Yole: MEMS to penetrate soaring antenna tuner market

The market for MEMS & Sensors for mobile phones and tablets will expand from $2.85 billion in 2013 to around $6.4 billion in 2019

The mobile phone and tablet market is growing, and price is decreasing. What's the best plan for entering this market and building success? Yole Développement investigates this in its report, "MEMS & Sensors for Mobile Phones and Tablets".

Competition between MEMS & Sensors players is fierce. How can new companies enter the fray and become successful ?

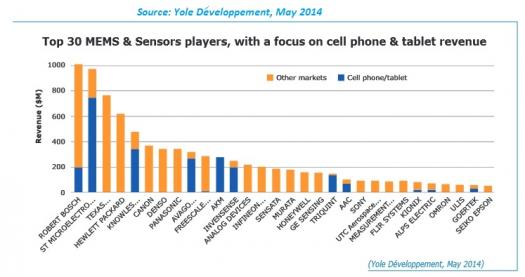

According to Yole, STMicroelectronics remains the global leader for MEMS in cellphones and tablets, but Knowles, Bosch Sensortec and InvenSense all grew in 2013.

In 2012, Knowles lost market share in the MEMS microphone business due to strong competition from Analog Devices, AAC Technologies and Goertek. Still, it managed to regain market share in 2013 by supplying two microphones in the iPhone 5C and iPhone 5S. However, it is hard to predict what its market share in 2014 will be after recently losing its dispute against Goertek.

The top four players own more than 50 percent market share in different MEMS & Sensors markets. Leading companies are trying to enlarge their MEMS products portfolio in order to supply a bundle of products to their customers.

STMicroelectronics provides inertial sensors, microphones and pressure sensors. Bosch Sensortec is also focused on these products. And in 2013, InvenSense joined in by acquiring Analog Devices' MEMS microphone business line, and signed a collaboration agreement with Sonion. InvenSense also released a 7-axis combo that integrates pressure sensors inside of a 6-axis IMU.

In these competitive conditions, two questions are key:

1) What strategies will newcomers pursue?

2) What is happening amongst the MEMS players already involved in the mobile phone and tablet market? Yole believes that one thing is for certain: new technologies are needed.

A continuously growing MEMS & Sensors for cellphones and tablets market, and ever-declining average sales prices

The MEMS & Sensors for mobile phones and tablets market is growing fast. In fact, the market will expand from $2.85 billion in 2013 to around $6.4 billion in 2019, while shipments will increase from 5.8 billion units to 17.5 billion units.

Only a few devices are close to mature: BAW filters and MEMS accelerometers. Many MEMS, sensors and actuators represent the "milk cow" part of the industry: gyroscopes, duplexers, MEMS microphones, etc. Yole has identified 1over fifteen other device categories that are just starting to hit the market or are still in development.

Motion sensors are the market's largest segment. The market for stand-alone sensors is more likely decline in the next few years - especially discrete accelerometers. Gyroscopes will find its new emerging function: OIS. Combo sensors such as 6-axis IMU and 9-axis combo will drive the future market. And price pressure is very high.

The microphone market is still growing, but should be somewhat limited. Except for Apple, no smartphone makers are integrating three microphones. Thus, in several years this market could be somewhat saturated.

Pressure sensors are now used in high volume, but LBS service applications must still be developed. Humidity sensors have been removed from the Samsung Galaxy S5; consequently, Yole sees this market declining significantly in 2014. However, it may take off again if a big smartphone maker decides to reignite it.

BAW duplexers are very popular for LTE RF modules (high frequency and difficult bands in particular). Antenna tuners are now skyrocketing and MEMS technology is positioned to participate in this market. Also, silicon MEMS timing devices should bring a high value proposition for diverse premium timing components such as 32kHz in smartphones, TCXO grade and MCUs.

Regarding optical MEMS, the use of uncooled thermal imagers in cell phones and tablets is still in an early stage for market acceptance. FLIR and Opgal are the two thermal imager solutions providers that have shown products, but other players are developing uncooled IR imagers for consumer applications as well.

After pressure and humidity sensors, there could be a market opportunity for IR detectors to provide the spot thermometry function in mobile devices, since the detector measures the surface emissivity of a random external object.

Sensor fusion is the business's hottest topic

Sensor hubs are now integrated in high volume: for example, Apple uses a sensor hub in the iPhone 5S. Sensor fusion valuation will increase in the next few years; Fairchild's acquisition of Xsens for $60 million is the first example of such increase. What's more, it will not be limited to basic function - data interpretation is also possible.

Different elements are required for sensor fusion, including MEMS, sensor hub, software, and low-power RF communication for transmission in some systems.

Sensor fusion could occur at different levels: in individual sensors, in sensor modules, in the sensor hub or in the application process.

Sensor fusion can enable numerous new applications in mobile phones and tablets: indoor navigation, augmented reality applications and context awareness, which may enable an "always-on" sensor. This report provides detailed examples of these applications.

CMOS Image Sensors, ambient light sensors, proximity sensors, fingerprint sensors and biosensors : more -sensor opportunities for the mobile phones and tablets market

Yole observed very strong growth for non-MEMS sensors, i.e. fingerprint sensors and CMOS image sensors.

The mobile phone market is by far the largest CIS application. In 2013, it represented 66 percent of the entire CMOS image sensor market in volume and 53 percent of total revenue. The mobile phone market has been strongly driven by the race towards higher resolution, aiming at reaching a DSC-like image quality for high-end smartphones. Omnivision, Samsung and Sony will continue to dominate this market due to their advanced technologies, large installed capacity and cost-optimised manufacturing machine.

Light sensors are also growing considerably at the moment. However, this market suffers from strong price erosion due to the low number of OEMs and a lack of innovative options. Combo sensors, long distance and gesture recognition are the three main ways to stabilise margins.

Fingerprint sensors are and will be widely integrated into smartphones following their adoption in Samsung and Apple's most recent offerings. Asian players have also announced new products with fingerprint scanners: Vivo's Xplay 3S was unveiled in December 2013 with a 6" 2K display, a powerful audio amp and a fingerprint reader; and Pantech's latest smartphones, the Vega Secret Up and the Vega Secret Note, both incorporate a fingerprint sensor. In October 2013 HTC launched its HTC One Max, which boasts a huge 5.9" display and a fingerprint scanner. Yole Développement believes that fingerprint sensors for the mobile phones and tablets market will see huge growth over the next few years.

Furthermore, other sensors are expected to be integrated as well, including gas sensors and biosensors, making this an exciting time in the industry.