Yole: CMOS image sensor market to rocket

This week, Yole Développement is releasing its CMOS Image Sensors report, "Status of the CMOS Image Sensors Industry Report, 2014 edition".

This report is an update of a first version launched for the first time, two years ago.

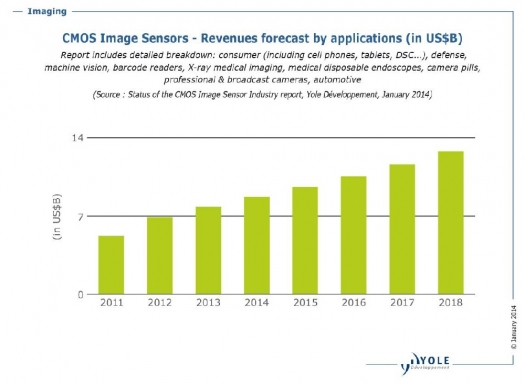

According to Yole, as major technology changes continue to reshape the industrial landscape, a 10 percent CAGR is forecast for the CMOS image sensor (CIS) market from 2013 to 2018. "The market will reach a total value of approximately US$13 billion by 2018, driven by consumer and automotive applications", explains Eric Mounier, Senior Analyst at Yole Développement.

In the 2014 edition, Yole Développement's analysts identified new players and introduced new applications with, for example, a focus on machine vision. They highlight how the strong move from a big player such as Sony will impact the supply chain change the business strategies of others.

The company has also developed a technological section describing new production trends in different categories: new functionalities / future CIS generation / advanced pixel architecture / improved light confinement & selection / BSI and 3D imagers.

Yole will describe its key results at the Yole WebTalk on January 23rd, 2013 and asks that you send the company any questions in advance.

Many different applications are driving CMOS image sensor integration. It's likely that the consumer market will benefit from new mobile technologies. As such, Yole foresees consumer applications such as tablets and DSC to be the growth driver over the next five years. This is the opposite of what has happened in the previous five years, which were driven exclusively by mobile applications.

What's more, after being dominated by CCD, DSC applications are now shifting towards CMOS. And while DSLR will be a substitution market, the next wave is likely to be automotive applications, which could become CIS' third big market.

Indeed, the CIS sensor market in automotive is showing steady growth, which is expected to continue in the coming years; possibly become CIS' third-largest CIS market. Automotive also demands new technologies such as high dynamic range sensors and near infra-red response, and will benefit (with appropriate optimisation) from technology developments in the handset market.

A shift from driving assistance applications to security-based applications may imply significant quality and reliability design improvements in the near future, possibly leading to traditional automotive product providers entering the market with more exuberance.

Many other emerging applications are also set to drive CIS' future growth, such as wearable electronics including smart watches, machine vision, security & surveillance, and medical applications. These applications are likely to be in position for strong growth in the mid and long-term.

On the technology side, Yole has identified the major trends. Indeed, the CMOS image sensors are undergoing numerous technological innovations. The race towards smaller pixels (thus smaller light-receiving photodiode area) to achieve better resolution also leads to pixel performance degradation due to the degradation of SNR and well capacity.

So, to cope with loss of resolution coupled with pixel size reduction, heavy process and design innovations are necessary to overcome the limitation of conventional pixel performance to move to advanced pixel technology while keeping high sensitivity.