IC Insights: Microprocessor sales growth expected in 2014

Cellphone and tablet MPUs are expected to hit new record highs while the rest of the market ends a two-year slump

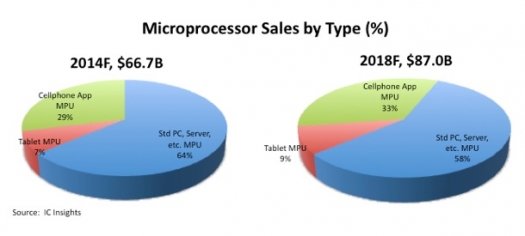

A modest recovery in personal computers this year is expected to slightly strengthen overall sales growth in microprocessors, which is forecast to rise 9 percent in 2014 to a record-high $66.7 billion compared to $61.0 billion in 2013, when revenues grew 8 percent

This is according to IC Insights' 2014 edition of The McClean Report, "A Complete Analysis and Forecast of the Integrated Circuit Industry".

The report shows mobile processors in cellphones and tablet computers continuing to provide most of the lift in overall microprocessor sales, but other MPUs used in PCs, servers, and embedded applications are forecast to pull out of a two-year slump and increase 3 percent in 2014 to $42.5 billion from $41.2 billion in 2013.

Cellphone application processor sales are forecast to grow 19 percent in 2014 to a record-high $19.3 billion, while tablet processors are projected to climb 35 percent to a new all-time peak of $4.9 billion, says the 2014 McClean Report, which becomes available this month.

Cellphone application processors are forecast to account for 29 percent of worldwide microprocessor sales in 2014, while tablet MPUs will reach 7 percent of the total.

Microprocessors used in standard PCs, servers, large computers, and embedded applications are expected to represent 64 percent of total MPU sales in 2014 as shown in the graph at the top of this story.

By 2018, cellphone application processors are expected to represent 33 percent of the total microprocessor sales, while tablet MPUs will be 9 percent and the large PC/server/embedded segment will shrink to 58 percent, based on the five-year forecast in the new McClean Report.

Revenues for microprocessors in PCs, servers, large computers, and embedded systems fell 2 percent in 2013 after dropping 6 percent in 2012.

These back-to-back declines were partly a result of PCs being superseded by tablet computer and smartphone sales, but also due to cutbacks in information technology (IT) spending by businesses while economic growth waffled in the past two years.

In 2013, shipments of PCs (desktops and notebooks) built with x86 MPUs from Intel and AMD suffered the worst decline ever, falling by about 9 percent to 315 million units worldwide, according to IC Insights' market date.

A projected 2 percent increase in PC unit sales in 2014, along with improved IT spending by businesses and stronger growth in embedded-processor applications, will enable the PC/server/embedded MPU market segment to grow again this year, but it will not set a new record high until 2015, when revenues are forecast to grow 6 percent to $45.2 billion.

The new McClean Report shows this large MPU market segment growing by a CAGR of 4.0 percent between 2013 and 2018, reaching $50.1 billion in the final year of the forecast.

Meanwhile, sales of cellphone application MPUs (which exclude baseband processors used in wireless modems) are expected to grow by a CAGR of 12.5 percent in the five-year forecast period, climbing to $29.1 billion in 2018.

Tablet processor sales are forecast to rise by a CAGR of 16.1 percent, reaching $7.7 billion in 2018. Total microprocessor sales are projected to rise by an annual rate of 7.4 percent in the forecast period to $87.0 billion in 2018, according to the 2014 McClean Report.