Positive Q1 Puts Chips on the Right Track

![]()

Industrial electronics semiconductors made small but important gains in the first quarter this year, affirming continued strength for a sector that had been battered only two years ago, according to a new report from IHS Technology.

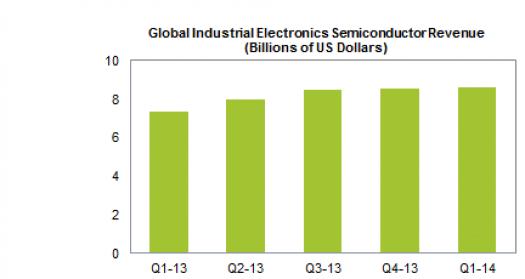

Revenue for industrial electronics chips amounted to $8.61 billion during the January to March period, up 0.6 percent from the fourth quarter of 2013 and a robust increase of 17.5 percent from the first quarter of 2013, as shown in the attached figure. While growth in the first quarter was less than 1 percent, the expansion was achieved during the first three months, traditionally the weakest time of the year.

Given a heartening start, industrial electronics semiconductors could finish 2014 with $35.42 billion in annual revenue, up 9.4 percent from $32.39 billion last year. This means 2014 could be the strongest period in several years for the market, following the solid revenue growth of 8.8 percent in 2013 and after a debilitating 5.0 percent loss in 2012.

"It's tempting to overlook the industrial portion of the overall semiconductor industry because it's a workhorse segment often taken for granted," said Robbie Galoso, principal analyst for industrial electronics at IHS. "However, industrial was second only to the mighty wireless space in racking up revenue for the total semiconductor market. Because of this, industrial electronics is, in every sense of the word, a phenomenal powerhouse in its own right."

Overall, industrial electronics in the first quarter drew strength from a continually improving global economy. The industry seems to have left behind the unstable market conditions of 2012, and the healthy projections ahead for this year also indicate that the recovery in 2013 wasn't a fluke.

Q1 dissected: winners and losers

For the first quarter, the industrial segments that performed best included factory automation, commercial aircraft, light-emitting-diode (LED) lighting, climate control, renewable energy, medical electronics, application-specific testers and transportation. The segments benefited from a rapidly stabilizing housing market, improved consumer finances, increased capital spending and better credit conditions, Galoso noted.

In contrast, the segments that did not do as well were homeland security, military aircraft, and general-purpose test and measurement. A tighter U.S. defense budget was responsible for military- and security-related declines, while lengthening capital-approval cycles negatively impacted test and measurement.

The top companies included many of the big names that have come to dominate the industry. Texas Instruments reported broad-based growth for the quarter in such areas as motor drives in factory automation, while Analog Devices Inc. turned in higher-than-expected performance in all its major applications that included energy and military applications. Maxim Integrated enjoyed strong medical electronics growth via analog solutions in low-power and portable patient-monitor devices, while Microsemi rebounded with revenue derived from electronic-oriented aircraft such as the Boeing 787 and Airbus A350.

Among the firms that struggled during the period were Cree, Nichia and Philips Lumileds"”all of which fell victim to normal seasonal pressures in the LED lighting area. For their part, NXP and Xilinx reported sales declines across a number of customer accounts.

The countries with the strongest presence or influence in semiconductor design for industrial electronics remained in the hands of all the expected hard-hitters. The United States, China, Japan and Germany together accounted for 71 percent of chip-design influence"”an inordinately high concentration of power among relatively few players.

The United States remains the leader with nearly one-third market share, but a strengthening China will increasingly challenge U.S. dominance and also benefit from a declining Japan. The top 10 included India, while the top 20 overall drew heavy representation from Western Europe, including the likes of Switzerland, the United Kingdom and Italy.