Gartner : PC market dwindles in Western Europe

The PC market in Germany, France and the U.K. showed single-digit declines in the fourth quarter of 2013

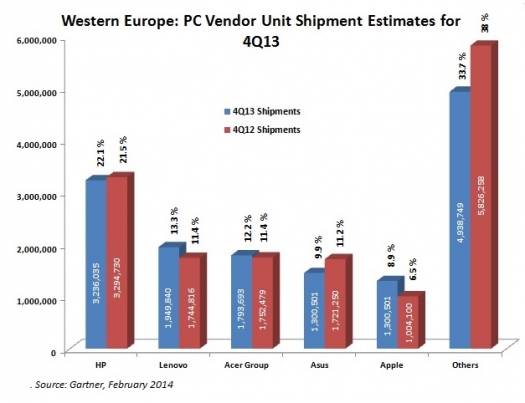

PC shipments in Western Europe totalled 14.7 million units in the fourth quarter of 2013, a decline of 4.4 percent compared with the same period in 2012, according to Gartner.

This is shown in the graph above, where the data includes desk-based PCs and mobile PCs, including X86 tablets equipped with Windows 8, but excludes Chromebooks and other tablets.

All PC segments in Western Europe decreased. Mobile and desktop PC shipments declined 6.5 percent and 0.3 percent, respectively. PC shipments in the professional PC market declined 1.7 percent, while the consumer PC market fell seven percent in the fourth quarter of 2013.

"Shipments for traditional PCs (desktops and mobile PCs) in 2013 decreased 14 percent, but the rate of unit decline is moderate across geographies - which could indicate that the impact of tablets cannibalising PC sales in mature markets is fading," says Meike Escherich, principal research analyst at Gartner. "Additionally, large numbers of professional PCs running on Windows XP remained in use, and the corporate market has been increasing its PC replacement - making up for a weak consumer PC market."

In the fourth quarter of 2013, HP remained the No. 1 PC vendor in Western Europe. HP, Lenovo and Asus strengthened their positions in the PC market at the expense of Samsung and Toshiba. "The battle for the fifth place was fierce," adds Escherich.

"Apple and Dell were very close in volume terms, but Apple won the No. 5 position in the fourth quarter of 2013 with double-digit growth in both the mobile and desktop PC markets. Apple has a strong presence in the consumer PC market, while Dell's presence in the enterprise is strong. "If demand for business PCs is stronger than consumer PCs, we may see the ranking change next quarter," continues Escherich.

"Holiday sales in Western Europe were primarily dominated by tablets and mobile devices," notes Escherich. "However, hybrid devices and lower cost notebooks could spur growth in 2014."

United Kingdom: PC Market Continued Single-Digit Decline in Fourth Quarter of 2013

PC shipments in the U.K. totalled 2.9 million units in the fourth quarter of 2013, a decrease of 6.7 percent compared with the same period in 2012, as shown in the table below.

Mobile shipments declined 10 percent, while desktop PC shipments were flat, in the fourth quarter of 2013. Both the consumer and professional PC markets declined, with demand from consumers decreasing 11.7 percent and demand from businesses falling 1.2 percent.

"The upgrade of professional desktops on Windows XP provided momentum in the fourth quarter of 2013, with four of the top five vendors in the professional PC segment seeing year-on-year growth," says Ranjit Atwal, research director at Gartner.

Despite a shipment decline in the fourth quarter of 2013, HP grew its market share and remained in the No. 1 position in the U.K. PC market. It increased its lead in both the consumer and mobile PC segments. For the first time, Lenovo moved to the second place ahead of Dell.

Lenovo's expansion in the consumer PC segment allowed it to take its share above nine per cent and cement its place in the top five consumer PC vendor rankings. Toshiba and Apple were the strongest performers in the quarter, with strong professional and consumer PC market growth.

