IC Insights: Top thirteen foundries monopolise sales in 2013

TSMC and five other foundries have achieved more than $1.0 billion in revenue

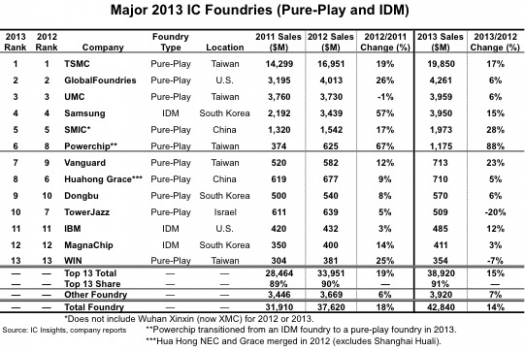

In total, the top thirteen foundries in the table above represented 91 percent of total foundry sales in 2013.

For comparison, the leading thirteen foundries accounted for 84 percent of total foundry marketshare in 2009, the year before Samsung dramatically ramped up its IC foundry production for Apple.

TSMC, by far, remained the leader with almost $20 billion in sales in 2013. In fact, TSMC's 2013 sales were over four times that of second-ranked GlobalFoundries and ten times the sales of the fifth-ranked foundry SMIC.

There are only three IDM foundries in the ranking - Samsung, IBM, and MagnaChip. Samsung was easily the largest IDM foundry in 2013 with over eight times the sales of IBM, the second-largest IDM foundry.

Powerchip has recently done very well in the foundry business after struggling to remain competitive in the DRAM business. Powerchip announced in January 2011 that it would stop selling DRAMs under its own brand name to focus on producing other devices such as LCD drivers, CMOS image sensors, Flash memory, and power management devices both for self-branded products and on a foundry basis for others.

The move came after Powerchip agreed to sell all of its DRAM-production output to Elpida, which had been buying about half of the company's commodity DRAMs under a previous foundry agreement.

In 2011, Powerchip's foundry sales were $374 million, which represented 29 percent of the company's semiconductor sales. In 2012, Powerchip's foundry sales surged 67 percent to $625 million, which represented 67 percent of the company's total semiconductor sales, and in 2013, Powerchip's disclosed that it had made the complete transition to a pure-play foundry with sales reaching $1,175 million, 100 percent of the company's total IC sales. Slowly but surely the company has transformed itself into a major IC foundry.

In 2013, Samsung had a 15 percent increase in its foundry sales and was less than $10 million behind the third-largest IC foundry in the world - UMC. Samsung has the ability (i.e., leading-edge capacity and a huge capital spending budget) and desire to become a major force in the IC foundry business. It is estimated that the company's dedicated IC foundry capacity reached 150K 300mm wafers per month in 4Q13. Using an average-revenue-per-wafer figure of $3,000, it is estimated that Samsung's IC foundry business segment has the potential to produce annual sales of about $5.4 billion.

With the barriers to entry (e.g., fab costs, access to leading edge technology, etc.) into the foundry business being so high and rising, IC Insights expects the "top 13" market share figure to continue to slowly rise in the future.