Why Intel is Considering Acquiring Altera

According to media reports, Intel has agreed to buy Altera Corporation for $54 a share, which is roughly $16.7 billion. Intel's largest purchase comes on the heels of a long series of semiconductor mergers and acquisitions "“ including last week's announcement that Avago had agreed to purchase Broadcom Corporation for $37 billion.

Prior competitor mergers also include NXP and Freescale, Cypress Semiconductor and Spansion, Lattice Semiconductor and Silicon Image, Qualcomm and CSR, Infineon and International Rectifier, and several more. While none of these companies directly competes with Intel for its largest market -- PC central processing units (CPUs) -- each of these mergers has had an influence on various embedded markets where Intel has a stake.

The new semiconductor landscape

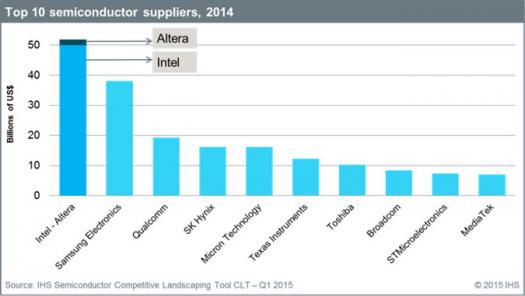

Intel is the largest supplier of microprocessors (MPUs) in the world, with overall semiconductor revenues nearing $50 billion in 2014 and MPUs comprising 80 percent of that revenue. While not as large as Intel, with $2 billion in 2014 revenues, Altera is the second-largest supplier of programmable logic devices (PLDs) and system-on-chip (SoC) field programmable gate arrays (FPGAs).

The largest markets for Intel's MPU solutions are CPUs for portable PCs and tablets, desktop PCs, notebooks, servers and high-performance computing (HPC) platforms. In the last several years, demand has stagnated for desktop PCs and the forecast for portable PCs has begun to slow. Much of this market sluggishness has been related to the introduction of more portable computing platforms, such as smartphones and tablets. IHS predicts that the tablet market is entering a saturation phase, with larger sizes also entering a slowing growth. More relevant to the Altera purchase, Intel supplies a host of integrated chip solutions to many markets beyond computers, and it is in many of these markets that Intel has the most potential for continued growth.

Communications infrastructure and data center equipment comprise some of the largest synergetic markets for Intel and Altera. Intel is already the leading supplier of high-performance wired and wireless telecommunications infrastructure processor solutions and -- with an increasing market for internet-of-things (IoT) connected devices -- these markets provide even greater opportunity for the right solutions. Altera's position as a strong supplier of broadband, networking and telecommunications solutions was likely a crucial consideration for Intel, when the company decided to purchase Altera.

On the whole, Intel's x86 microprocessors and applications processors would be very complementary to Altera's broad base of programmable logic, especially for networking solutions. Intel microprocessors are optimized for high-performance control, and Altera PLDs and FPGAs are flexible and can be easily configured to process huge parallel streams of packet data as a coprocessor to the MPU, which could be a key strength of the acquisition. There are a few small overlaps to consider, such as the Altera system-on-chip (SoC) FPGA with embedded ARM Cortex A processors. Whether Intel will continue to develop ARM core-based solutions, a strategy they tried and abandoned with the XScale technologies, will be the type of strategic choices IHS will continue to follow after the acquisition.

There are many applications and markets where a high-performance MPU and configurable logic are designed to work side by side: Industrial applications for military and aerospace, manufacturing and process control, automotive applications, security and surveillance, broadcast, and many more. Even in HPC, FPGAs will perform co-processing functions. Whether it is offering complementary solutions, or combining intellectual property, in order to create new unique SoCs, the combined potential of Intel and Altera should be well poised to target a growing telecommunications market and IoT applications.