Similar to other Western European countries, the U.K. PC market saw strength in a market that had exhibited double-digit declines during the past few years. "We expect that the PC market in the U.K. will be smaller and stabilise at a lower level," adds Atwal.

France: Lenovo Moved to No. 3 Position in a Declining PC Market

PC shipments in France totalled 2.4 million units in the fourth quarter of 2013, a decrease of 1.7 percent compared with the same period in 2012. This is depicted in the table below.

"For the sixth consecutive quarter the PC market in France showed a decline, but this decline was less steep than in the UK and Germany during the fourth quarter of 2013," notes Isabelle Durand, principal research analyst at Gartner. Both the consumer and professional PC markets decreased - at 0.5 percent and 3.1 percent, respectively.

Shipments of desktop PCs did better than mobile PCs in the fourth quarter of 2013. The mobile PC market accounted for 63 percent of total PC shipments in France, with volumes decreasing 4.9 percent. Desktop PCs increased 4.5 percent year-on-year, thanks to continuous demand for desktop PCs from the corporate and education segments. The end of Windows XP support also had an impact on PC replacements in the fourth quarter of 2013.

Despite the weak performance of mobile PCs, ultramobiles represented 20.6 percent of all mobile PCs shipped in the fourth quarter of 2013. A variety of new ultramobile devices, such as two-in-one, hybrid models, and Windows 8 tablets, were introduced during the quarter.

In the fourth quarter of 2013, HP remained the PC leader in France despite a decline of 11 percent year-on-year. HP managed to reduce the decline further by achieving strong sales of mobile PCs in the consumer market.

Lenovo had another strong quarter and was the fastest growing vendor of the top five PC vendors in the fourth quarter of 2013, growing 54 percent year-on-year. Lenovo moved to the No. 3 position in the fourth quarter of 2013, thanks to strong mobile consumer PC sales (at 103 percent growth) and professional desktop PC sales - which achieved 100 percent growth.

Acer returned to growth thanks to strong sales of desktop PCs. Asus experienced a double-digit shipment decline in the fourth quarter of 2013 and, despite high demand for the Transformer Book T100 hybrid model, it has focused its efforts on the tablet market.

"We expect ultramobiles will continue to drive growth in the mobile PC market," anticipates Durand. "Through 2014 we also expect PC refreshment in the professional PC segment will continue."

Germany: PC Shipments Declined in Fourth Quarter of 2013 but No Change in the Top Five Vendor Ranking

PC shipments in Germany totalled 3.2 million units in the fourth quarter of 2013, a decrease of 5.6 percent compared with the same period in 2012 (see the table below)

Both mobile and desktop PC shipments declined seven per cent in the fourth quarter of 2013. Consumer and professional PC demand declined 10 percent and one percent, respectively.

"The Windows 8.1 launch during the quarter had no impact on PC volumes, but its improvements against Windows 8 may encourage some new operating system adoption among business companies in the next 12 months," says Escherich.

Despite a decline in PC volumes in the fourth quarter of 2013, Lenovo remained in the No. 1 position in the German PC market. This vendor took the lead in both the home and the mobile PC segments.

HP maintained its lead the in the professional and desktop PC segments, achieving 22 percent growth in sales of business PCs.

Acer and Asus have maintained their No. 3 and No. 4 positions and decided to put their focus on the tablet market. Acer has established a strong position in the Chromebook market, while Asus has built a good reputation in the tablet market. "PCs are still strategic products for both companies, but gaining market in this segment is no longer their primary concern," adds Escherich. Fujitsu remained in the No. 5 spot while Dell ranked No. 6 in the fourth quarter of 2013.

"In Germany, the PC market has seen an improvement from the double-digit declines that occurred in the first half of 2013 and the 14 percent decline in the third quarter of 2013," adds Escherich. "This means that we could reach the end of the PC-installed base readjustments that began two years ago. Going forward, we will see more PC purchases driven by demand for ultramobiles. At the same time, the refreshment of professional PCs will continue throughout the year, driven by Windows XP replacement."