's 450mm wafer fab will probably be double that.

Despite the cost-per-unit area advantage that larger wafers provide, there are fewer and fewer companies willing and able to continue investing that kind of money.

IC Insights believes that the capacity shares of the top five, ten, fifteen and twenty-five leaders will continue to increase over the next several years as the big get bigger, middle-tier manufacturers merge to consolidate resources and improve competitiveness, and a greater number of mid- to small-size companies move away from in-house IC fabrication and move toward using third-party foundries.

Rankings of IC manufacturers by installed capacity for each of the wafer sizes are shown in the figure below.

Looking at the ranking for 300mm wafer capacity, it is not surprising that the list includes only DRAM and Flash memory suppliers like Samsung, Toshiba, Micron, SK Hynix, and Nanya; the industry's biggest IC manufacturer and dominant MPU supplier Intel; and the world's three largest pure-play foundries TSMC, GlobalFoundries, and UMC.

These companies offer the types of ICs that benefit most from using the largest wafer size available to best amortize the manufacturing cost per die. The ranking for less than 150mm includes a more diversified group of companies.

A significant trend with regard to the industry's IC manufacturing base, and a worrisome one from the perspective of companies that supply equipment and materials to chip makers, is that as the industry moves IC fabrication onto larger wafers in bigger fabs, the group of IC manufacturers continues to shrink in number.

There are just 36 percent the number of companies that own and operate 300mm wafer fabs than 200mm fabs and the distribution of worldwide 300mm wafer capacity among those manufacturers is very top-heavy.

Essentially, there are only about fifteen companies that comprise the entire future total available market (TAM) for leading-edge IC fabrication equipment and materials.

When 450mm wafer fabrication technology comes into production, this manufacturer group is predicted to shrink even further to a maximum of just ten companies.