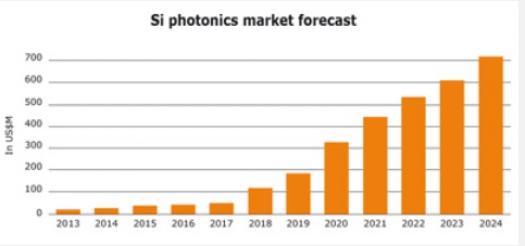

Yole: Silicon photonics set to take off

Don't believe the hype. Market drivers and technological developments are converging to ensure a bright future for silicon photonics.

Big data is getting bigger by the second, and transporting it with existing technologies will push the limits of power consumption, density and weight.

Yole Développement analysts are convinced that photons will replace electrons, and that silicon photonics will be the mid-term platform to assist this transition.

Silicon photonics offers low cost, higher integration, more embedded functionalities and higher interconnect density. It also provides two other key advantages:

1. Low power consumption: particularly when compared to copper-based solutions, which are expensive and require high electrical consumption.

2. Reliability: especially important for data centres, where a typical rack server's lifespan is two years before replacement.

In 2006, VOA were the market's first silicon photonics products. Today, there are still a few silicon photonics products on the market (i.e. VOA, AOC and transceivers from Luxtera, Kotura/Mellanox and Cisco/Lightwire) but big companies (i.e. Intel, HP and IBM) are close to realising silicon photonics products.

Yole also sees big OEMs such as Facebook, Google and Amazon developing their own optical data centre technology in partnership with chip firms (such as Facebook with Intel).

Yole says that, in the short-term, silicon photonics will be the platform solution for future high-power, high-bandwidth data centres. Silicon photonics chips will be deployed in high-speed signal transmission systems, which greatly exceed copper cabling's capabilities, i.e. for data centres and high-performance computing (HPC).

As silicon photonics evolves and chips become more sophisticated, Yole expects the technology to be used more often in processing tasks such as interconnecting multiple cores within processor chips to boost access to shared cache and busses.

Analysts also analysed silicon photonics' chances of being used for telecom, consumer, medical and biosensors applications, compared with competing technologies.

Acquisitions and consolidations are ongoing.

Yole estimates that almost US$1 billion has been spent in the past three years on silicon photonics companies' acquisitions.

Not surprising, considering that silicon photonics is seen as the optical technology that will leverage future bottlenecks for interconnects in data centres and HPCs at short-term.

The main motivations for acquisitions are to handle increasing traffic in data centres and strengthen the company's portfolio in 40GB and 100GB optical engines.

Acquisitions are generally made by module/system makers as a means of enlarging their technologies portfolio, since this is a faster, cheaper route than R&D investments.

Yole also sees big players such as Intel taking both approaches (acquisitions and R&D), while others have decided not to invest in silicon photonics since they think future designs will be accessible via foundry services.

In fact, Yole thinks many IC foundries have started proposing silicon potonics wafer foundry services, so this could create additional acquisition opportunities in the near future.

![]()

Silicon photonics mixes optics, CMOS, MEMS and 3D stacking technologies. Over the past several years, it's become clear that some technical choices will be better than others for successful commercial development:

Light source is a big integration challenge. As silicon laser is probably years away from realisation, the different approaches are likely to be either attached laser (i.e. Luxtera) or (InP) wafer-to-wafer/die-to-wafer bonding, followed by post-processing (i.e. Intel or Leti).

Yole has also seen a shift from monolithic integration for electronic/photonic-to-hybrid integration, since critical dimensions are very different.

Today, the favoured approach seems to be two-chip hybrid integration (the Cu-pillar from STMicroelectronics, for example), since semiconductors' and photonics' critical dimensions are likely to be at least one order of magnitude different.