IHS : Intel and Chinese rivals to battle in tablet processor chip market

The market is to surge by 23 percent this year

Strong growth in the processor market for tablet devices this year and beyond will draw increasing competition from suppliers eager to throw their hat into the ring, including the likes of giant chipmaker Intel, according to a new report from IHS Technology.

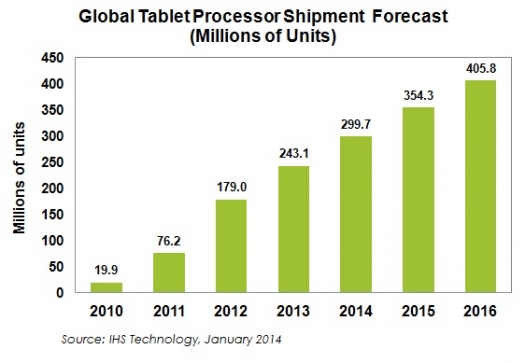

Global shipments in 2014 of tablet processors will reach an estimated 299.7 million units, up 23 percent from 243.1 million last year.

Another robust increase is expected in 2015 when volumes spike 18 percent, with tablet processors then exceeding 400.0 million units by 2016, as shown in the figure above. The findings are contained in the report, "Intel Sets Aggressive Target in Tablet Processor Market."

"With the iPad from Apple, Samsung's Galaxy and other offerings from various tablet makers still selling well among consumers, a number of vendors are starting to join the race to supply tablet processors for the market," says Gerry Xu, senior analyst for processor research at IHS. The players range from kingpin Intel, to a smattering of Chinese suppliers involved in the so-called white-box market for lower-end tablets, Xu notes.

However, the new entrants will face a small, entrenched group of tablet processor makers with very deep pockets, which could make gaining headway difficult for the upstarts.

Among this powerful group is Samsung Electronics, the maker of tablet chips for the iPad, still the industry's best-selling tablet. Another formidable actor is Qualcomm, the chief supplier of baseband chips for smartphones, which is also placing a huge bet on the tablet space with semiconductors that provide cellular functionality to complement the built-in Wi-Fi feature of tablets.

For Intel, the highest-profile new competitor, its tablet chips will find their way into a broad array of Android-based tablets. Intel Bay Trail processors could be in entry-level, 7- to 8-inch Android tablets by the first quarter, while later generations of chips - such as Cherry Trail and Willow Trail - are planned for future implementation down the road.

Intel's new focus was confirmed in statements made by executives during its November 2013 investor meeting, which indicated the company was entering the tablet-processor space, making chips for devices from the entry-level class all the way to high-end tablet models.

Intel's task ahead - and how to fend off the Chinese

The main challenge facing Intel will be how to compete in the entry-level segment. The category, which claims one-third of the tablet processor market, is crowded with Chinese vendors known for producing lower-end but more affordably priced chips.

The Chinese makers include the two largest vendors, Rockchip and Allwinner, as well Amlogic, which is much smaller but still boasts of considerable volume.

Another player, MediaTek from Taiwan, is already a major supplier of processors for smartphones that is now looking to infiltrate the entry-level tablet market. MediaTek is also known to be fiercely competitive in pricing.

The tablets for which Chinese vendors are supplying could cost as little as $50, so the tablet processors being made for these companies are also priced much lower than comparable chips made for Tier 1 tablet brands.

One major advantage for the Chinese, however, is an astute handle on costs and the capability to produce turnkey chip solutions ready for deploying in any number of generic white-box tablets, Xu remarked. While such tablets carry little differentiation, they are designed in such a way that the chips can be slapped on the devices for on-the-fly marketing and sales.

Meanwhile, other Chinese vendors are said to be training their sights on higher ground, which could pose another threat to Intel. Here the aim is to gain design wins with global brands like Lenovo and Hewlett-Packard, which have tablet models straddling the midrange.

Once again, an aggressive pricing strategy is the chief weapon of this group of Chinese makers, which could make the midrange tablet processor field more competitive in the process.