IHS: Industrial electronics chip market bounces back

This sector has been invigorated by resurgent activity. In 2013 the top five spenders were the U.S., China, Japan, Germany and France

Powered by the freshly fuelled gears of reviving economies, the global market for semiconductors used in industrial electronics applications overcame a serious decline in 2012.

It roared back to life last year, boding well for an even more energetic 2014, according to a new report from IHS Technology.

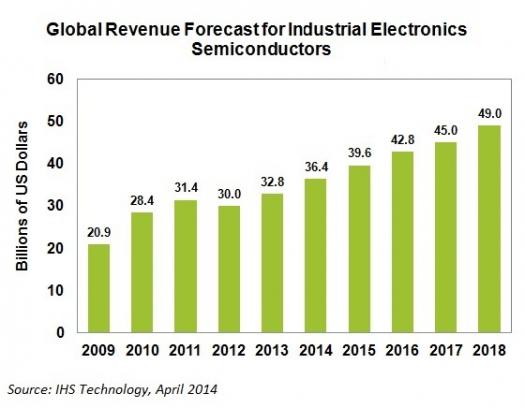

IHS says the industrial electronics chip market finished 2013 with worldwide takings of $32.8 billion - up a solid 9 percent following the torrid 5 percent plunge suffered by the space only a year earlier.

The dive, an unexpected weakening of the market after stellar output, had raised fears and painful memories going back three years earlier, when the industry contracted also in the double digits at the height of the global recession.

All that, however, now lies in the past, as the market has rebounded convincingly.

Employed in various sectors like medical electronics, factory automation, energy distribution and generation, building and home control, test and measurements, and military and civil aerospace, the industrial electronics chip market is forecast for even more potent growth this year.

Revenue for 2014 is projected to climb 11 percent to $36.4 billion.

According to the market analyst, the next four years will also see continued expansion for the market at robust levels. By 2018, industry revenue will amount to some $49.0 billion, as shown in the graph at the top of this article.

"A recovery in the industrial market on a worldwide scale during the second half of 2013 made industrial electronics the second-highest growth sector in the overall semiconductor business for the year, just behind wireless," says Robbie Galoso, principal analyst for industrial electronics at IHS.

"Moreover, several chip companies and original equipment manufacturers across the industrial application market reported improved revenue and orders in the fourth quarter, which helped to strengthen year-end results."

These findings have been detailed in the report, "Stable Q4 Fuels Industrial Semiconductors' Robust 2013 Growth," from the Semiconductors & Components service of IHS.

US and China are important players on the global scale

Growth was strong in the United States, Galoso notes, spurred by an improved economic climate as well as optimism generated by recovery in the residential housing space.

China, another area of growth, also enjoyed solid broad-based revenue increases in industrial segments such as medical electronics, energy, manufacturing, and building and home control.

Even Western Europe managed to drag itself out of its financial doldrums, with leading companies like German company Siemens, citing the economic rebound as a driver.

Among companies that performed well in the fourth quarter, many rode to a strong finish on the robust sales associated with light-emitting diodes (LED) aimed at the residential market. These were manufacturers such as Cree from California's Silicon Valley, Osram of Germany and Philips of the Netherlands.

Also enjoying a banner year was Dallas-based Texas Instruments thanks to factory automation, especially motor drives such as AC and DC variable-speed drives.

The most important countries for the industry were those considered to have the strongest influence on the design of industrial electronics chips, based on the percentage spent by each country on industrial chip design.

In 2013 the top five spenders were the United States, China, Japan, Germany and France, with Switzerland, Taiwan, South Korea, Canada and India making up the rest of the top ten.

LEDs are projected to be the industrial electronics semiconductor product with the highest growth within a five-year span, delivering revenue worth $7.8 billion by 2018, as countries continue to ban energy-inefficient incandescent lamps.

Also anticipated to be a powerhouse performer is the segment for thyristors, rectifiers and power diodes, forecast to reach $7.3 billion in total market revenue by 2018.