Bonding Wire Transition Marches On

"Cost-down" is a mantra heard across the electronics industry and is one that challenges the semiconductor supply chain as the industry seeks to deliver improved performance to the consumer at a lower cost. Pricing pressures are abundant throughout the supply chain and can impact material selection in both wafer fab and package manufacturing. A particularly dramatic change in materials has been observed over the past seven years as companies sought to reduce the impact of gold metal costs in semiconductor packaging.

For decades gold bonding wire was the mainstay material in wire-bonded packages. Semiconductor manufacturers began to closely examine the use of copper wire material to offset rising gold metal prices as gold pricing began to rise in 2006. By September 2011, average gold pricing peaked at its record high, $1,772/ Troy Ounce (trz) and remained above $1,660/trz throughout much of 2012. Gold metal pricing subsided from late 2012 and throughout most of 2013, with gold pricing falling to below $1,300/trz in 2013 and remaining at this level throughout 2014"”though still at levels almost double gold pricing in 2007.

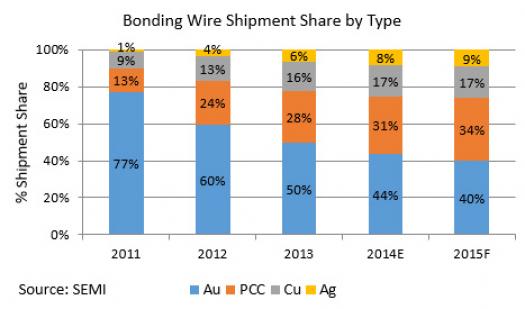

As a result, companies along the bonding wire supply chain invested in alternatives to gold wire, specifically copper wire, palladium-coated copper (PCC) wire, and silver/silver alloy wire. In 2007, gold wire totaled about 98% share of the 16 billion meters of wire shipped to packaging manufacturers. By 2013, gold wire shipments declined to just about half of total bonding wire shipments and further declined to an estimated 44% share of the over 20 billion meters of wire shipped in 2014.

In 2014, total copper wire, including both bare copper and PCC, captured 48% of the shipment share and silver-type wire grew to an 8% share. In 2015, it is forecasted that this trend will continue with total copper wire shipments topping 50% of the total shipment share and silver wire gaining some share as well.

To succeed at this transition to reduce the impact of gold metal pricing, leading packaging subcontractors invested in copper bonding wire capacity, with many integrated device manufacturers and fabless customers qualifying and now using copper bonding wire in new products. Consumer and communication devices were products that initially drove this transition but usage and interest now includes a range of industrial, server, and even some automotive device applications. Copper wire usage occurs across the spectrum of packaging types and form factors, covering both leadframe and organic substrate-based packages.

Silver bonding wire usage has also emerged as a low cost alternative to gold wire without, necessarily, the need for investments in high-end bonding equipment needed for copper wire. Interest in silver wire developed initially for use in LED packaging and for some memory devices, though it has ramped in production for other IC devices, such as mobile baseband chips. The latter typically have less demanding reliability requirements compared to other device applications.

In addition to packaging manufacturers, bonding equipment suppliers, wire suppliers, and bonding component manufacturers all played a critical role in achieving this transition. It is estimated that the industry spent $2.8 billion on gold wire last year, which is well below the estimated $5.5 billion spent in 2011. This collaborative effort succeeded in reducing material costs in electronics in the face of increasingly complex performance requirements and tighter form factors.