IC Insights: Foundry business continues impressive growth

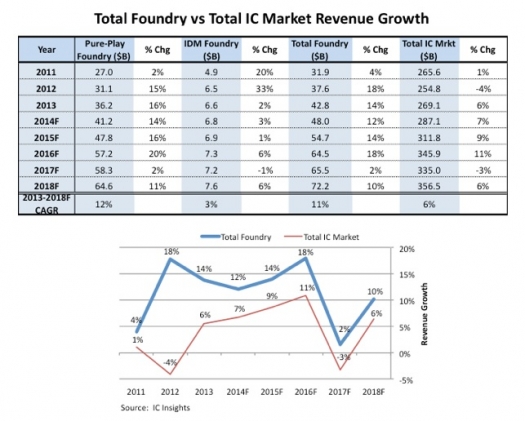

Total IC foundry sales increased 14 percent in 2013; Pure-play foundry sales surged 16 percent

Within the total IC foundry market, pure-play foundry sales increased a strong 16 percent to $36.2 billion in 2013. IC Insights defines a pure-play foundry as a company that does not offer a significant amount of IC products of its own design, but instead focuses on producing ICs for other companies.

Major pure-play foundries include TSMC, GlobalFoundries, UMC, and SMIC. Meanwhile, IDM (integrated device manufacturer) foundry sales increased 2 percent to $6.6 billion in 2013. IDM foundries are defined as those companies that offer foundry services in addition to manufacturing their own ICs. Examples include Samsung, IBM, and Fujitsu.

In 2014, IC Insights forecasts the pure-play foundry market will grow 14 percent to $41.2 billion and once again significantly outperform the total IC market, which is forecast to increase 7 percent. IDM foundry sales are forecast to grow 3 percent to $6.8 billion this year.

On an annual basis, IC Insights anticipates continued revenue growth in the pure-play foundry market throughout the forecast period rising to $64.6 billion in 2018, which amounts to a compound annual growth rate (CAGR) of 12 percent from 2013 to 2018, twice the expected 6 percent CAGR of the total IC industry, according to the 2014 McClean Report.

Overall, the IDM foundry's most pressing problem is expected to be the ongoing intense competition from the major pure-play foundries, which will be especially evident as Apple begins moving a significant portion of its foundry business from IDM-foundry Samsung to pure-play foundries such as TSMC and/or GlobalFoundries in 2014.

Moreover, with IBM concentrating on its "specialty" RF SOI and SiGe foundry business, IC Insights believes that this leaves only Samsung and Intel as the primary high-volume leading-edge IDM IC foundries in the future, with the extent of Intel's dedication to the foundry business still unclear.