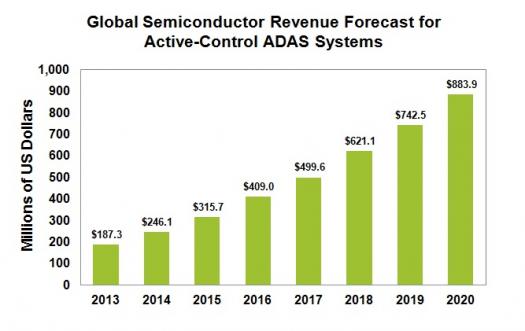

IHS: Semiconductor market for vehicles to quadruple

The global semiconductor market for active-control systems in the autonomous vehicle will grow nearly fivefold in just seven short years, according to a new report from IHS Technology.

This expansion will be driven by an increasing shift from cars simply providing alerts in hazardous situations to direct intervention in order to avoid accidents.

Worldwide revenue for active-control systems in vehicles is set to reach $883.9 million in 2020, up from $187.3 million last year. The increase of nearly $700 million from 2013 to 2020 equates to a compound annual growth rate of 25 percent for the seven-year period. This year alone, revenue is projected to climb a robust 31 percent to $246.1 million, as shown in the attached table.

Active-control mechanisms can be distinguished from their passive-warning counterparts - older systems that have been around much longer - by the degree of driver involvement in both systems.

"Passive mechanisms in the autonomous vehicle help identify potentially hazardous conditions, but the driver is still fully responsible for avoiding an incident," says Akhilesh Kona, analyst for automotive semiconductors. "In active-control systems, however, the mechanism takes over if the driver does not react to warnings so that the vehicle can avoid an accident or minimise the impact of a collision."

An example of a passive mechanism is lane-departure warning, which monitors the lane markings on a roadway and alerts a driver when a car starts veering out of its lane if the turn signals are not being used. In this case, the driver must still take control of the car and steer the vehicle back to its proper lane.

But in an active-control mechanism such as lane-keep assist, the car acts in more proactive fashion: if the driver does not respond after an initial warning from the car, the car itself typically takes action to keep the vehicle from drifting.

Another example of an active-control mechanism is automatic emergency braking (AEB), which uses forward-looking radar and video systems to detect the relative speeds of vehicles to determine if a collision is imminent. If a potential collision is detected, the vehicle applies full or partial braking power to stop the car or slows it down significantly in order to mitigate the severity of the collision.

"Overall, active-control systems are growing faster than passive-warning mechanisms. Compared to the phenomenal growth of the active-control semiconductor market, the chip market for passive-warning systems is projected to grow at a less furious pace from 2013 to 2020," notes Luca DeAmbroggi, principal analyst for automotive semiconductors at IHS.

"The semiconductors used for active-control systems need to be compliant with stringent safety certifications, such as Automotive Safety Integrity Level (ASIL), or ISO 26262," DeAmbroggi adds. "Since safety considerations are of paramount importance to active-control semiconductors throughout their life cycle, ASIL systems will require compliant chips that will typically cost more than the standard ASIL counterparts used in passive systems."

ASIL-compliant microcomponents (MCU) will enjoy even faster growth than overall semiconductors for active-control systems, with ASIL revenue growing to $450 million in 2020 from $70 million in 2013.

These findings are contained in the report, "ADAS Semiconductor Market Tracker H1-14," from the Automotive & Transportation research area of IHS.

The role of sensors in active-control systems

Automotive radar sensors are highly effective in implementing active-control functions such as AEB or automatic cruise control, but an alternative approach is also possible through the use of optical sensors along with powerful processors. Ultimately, the vehicle manufacturer's preference is the deciding factor for the type of sensor used in the application.

In general AEB can be implemented with just one type of sensor, but implementation also depends on the ASIL targeted for the system deployed. For higher levels of ASIL certification, the preferred solution is a radar sensor, backed by an optical sensor as a redundant approach. AEB is likely to be promoted in the near future as a mandatory feature for light vehicles, which would provide a higher level of protection in affordably priced cars.

Mandates and guidance from regional bodies will help even more

In Europe, the New Car Assessment Program (NCAP) is encouraging car makers to implement AEB for pedestrian detection and to help vehicles avoid collisions with other vulnerable road users, including cyclists and animals.

Vehicle manufacturers are already planning for their cars to support AEB systems, with the aim of obtaining a five-star rating from the European program. Based in Brussels, Belgium, the NCAP is patterned after the American model created by the U.S. National Highway Traffic and Safety Administration, evaluating new vehicle designs for safety and performance threats.

Given the European program's call to action, global semiconductor revenue for pedestrian-detection systems is projected to climb as well in the coming years, rising from just $2 million in 2013 to $400 million in 2020.

Fast forward to the future

The next 20 years will require an entire ecosystem for autonomous vehicles to be in place in order to be successful, IHS believes. Specifically, mandates, regulations and legislations will need to be shared among different countries, and infrastructure surrounding vehicles must also figure into the equation.

Moreover, vehicle manufacturers will have to build from scratch a database of possible situation and test patterns to evaluate, and both system and vehicle testing must be bullet-proof before fully autonomous vehicles are launched on the market.

Such extensive testing will likely increase production costs, in addition to the higher expenses that would come from the increasing amount of electronics and software being used.