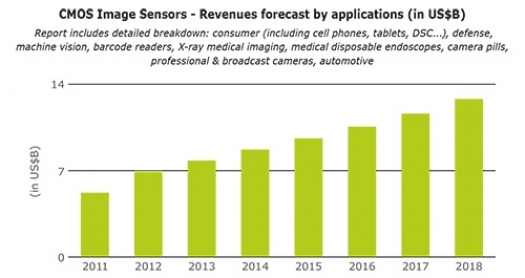

Yole: CMOS image sensor market to hit $13 billion

As major technology changes continue to reshape the industrial landscape, a 10 percent CAGR is forecast for the CMOS image sensor market from 2013 - 2018. The market will be driven by consumer and automotive applications

Driven by handset and tablet applications, a 10 percent CAGR is forecast for the CMOS image sensor market from 2013 "“ 2018, reaching a value of almost US$13 billion by 2018.

Many different applications are driving CMOS image sensor (CIS) integration.

It's likely that the consumer market will benefit from new mobile technologies. As such, Yole Développement foresees consumer applications (tablets, DSC etc.) to be the growth driver over the next five years (which is the opposite of the previous five years, which were driven exclusively by mobile applications).

What's more, after being dominated by CCD, DSC applications are now shifting towards CMOS. And while DSLR will be a substitution market, the next wave is likely to be automotive applications, which could become CIS' third big market.

Indeed, the CIS sensor market in automotive is showing steady growth, which is expected to continue in the coming years; possibly become CIS' third-largest CIS market. Automotive also demands new technologies such as high dynamic range sensors and near infra-red response, and will benefit (with appropriate optimisation) from technology developments in the handset market.

A shift from driving assistance applications to security-based applications may imply significant quality and reliability design improvements in the near future, possibly leading to traditional automotive product providers entering the market with more exuberance.

Many other emerging applications are also set to drive CIS' future growth, such as wearable electronics (i.e. smart watches), machine vision, security & surveillance, and medical applications. These applications are likely to be in position for strong growth in the mid and long-term.

The "Big three" are likely to maintain their leadership, thanks to advanced technologies and strong production capacity

For each application, different market dynamics exist between competitors. In the handset market, Yole believes the big three, Omnivision, Samsung and Sony, will continue to dominate thanks to advanced technologies, a large installed capacity and a cost optimised manufacturing machine, while second tier players must overcome economic and technical challenges to stay competitive.

In the consumer market, major Japanese companies will still lead in DSLR, and it's likely to stay that way since they're vertically-integrated (although some CIS companies have announced dedicated products). Automotive is a highly concentrated market, with 95 percent served by the top five suppliers.

The strong move in the CIS markets from major player such as Sony's pushes other companies to a fablight / fabless strategy. Indeed, this evolution has started already with companies like Aptina and STMicroelectronics.

As they are stuck with limited volumes and struggling because of fierce competition from both high-end and very low-end players, they need to outsource or co-develop their leading edge production (as their volumes are not high enough to invest in the prohibitively expensive infrastructures). Besides a dramatic change in their business model, these players also move to higher end applications and out of the traditional mobile phone market.

From front-end to camera module, numerous technological innovations will contribute to better resolution and new functionalities

Back-Side Illumination (BSI) is on its way to becoming a mainstream technology. As Yole foresaw in 2010, the CMOS image sensor industry has evolved since BSI's introduction. And though BSI increases manufacturing costs, it enables a dramatic increase of sensor sensitivity which has allowed pixel size to decrease further towards higher resolution.

Three years after its introduction by Sony and Omnivision, BSI image sensors accounted for 27 percent of total CIS sales in 2012. BSI's adoption is expected to reach more than 78 percent in 2018, bringing its total revenue to $10 billion. The technology will be widely adopted by handsets. Another breakthrough technology is stacked wafer CIS technology, which represents a disruptive route for performance and cost optimisation.

Over the last few years, one of the image sensor world's burning topics has been 3D cameras. The technology has seen increased development since the 2000s, and several products have reached the consumer market. Although 3D imaging has long been used in industrial automation, it only entered the consumer market in 2010, when Microsoft introduced Kinect, its low-cost 3D sensing camera.

The next generation of consumer 3D cameras will fuel the image sensor market with considerable potential, such as:

Gesture recognition in consumer applications, i.e. TV and gaming

Optical quality inspection in industrial automation

3D imaging in photographic or video cameras

Image analysis in automotive, surveillance and biometrics

At the front-end level, CMOS image sensors are undergoing numerous technological innovations. The race towards smaller pixels (and thus a smaller light-receiving photodiode area) in order to achieve better resolution also leads to pixel performance degradation. This is due to the degradation of two key parameters: SNR (limited by QE and spectral cross-talk) and well capacity.

To cope with resolution loss when pixel size is reduced, heavy process and design innovations are necessary to overcome the limitations of conventional pixel performance and move to advanced pixel technology, while maintaining high sensitivity. All of these process improvements can be applied to less-aggressive pixel sizes and therefore contribute to overall performance increase.

The current batch of breakthrough CMOS image sensor technologies aim to:

Diminish thickness (module level)

Improve image sensor performance (i.e. QE, sensitivity, resolution, reduced cross-talk, higher dynamic range, multispectral imaging, faster processing, higher CRA, lower power consumption)

Permit new functions (i.e. post/fast focus, photon discrimination, 3D imaging, gesture recognition, increased processing power).