IC Insights: AMD and ARM chipping away at Intel marketshare

Although Intel continues to dominate total MPU sales, suppliers of tablet and cellphone processors increased their marketshare from 26 percent in 2012 to 31 percent in 2013

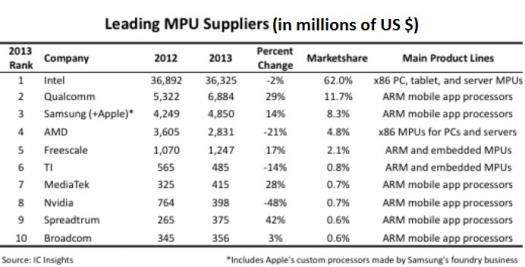

IC Insights' April Update to The 2014 McClean Report shows a ranking of the 2013 top-10 microprocessor suppliers (as well as the leading foundry, DRAM, Flash, DSP, MCU, standard cell, analogue, and PLD suppliers).

A subset of this ranking listing the top 5 MPU suppliers is depicted in the table above. The $58.6 billion microprocessor market was the largest single semiconductor product category in 2013, accounting for 22 percent of total IC sales.

In 2013, tablet microprocessors represented nearly 6 percent of worldwide MPU sales compared to 4 percent in the previous year, while cellphone application processors accounted for 25 percent of the revenue total, up from 22 percent in 2012. MPUs used in PCs, server computers, and embedded-processing applications slid to 69 percent of total microprocessor sales in 2013 compared to 74 percent in 2012.

Among the MPU leaders, only top-ranked Intel and fourth-place Advanced Micro Devices (AMD) supply central processors built with the x86 microarchitecture for standard personal computers that run Windows operating system software from Microsoft.

The remaining top suppliers develop and sell mobile MPUs built with RISC processor cores licensed from ARM in the U.K. Since the end of the last decade, Intel has also been trying to compete with ARM processors and expand into smartphones and tablets by offering low-cost, low-power mobile MPUs in its x86-based Atom series. Meanwhile, AMD has licensed ARM cores for new 64-bit server processors, which are expected to become available in 2014.

Intel continues to dominate the microprocessor business, accounting for nearly two-thirds of the market's total sales in 2013, but the company's huge MPU marketshare is being chipped away by strong growth in ARM-built processors for smartphones, tablets, and new high-density microservers, which can lower cost in data centres for high-volume Internet traffic and cloud-computing services.

With shipments of standard PCs waning, Intel's total MPU sales fell by about 2 percent to $36.3 billion in 2013, following a 1 percent decline in 2012, primarily due to slowing demand for x86 central processing units (CPUs) in personal computers.

Standard notebook PCs continue to face stiff competition from tablets sold by Apple, Samsung, Amazon.com, and more than a dozen other suppliers worldwide. New smartphones, which are often built with similar ARM processors as tablets, also continue to infiltrate more PC applications.

AMD's x86 microprocessor sales have been hit harder by the slowdown in notebook and desktop PCs, resulting in its total MPU revenues plunging 21 percent in both 2012 and 2013. AMD's 2013 microprocessor sales (excluding stand-alone graphics processors) fell to $2.8 billion, which represented 4.8 percent of total MPU sales last year compared to its previous marketshares of 6.4 percent in 2012 and 8.2 percent in 2011. AMD remained in fourth place among MPU suppliers in 2013.

The two x86 rivals are now scrambling with different strategies to reverse their slumping fortunes in microprocessors. AMD has joined the ARM camp, preparing 2014 introductions of new 28nm Opteron A1100 server processors (with up to eight ARM-based 64-bit CPU cores) while the company also aims graphics-enhanced x86 designs at tablets and notebook PCs. AMD says it will be the only microprocessor maker to offer both ARM and x86 solutions.

Meanwhile, Intel is accelerating its push to diversify its x86 MPUs and make new processors more competitive with ARM-based solutions in a wide range of platforms"”from smartphones and tablets to convertible notebooks that can function like tablets, high-density microservers, new wearable systems, and embedded "Internet of Things" (IoT) applications.

Intel continues to emphasize its manufacturing leadership, preparing to introduce the first 14nm-fabricated processors (code-named "Broadwell") in 2H14.

With its newest 22nm Atom SoC processors and existing 22nm Core x86 flagship microprocessors, Intel aims to ship 40 million tablet MPUs in 2014, up fourfold from 2013.