News Article

IHS: China automotive semiconductor market to drive forward

Revenues in the sector could go up by 11 percent thanks to safety issues

The fast-growing semiconductor market for China's automotive industry is set for double-digit expansion in revenue this year.

This will be propelled by an increasing desire among Chinese car buyers for added vehicle safety features and helpful infotainment applications like car navigation, according to a new report from IHS Technology.

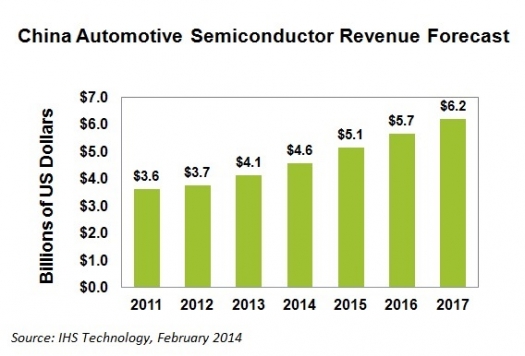

Chip consumption in 2014 by the country's automotive industry will amount to $4.6 billion, up a solid 11 percent from $4.1 billion last year. This year's projected revenue growth improves on the already strong 10 percent rise of the China automotive chip market in 2013, and three more years of similar notable increases will take place. By 2017, revenue will reach $6.2 billion, as shown in the figure above.

"The replacement of midrange and high-end cars this year will drive the China chip market for automobiles," says Alex Liu, analyst for China research at IHS. "In particular, demand will be great in vehicle safety and control applications like advanced driver assistance systems (ADAS), as well as in manufacturer-included or aftermarket infotainment navigation equipment."

China continues to be a place of rising automobile production and shipments. Passenger cars, for instance, which make up three-fourths of all cars in the country, saw shipments climb 2 percent last year to 15.8 million units. The steady outflow of cars means there is a continuous demand for automotive semiconductors, especially for new microcontrollers and sensors that help drive car safety and vehicle comfort - two areas of increasing concern to China's car buyers. These findings are contained in the report, "Automotive Electronics Report - China - H2 2013," from the Automotive & Transportation service of IHS.

Navigation a hot contest between OEM and aftermarket

Vehicle navigation is a key application of automotive semiconductors used for infotainment. Here original equipment manufacturers (OEM) of navigation equipment compete ferociously with the aftermarket for consumer dollars. But unlike other automotive applications such as power train and safety, the aftermarket segment for navigation has a sizable presence in China, providing car buyers the option to update or change the navigation systems in their cars after purchase.

Aftermarket shipments in China for car navigation systems last year reached 7.1 million units, up 20 percent from a year earlier. Key navigation-processor suppliers included CSR of Wales, MediaTek and MStar Semiconductor of Taiwan, Samsung of South Korea and Freescale Semiconductor from Texas. OEM navigation shipments, in comparison, trailed at 2.4 million units, up 15 percent.

But while the aftermarket is projected to slow down, OEM-related navigation will enjoy rapid growth in the years ahead as prices decline in branded systems. Moreover, next-generation technology such as telematics and internal smart connections are forging close ties with OEMs, which could provide the branded market highly needed leverage over the aftermarket. Japan's Renesas Electronics was the leading processor provider for OEM navigation with more than 40 percent shipment share, followed by other important players like Freescale Semiconductor and Dallas-based Texas Instruments; CSR, also prominent in the aftermarket; and Bosch of Germany.

Security matters

Not just for high-end or luxury vehicles, ADAS systems are becoming increasingly common in China. Features such as adaptive cruise control, parking assist, forward-collision warning, lane-departure warning and blind-spot detection are fueling a vigorous market for automotive sensors that control such functions.

The sensors used here include cameras, radar systems, ultrasound and LIDAR. Parking assist is particularly popular in the Chinese market, owing to the serious space and parking problems in China's megacities. Lower system prices have helped push growth for this market, with the total installed base by 2017 anticipated to reach some 18 million units. Total processor revenue in China for ADAS and vehicle-related safety features amounted to $8.8 million last year, forecast to climb to $45.0 million by 2017.

This will be propelled by an increasing desire among Chinese car buyers for added vehicle safety features and helpful infotainment applications like car navigation, according to a new report from IHS Technology.

Chip consumption in 2014 by the country's automotive industry will amount to $4.6 billion, up a solid 11 percent from $4.1 billion last year. This year's projected revenue growth improves on the already strong 10 percent rise of the China automotive chip market in 2013, and three more years of similar notable increases will take place. By 2017, revenue will reach $6.2 billion, as shown in the figure above.

"The replacement of midrange and high-end cars this year will drive the China chip market for automobiles," says Alex Liu, analyst for China research at IHS. "In particular, demand will be great in vehicle safety and control applications like advanced driver assistance systems (ADAS), as well as in manufacturer-included or aftermarket infotainment navigation equipment."

China continues to be a place of rising automobile production and shipments. Passenger cars, for instance, which make up three-fourths of all cars in the country, saw shipments climb 2 percent last year to 15.8 million units. The steady outflow of cars means there is a continuous demand for automotive semiconductors, especially for new microcontrollers and sensors that help drive car safety and vehicle comfort - two areas of increasing concern to China's car buyers. These findings are contained in the report, "Automotive Electronics Report - China - H2 2013," from the Automotive & Transportation service of IHS.

Navigation a hot contest between OEM and aftermarket

Vehicle navigation is a key application of automotive semiconductors used for infotainment. Here original equipment manufacturers (OEM) of navigation equipment compete ferociously with the aftermarket for consumer dollars. But unlike other automotive applications such as power train and safety, the aftermarket segment for navigation has a sizable presence in China, providing car buyers the option to update or change the navigation systems in their cars after purchase.

Aftermarket shipments in China for car navigation systems last year reached 7.1 million units, up 20 percent from a year earlier. Key navigation-processor suppliers included CSR of Wales, MediaTek and MStar Semiconductor of Taiwan, Samsung of South Korea and Freescale Semiconductor from Texas. OEM navigation shipments, in comparison, trailed at 2.4 million units, up 15 percent.

But while the aftermarket is projected to slow down, OEM-related navigation will enjoy rapid growth in the years ahead as prices decline in branded systems. Moreover, next-generation technology such as telematics and internal smart connections are forging close ties with OEMs, which could provide the branded market highly needed leverage over the aftermarket. Japan's Renesas Electronics was the leading processor provider for OEM navigation with more than 40 percent shipment share, followed by other important players like Freescale Semiconductor and Dallas-based Texas Instruments; CSR, also prominent in the aftermarket; and Bosch of Germany.

Security matters

Not just for high-end or luxury vehicles, ADAS systems are becoming increasingly common in China. Features such as adaptive cruise control, parking assist, forward-collision warning, lane-departure warning and blind-spot detection are fueling a vigorous market for automotive sensors that control such functions.

The sensors used here include cameras, radar systems, ultrasound and LIDAR. Parking assist is particularly popular in the Chinese market, owing to the serious space and parking problems in China's megacities. Lower system prices have helped push growth for this market, with the total installed base by 2017 anticipated to reach some 18 million units. Total processor revenue in China for ADAS and vehicle-related safety features amounted to $8.8 million last year, forecast to climb to $45.0 million by 2017.