Booming DRAM Market Propelled Strong Growth in 2014

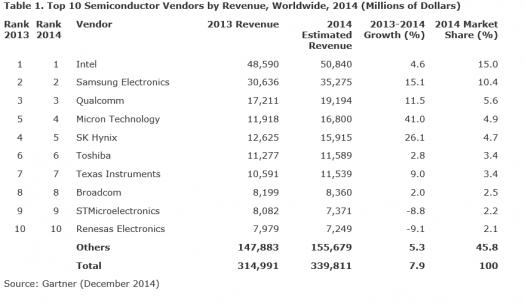

Worldwide semiconductor revenue totaled $339.8 billion in 2014, a 7.9 percent increase from 2013 revenue of $315 billion, according to preliminary results by Gartner, Inc. The top 25 semiconductor vendors' combined revenue increased 11.7 percent, which was more than the overall industry's growth. The top 25 vendors accounted for 72.1 percent of total market revenue, up from 69.7 percent in 2013.

"As a group, DRAM vendors outperformed the rest of the semiconductor industry. This follows the trend seen in 2013 due to a booming DRAM market that saw revenue increase 31.7 percent during 2014 as the undersupply and stable pricing continued," said Andrew Norwood, research vice president at Gartner. "In contrast to 2013, which saw revenue decline in key device categories, including ASIC, discretes and microcomponents, all device categories saw positive growth in 2014, but none could match the growth of the memory market, which grew 16.9 percent in 2014. Excluding memory revenue, growth for the remainder of the market reached 5.4 percent, but this is much better than 2013 growth of 0.8 percent for nonmemory revenue."

Intel saw a return to growth in 2014, following two years of revenue decline, with 4.6 percent growth (see Table 1). The company reorganized itself into five new business units in 2014, with the Datacenter Group continuing to be the most the stable unit for the company. Intel is on pace to reach its goal of 40 million tablet processors in 2014, although these processors are being shipped at significantly discounted prices with incentives. On the PC front, Intel continued to gain market share from AMD, and Gartner expects volume increases for both Intel's notebook and desktop platforms compared with 2013. Intel has maintained the No. 1 market share position for the 23rd consecutive year, capturing 15.0 percent of the 2014 semiconductor market, down slightly from its peak of 16.5 percent in 2011.

"In 2014, we saw a return to production growth in the traditional PC sector, after a 10.1 percent decline in 2013," said Mr. Norwood. "The smartphone market continued to perform well, with production growth of around 34 percent, down slightly from 39.5 percent in 2013, although there was a distinct shift to utility and basic smartphones away from premium handsets. Tablet production, however, experienced a sharp slowdown from last year."

"DRAM revenues will hit $46.0 billion in 2014, an all-time high surpassing the previous record set back in 1995." said Mr. Norwood. "However, in terms of the overall share of the semiconductor market, DRAM accounted for 13.5 percent in 2014, half of the 27.9 percent share it held back in 1995."

SK Hynix and Micron Technology benefited the most from the strong memory market, with the strongest growth of the top 10 vendors. SK Hynix saw a second strong year of revenue growth propelled by the booming DRAM market. DRAM accounts for about 80 percent of the company's revenue.

Micron Technology moved up one place in the rankings in 2014 due to its 41 percent growth. Its acquisition of Elpida Memory in 2013 helped make it one of the fastest-growth semiconductor vendors in the top 25. Micron's DRAM business slightly underperformed the overall DRAM market as the company converted Fab 7 (formerly Tech Semiconductor) from DRAM to NAND in order to rebalance the portfolio following the Elpida acquisition. This conversion improved the overall DRAM supply-and-demand balance, although it resulted in slower bit growth year over year. In 2014, DRAM accounted for just under 70 percent of Micron's revenue, and NAND flash accounted for slightly under 30 percent.

There was significantly more merger and acquisition activity among the major vendors in 2014 than the previous year. Among the most significant deals was Avago Technologies' acquisition of LSI, propelling the company into the top 25 semiconductor vendors for the first time. MStar Semiconductor was merged with MediaTek after a prolonged merger, and ON Semiconductor acquired Aptina Imaging. Meanwhile, Infineon Technologies' bid for International Rectifier has yet to be completed. After adjusting for M&A activity, the top 25 vendors grew at 10.0 percent, meaning the rest of the market saw a more respectable growth of 2.6 percent.