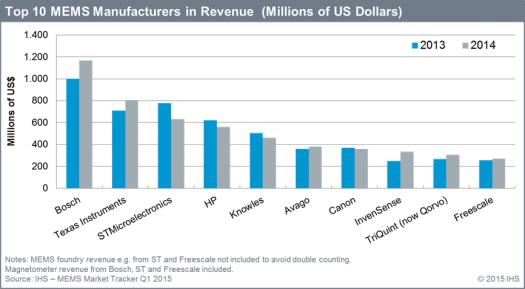

Apple dictates the ranking of top 10 MEMS manufacturers in 2014

According to the upcoming IHS Technology Q1 MEMS market tracker report Apple dictates the ranking of top 10 MEMS manufacturers in 2014.

Bosch #1

Bosch reinforced its leadership in the MEMS industry in 2014 with a 16.6% increase to $1167 million up from $1001 million in 2013. Bosch alone held 12% of the very fragmented MEMS market in 2014 compared to 11% in 2012.

Bosch took the leadership in 2013 thanks to his design in the Apple iPhone 5s and iPad with its accelerometer. Apple boosted Bosch's MEMS revenue in 2014 again as Bosch is the sole supplier of the pressure sensors added to the iPhone 6 and 6+. Besides Apple, Bosch enjoyed a strong growth of its motion combo sensors with Sony both for gaming with the Sony PS4 and for handsets and tablets. Bosch started going after the consumer MEMS market in 2005 when it created Bosch Sensortec. It added MEMS microphone to its portfolio with the acquisition of Akustica in 2009. Bosch's bet on consumer applications paid off as this segment now accounted for a third of Bosch's total MEMS revenue in 2014 compared to less than 18% in 2012.

The legacy automotive business continues to dominate Bosch's MEMS revenue with 67% in 2014. Bosch is the undisputed leader in automotive MEMS with 30% market shares in 2014 and with revenue more than three times as high as the 2nd largest Automotive MEMS maker Denso.

Texas Instrument #2

Texas Instrument enjoyed a rebound of its Digital Light Processing business in 2014 with an estimated $805 million up from $709 million in 2013. The business growth in 2014 was seen mostly in the main business line of DLP business projector segment using TI's Digital Micromirror Device (DMD). TI's DLP business had declined from 2010 to 2013 as Epson "“ TI's DLP's main competitor with its (non-MEMS) LCD technology "“ won shares in the projector business. Also the business projector market suffered in the past few years from the competition from low cost LCD flat panels being used as an alternative to projectors for many conference rooms, especially in Asia region. TI won back shares in the projection display market against Epson's LCD technology last year.

STMicroelectronics #3

ST's MEMS business suffered a 19% decline in revenue from $777 million to $630 million. ST is still the #1 MEMS manufacturer for consumer and mobile applications with 15% of this segment. The historical MEMS business of ST i.e. motion sensors for consumer applications has been hit as ST lost its spot in the latest iPhone for the accelerometer in 2013 and for the gyroscope in 2014 and as well as for the combo motion sensors in the Samsung Galaxy S5. In this game of musical chair ST mitigated the damage however by winning 100% of the pressure sensor in the Galaxy S5.

ST has laid in 2014 the foundation for a rebound of its MEMS business in 2015. Especially ST's MEMS microphone is growing very fast thanks to the design win in the iPhone 6 in addition to ST's existing microphone sales into the iPad. ST's MEMS microphone shipment grew more than 2.5 times in 2014 and IHS expects the Apple design win to attract further customers.

The decline of inkjet makers (HP #4 and Canon #7)

HP #4th and Canon #7th continue to see the revenue associated to their MEMS inkjet printheads declining. Canon saw a slight decline of its inkjet printer sales. Sales of inkjet printers were up 1% for HP in 2014 but the shipment of inkjet is declining since HP started the transition from disposable printheads (which are part of the ink cartridge) to permanent printheads in 2006.

Knowles #5

After enjoying a 19% and 50% growth respectively in 2012 and 2013 Knowles saw its MEMS microphone revenue decline 9% from $505 to $460 million in 2014. While Apple was largely responsible for the formidable year 2013 as Knowles won a second spot in the iPhone 5S, the decline in 2014 was also related to the iPhone. Early teardowns by IHS of the iPhone 6 and 6+ reveal that Knowles was present with ST and AAC in the first batch of iPhones. Knowles dropped out of the supply chain however due to a technical defect leaving the business to ST, AAC and the new-comer Goertek. Still Knowles remains by far the top MEMS microphone supplier with more than 45% units shares. It is also the second largest MEMS manufacturer for consumer and mobile applications with 12% revenue share. IHS believes that Knowles will resume with revenue growth in 2015 as it starts shipping to Apple again.

BAW filters makers continue to thrive on LTE (Avago #6 and TriQuint #9)

Avago and TriQuint grew 6% and 15% respectively their MEMS based BAW filter business. The LTE band is a boon for the two BAW filter makers, especially in the 2.3 GHz to 2.7 GHz bands, as BAW devices perform better than SAW filters at these frequencies, and solve the coexistence issues of Wi-Fi and LTE. The BAW filter market is currently experiencing resurgence thanks to LTE and as the number of bands of in handsets keeps increasing.

InvenSense # 8

InvenSense was the fastest growing company in the top 10 with an impressive 34% jump to $332 million. The vast majority of his jump comes from InvenSense win of the 6-axis motion combo sensor in the iPhone 6 and 6+. InvenSense has also been very successful with its gyroscope built into camera modules for Optical Image Stabilization (OIS).

Freescale # 10

Rounding up the top 10 Freescale saw its MEMS revenue grow 6% to $271 million in 2014. Automotive continue to make up for around 80% of Freescale's. Freescale enjoyed especially a robust expansion of its pressure sensor sales for Tire Pressure Monitoring Applications.

In March 2015 NXP and Freescale announced a merger. There is no overlap on the sensor side. NXP has had various MEMS developments in the past 10 years (RF MEMS switches, MEMS timing"¦) but nothing has come in production yet. NXP is however one of the leading magnetic sensor suppliers for automotive. The new entity will become the leading merchant supplier of automotive semiconductor sensors with a very strong positon in chassis and safety applications especially. NXP is also the leading suppliers of microcontrollers used as sensor hubs as it produces the sensor hubs for the Apple iPhone and iPads.

Reference: IHS MEMS Market Tracker Q1 2015