IHS: 4G smartphone market in China set to rocket

3G shipments will continue to dominate the China smartphone market for two more years, after which 4G handsets will take over permanently

China's domestic market for 4G smartphones is poised for a massive lift-off this year as shipments grow sixteen fold from 2013 levels, according to a new report from IHS Technology.

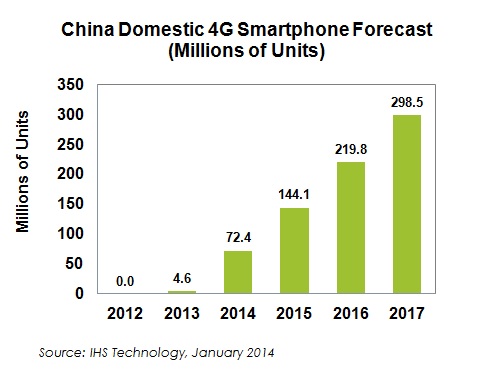

Shipments in 2014 of 4G smartphones within China are forecast to reach 72.4 million units, up nearly 1,500 percent from just 4.6 million last year, with the market expected to take off after the second half. It will be the first big year for 4G smartphones in only its second year in the country, up from a practically non-existent base two years ago.

For the next few years the 4G smartphone market in China will see unstoppable growth, doubling in shipments next year to 144.1 million units, rising another 53 percent to 219.8 million, and then ending 2017 at 298.5 million units, as shown in the attached figure. The findings are contained in the report "China Smartphone Market Enters 4G Era," from the China Electronics Supply Chains service of IHS.

"With support from the government and increasing clamour from the public, 4G smartphones will be the new hot market in China," says Kevin Wang, director for China research at IHS. "Already Beijing has granted licenses for TD-LTE, China's homegrown version of the 4G Long Term Evolution standard, to the state's three carriers. This way, China Mobile, China Telecom and China Unicom can all launch commercial 4G services whenever they wish."

To be sure, 4G smartphones will account for just 19 percent of the entire China smartphone market this year of 371.8 million, with 3G handsets still making up the majority and 2G models also still available.

China's 3G smartphone market in 2014 will reach 290.3 million units, up 1 percent from 287.2 million last year. 3G shipments will continue to dominate the China smartphone market for two more years, after which 4G handsets take over permanently.

Chinese makers rule in shipments

The overall Chinese smartphone market is controlled by domestic original equipment manufacturers (OEM), which collectively owned 70 percent of shipments in 2013. Here the Top 10 alone accounted for more than half of the total, and lesser names as well as mostly anonymous white-box smartphone suppliers are increasingly being marginalized.

The top smartphone shipper was Huawei Technologies with more than 50 million units, followed by Lenovo with 44 million and ZTE with 40 million. The new stars in 2014 will be Xiaomi, OPPO and vivo.

For the first half this year, the 4G smartphones predicted to be popular in China include the Note 3 from Samsung, as well as the iPhone 5s from Apple. At the beginning of the year, Apple notched a huge triumph by starting to sell iPhones under China Mobile, following a long period of negotiations. IHS expects Apple will sell more than 20 million iPhone units in China this year.

Carriers bear the heavy cost of subsidies

High-end smartphone models in China can go for more than 3,000 renminbi, or nearly $500, and the high-end 4G smartphone market will make up close to 40 percent of the entire 4G space in China this year, IHS predicts. And like the practice in the United States, the cost of smartphones is heavily subsidised by the carriers to help persuade consumers to buy new handsets.

Last year, for instance, the three operators spent a total of 27 billion renminbi (almost $4.5 billion) in subsidies for 3G smartphones, up 10 percent from 2012, which hurt net income for all three Chinese carriers.

Meanwhile, the underground grey market for China-made handsets is on the decline after active government intervention to stop a once-thriving trade. The grey market for such handsets, considered illegal by authorities, will decline to 183 million units this year, down from 200.3 million in 2013.