Maturing smartphone market signals falling growth for wireless semiconductors

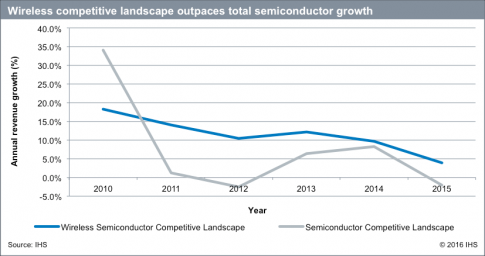

Revenue associated with the wireless competitive landscape continued to serve as a bright spot in the larger semiconductor market in 2015, growing almost 4 percent to over $56 billion, year over year, while total semiconductor revenue fell 2 percent to $347 billion during the same period. The wireless competitive landscape includes logic and analog semiconductors used in connectivity, mobile phones, media tablets, mobile infrastructure and other applications. However, due to slowing sales of smartphones and other wireless devices, the wireless competitive landscape faces a set of challenges that could result in similar or slower growth in 2016, according to IHS Inc.

"Apple recently reported its fiscal second quarter results, and for the first time iPhone unit sales fell year over year, indicating the potential magnitude of the softness in the premium smartphone market," said Brad Shaffer, senior analyst, mobile devices and networks, IHS Technology. "If the iPhone and other premium smartphones fail to gain enough traction to support growth in that market segment, it may be reflected in the underlying semiconductor market in 2016."

According to the IHS Wireless Semiconductor Competitive Intelligence Service, the mobile handset integrated-circuit (IC) market is the largest segment in the wireless competitive landscape, comprising 62 percent of revenue in 2015 as the smartphone market continued to grow. "If unit shipments from Apple and other smartphone original equipment manufacturers continue to decline, the wireless competitive landscape could have a dragging effect on the larger semiconductor market in 2016. However, though currently too early in their lifecycles to make a material difference in the short term, emerging technologies like LTE-Advanced Pro or 4.5 G could provide upside potential in the next 12 to 18 months," Shaffer said.

Along with maturing growth rates in the smartphone market, Samsung, Apple, Huawei and other OEMs that are vertically integrated have varying degrees of internal semiconductor capabilities at their disposal -- with the potential to supply their own smartphones and other OEMs as well. These internal design decisions tend to be cyclical in nature and can change from one product iteration to another, switching from internally-supplied components to third-party solutions.

"While this vertical integration has been especially evident in the premium smartphone tier, it helps to create a fiercely competitive environment in all market tiers, as it can limit the available market for third-party suppliers," Shaffer said. "The increased competition resulting from a smaller market could impact core handset integrated-circuit prices in the entry-level and mid-range segments, with MediaTek, Spreadtrum and other suppliers vying for revenue share with market leader Qualcomm."