6 and 9-axis DOF MEMS sensors to lift combos business

By 2018, the inertial sensor market will reach 1 million 8" equivalent wafers

Over the last few years, inertial MEMS have been subject to dramatic market & technological evolution. This has been driven by a large increase of the consumer market.

Along with stand-alone MEMS devices, inertial combo sensors - a combination of several inertial sensors in a single package - are also coming.

This is said in te publication, "Inertial MEMS Manufacturing Trends 2014 report - Volumes 1 & 2." from Yole Développement.

Main applications are consumer - e.g. accelerometer with magnetometer or accelerometer with gyro - and automotive for ESC and rollover functions first.

To give clues about the differences in cost, size, package, structures of the different inertial MEMS, current technological developments are motivated by several market drivers.

For example, integrators for consumer products apply strong price pressure on component manufacturers, thus motivating die size reduction in order to lower manufacturing costs and change the manufacturing platform.

Other industry requirements include low-power consumption for mobile applications, better performance and higher integration of functionalities.

These required improvements have been the same for some time now. The difference mainly lies in the way that technology adapts in order to meet these increasingly stringent specifications. Over the past several years, the tendency was to increase the number of axes for stand-alone components while decreasing size. Now, the industry favours complete integration of 9+ axis sensors and platform standardisation.

Indeed, in term of detection principle, and in terms of physical concepts in general, Yole and System Plus Consulting haven't seen many disruptive approaches reach the market, aside from Qualtré BAW-based inertial sensors.

Nevertheless, strong efforts have been made to develop standardised platforms. For example, Teledyne DALSA now offers a generic platform for accelerometers and gyroscopes, as does STMicroelectronics via its THELMA process.

Moreover, a very innovative approach in terms of standardisation can be seen in CEA-LETI's M&NEMS platform, in which the company intends to use silicon nanogauges as detection principle for their accelerometers, gyroscopes and magnetometers.

The concept lies in using nanoscale gauges for detection, thus increasing sensitivity and reducing size, while keeping a microscale mass for better detection reliability.

M&NEMS technology allows for the integration of 9-axis sensors with small form factor. This process is expected to enter production through Tronics Microsystems within the next few years.

Innovation also comes from back-end processing. Packaging issues had to be leveraged in order to attain the high integration required by advanced inertial combos. Key packaging developments and innovative front-end approaches are analysed in this report.

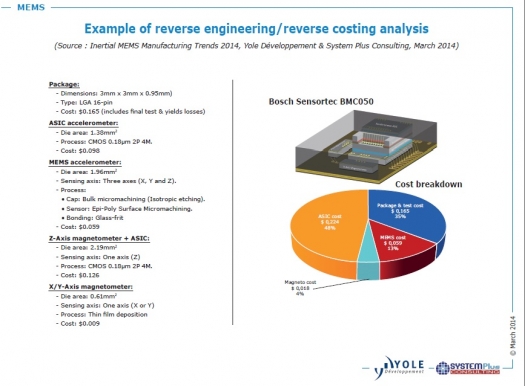

Forty-six inertial MEMS components have been reverse engineered to provide insights and data regarding accelerometers, gyros and combos. In this report, a reverse costing simulation of the MEMS, ASIC and packaging parts of these devices has also been made.

These tasks were performed by System Plus Consulting, Yole Développement's sister company.

This factual analysis well underlines the previously mentioned trends, and permits a concrete visualisation of different companies' current status in terms of integration. This analysis is complemented by the twenty-three devices that were reverse engineered for the previous report in order to visualise general trends over a five year timeframe.

One noticeable evolution shown in this report is that sensor die size has stabilised over the last few years, while prices continue dropping. Yole Développement & System Plus Consulting's report also shows how die size reduction has been achieved through new packaging approaches (i.e. new sealing bond).

By 2018, the inertial sensor market will reach almost the equivalent of 1million 8" wafers

The inertial sensor market has been very active over the past few years, and innovation is ongoing. Today these sensors represent the largest MEMS market (accounting for more than $3.5 billion in 2012) and Yole and System Plus Consulting analysts don't see this changing any time soon.

Stand-alone inertial devices (1 - 3 axis accelerometers, gyroscopes and magnetometers) have matured over the last several years, and they will soon start to decline. In terms of value, this decline has already begun in the consumer accelerometer market.

Nevertheless, the inertial sensor market can rely on combos for its future growth.

Currently, accelerometer/gyroscope combos, e-compass and 9-axis sensors are penetrating consumer applications. For example, 9-axis combos are expected to be an $850 million market in five years.

The consumer market remains the main opportunity for inertial sensors. Also, the automotive industry will benefit from the integration of gyroscopes and accelerometers on the same components for ESC applications, representing a $625 million opportunity for gyroscope/accelerometer combos by 2018.